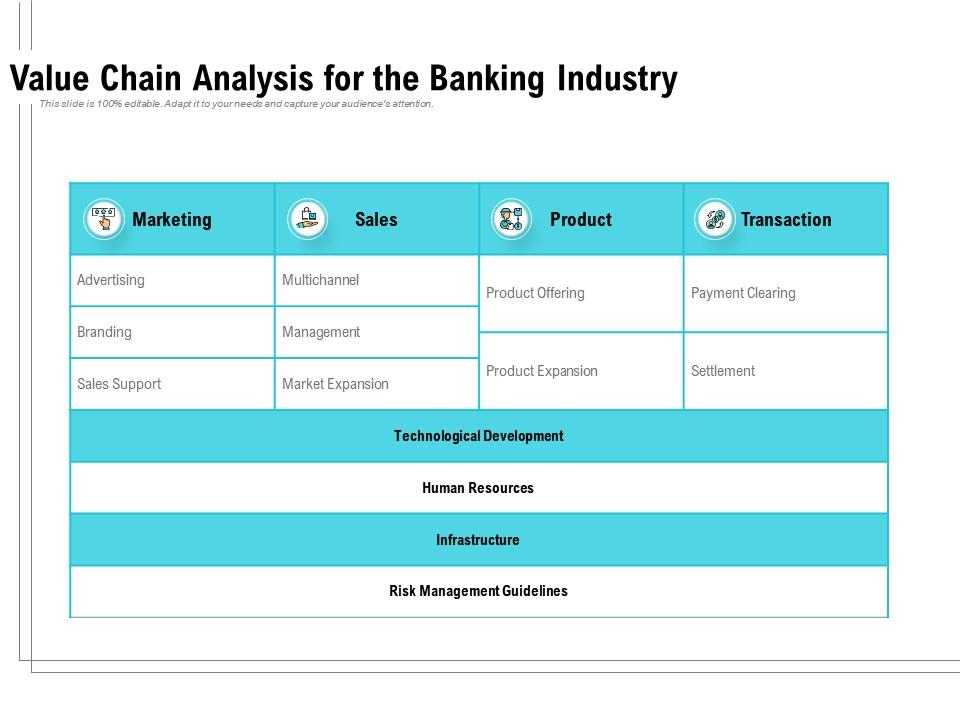

The sales function plays a vital role in the banking sector as it helps banks to generate revenue and achieve their business objectives. Banks use various channels to sell their products and services, including branches, call centers, digital platforms, and external agents.

One of the main products that banks sell is financial products such as loans, mortgages, and insurance. These products help customers to meet their financial needs, such as buying a house or car, saving for retirement, or protecting their assets. Banks also sell non-financial products, such as debit and credit cards, foreign currency exchange, and investment products.

To be successful in sales, bank employees need to have a deep understanding of the products and services that they are selling and the needs of their customers. They also need to be able to build strong relationships with customers and persuade them to buy the products that they are offering. This requires excellent communication and interpersonal skills, as well as a strong knowledge of the competitive landscape.

In recent years, the banking sector has seen a shift towards digital sales channels, as more and more customers are using online and mobile platforms to access financial services. This has led to the development of new sales roles, such as digital sales agents, who are trained to sell products and services through digital channels.

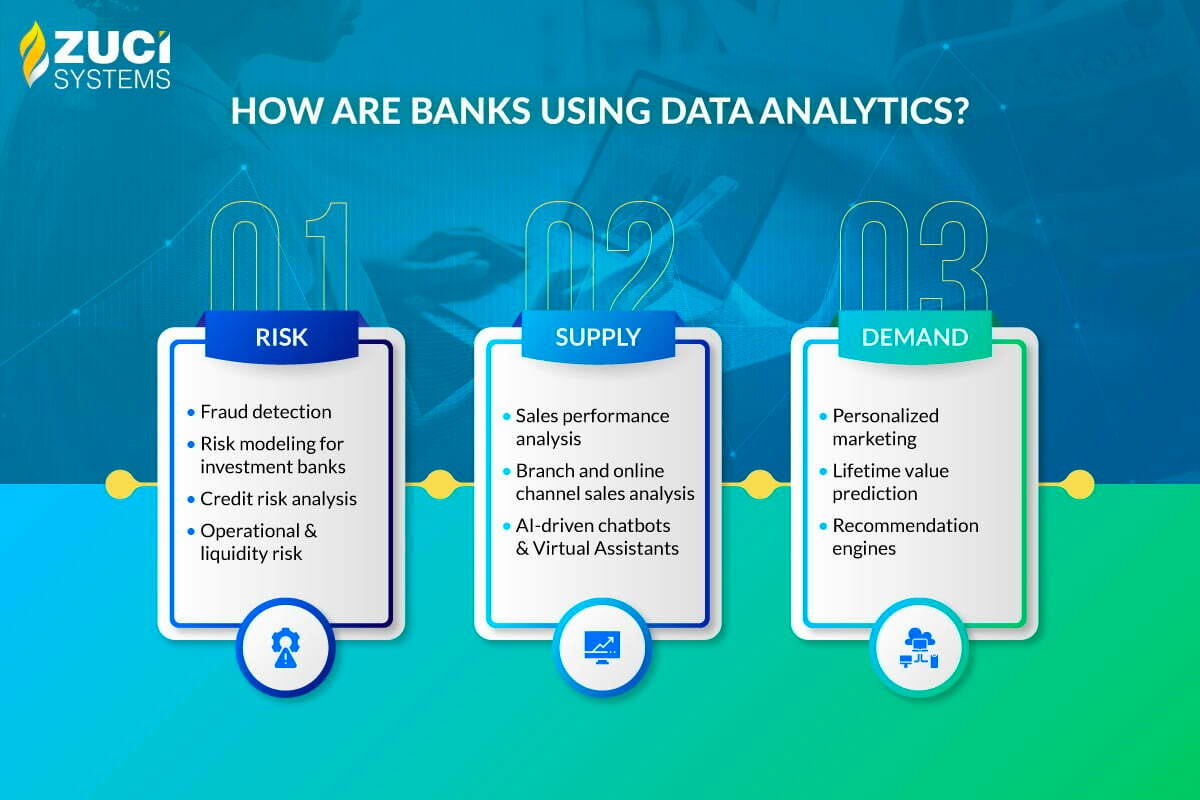

In order to achieve their sales targets, banks may use various sales techniques and strategies. These can include offering promotions and discounts, cross-selling products, and upselling higher-value products. Banks may also use data analytics to identify potential customers and target them with personalized sales campaigns.

Overall, the sales function plays a crucial role in the banking sector, helping banks to generate revenue and achieve their business objectives. It requires a combination of product knowledge, customer relationship skills, and sales strategies in order to be successful.

Win Your Sales Game In Banking Sector With Anish Chowdhary

Some banks are even conducting real-time feedback surveys after branch interactions in addition to more traditional monthly feedback tools. This report segments the global Consumer Banking market comprehensively. Make sure RMs see a constant flow of market information about deals, rates, and market activity that they need when they talk to customers. Browse Detailed TOC, Tables and Figures with Charts that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector. They should be ready to give details on any complex or unique agreements, such as the loan agreements.

Bank Sales Management

By understanding the criteria and the abilities of a product, bankers can broaden internal as well as external satisfaction. Regulatory pressures: The regulations in the banking sectors are increasing, and banks are witnessing regulatory pressures to allocate a majority of their budgets towards being compliant. To achieve positive outcomes for both customers and the bottom line, banks should focus on three areas: incentives, sales practices, and change management exhibit. Follow-up divides professionals from everyone else. The only way to get out of this painful sequence is to address all the aforementioned points in your pitch and filling all the loopholes. Consumer Banking Market Size is projected to Reach Multimillion USD by 2028, In comparison to 2021, at unexpected CAGR during the forecast Period 2022-2028.

A consumer

All of these resources are accessible, but they are time consuming and not always readily available. Or when noticing that the professional employees of a company travel a great deal, bankers can identify an opportunity for marketing a Direct Deposit of Payroll Richardson, 1992, p. Resistance to Selling Even though the consultative approach to sales in banking gives away bankers the chance to serve as advisers and consultants to their customers, not all bankers are contented with the idea of selling. A spike in the sales of a particular product could be an indication of overselling or mis-selling. While it was tempting to simply link these drivers to financial incentives, the risk of employees pushing to hit target activity levels to the detriment of quality—for example, with short and ill-prepared conversations—led the bank to use performance dialogues and reporting to improve results instead. Without this basic knowledge bankers will not be able to answer the needs of their customers or prospects and will not be able to speed up processes or to maximize recognized opportunities. And they must pay particular attention to channel overlaps, determining, for example, how credit for a sale is shared when the customer uses multiple channels.

Consumer Banking Market 2023 Size, Revenue Analysis, Sales, Share and Research Depth Study 2028

Since bankers themselves are the most central factor in communicating information, they should not rely on the telephone voices alone to establish rapport, credibility, or suitable for the time necessary for an effective sales interview Richardson, 1992, p. Integrate tablets into lobby service. The reality in which banks will emerge over the next 10-15 years will be as considerably different for these organizations as comparing retail banks today with what they were in past years. Leading banks share best practices in sales leadership by having experienced and tenured team members coach frontline managers. Your ideal customers are your most profitable, lowest risk, lowest cost to serve relative to prices they pay , most reliable, most predictable, and most loyal customers. It appreciates the value that the client derives from the sale. Article PDF-342KB Regulators across the world are paying increasing attention to the sales practices of retail banks.

New & recent Innovations in the Banking Sector 2023

Banks should work with regulators to identify the practical, safe, and sustainable ways to deliver good customer outcomes, underpinned by a thoughtful assessment of risk and consideration of controls. Selling seems to many bankers to be a departure from the profession they originally chosen. Step 3 — The Cast: Define your sales system. Like a fly fisherman choosing a fly based on the type of fish, time of day, time of year and specific characteristics of the stream, choose your value story to entice your ideal prospects. There has been strategic investment in recent banking innovations through crowdsourcing, piloting, collaborations and partnering to develop revolutionary banking solutions. Beyond some vague comments about customer satisfaction surveys, those answers can be a lot harder to pin down. They are vital to the banking sector and these customers are considered to be the best prospects in cross-selling.