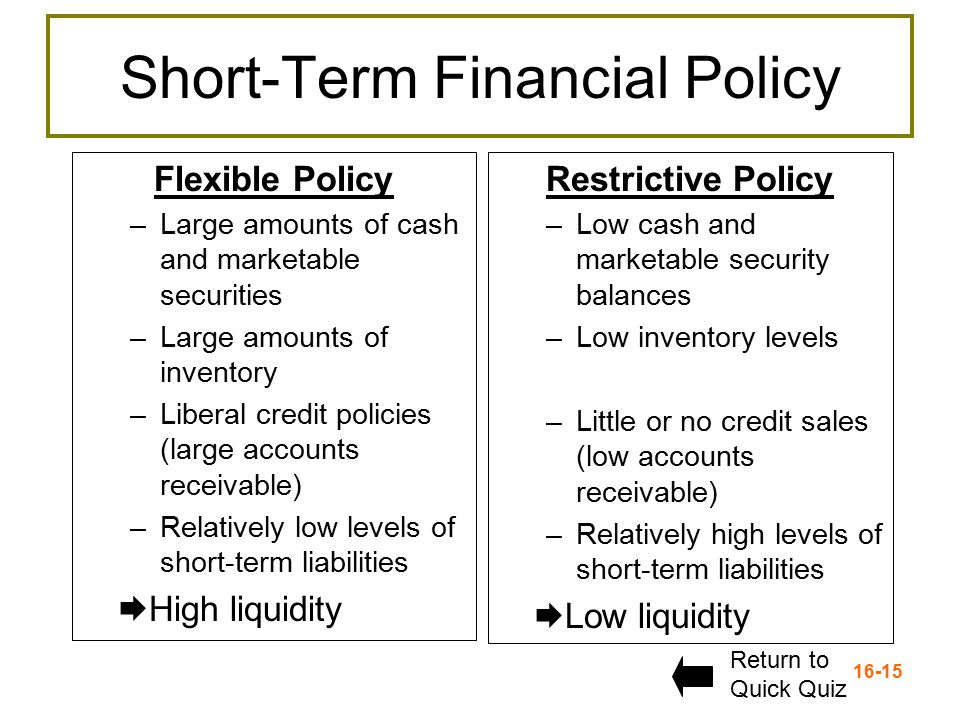

A short term financial policy is a set of guidelines and strategies that a business or organization follows to manage its financial resources in the short term. This type of policy is typically focused on managing cash flow and liquidity, and is designed to help the organization meet its financial obligations and achieve its financial goals over a period of time that is typically one year or less.

There are a variety of factors that can influence a short term financial policy, including the organization's overall financial situation, its business goals and objectives, and the economic conditions in which it operates. The policy may include measures such as setting budget targets, controlling expenses, and maximizing revenue in order to improve the organization's financial position. It may also involve financial forecasting and planning to ensure that the organization has sufficient resources to meet its short term obligations.

One important aspect of short term financial policy is cash management. This involves techniques such as careful forecasting of cash flows, maximizing the use of available credit, and minimizing the need for external financing. For example, an organization may choose to implement a cash management system that helps it to track and forecast its cash needs, and to make decisions about how to allocate its financial resources in order to meet those needs.

Another key component of short term financial policy is risk management. This involves identifying and assessing potential risks to the organization's financial health, and taking steps to mitigate those risks. This may involve measures such as diversifying investments, setting aside reserves, and implementing contingency plans.

Ultimately, the goal of a short term financial policy is to help the organization achieve financial stability and success in the short term, while also positioning it for long term growth and success. By carefully managing its financial resources and taking proactive steps to mitigate risks, an organization can set itself up for financial success in the short term and beyond.