Standard accounting principles are a set of guidelines that businesses and organizations follow when preparing financial statements. These principles provide a common language for financial reporting and help to ensure that financial statements are consistent, transparent, and reliable.

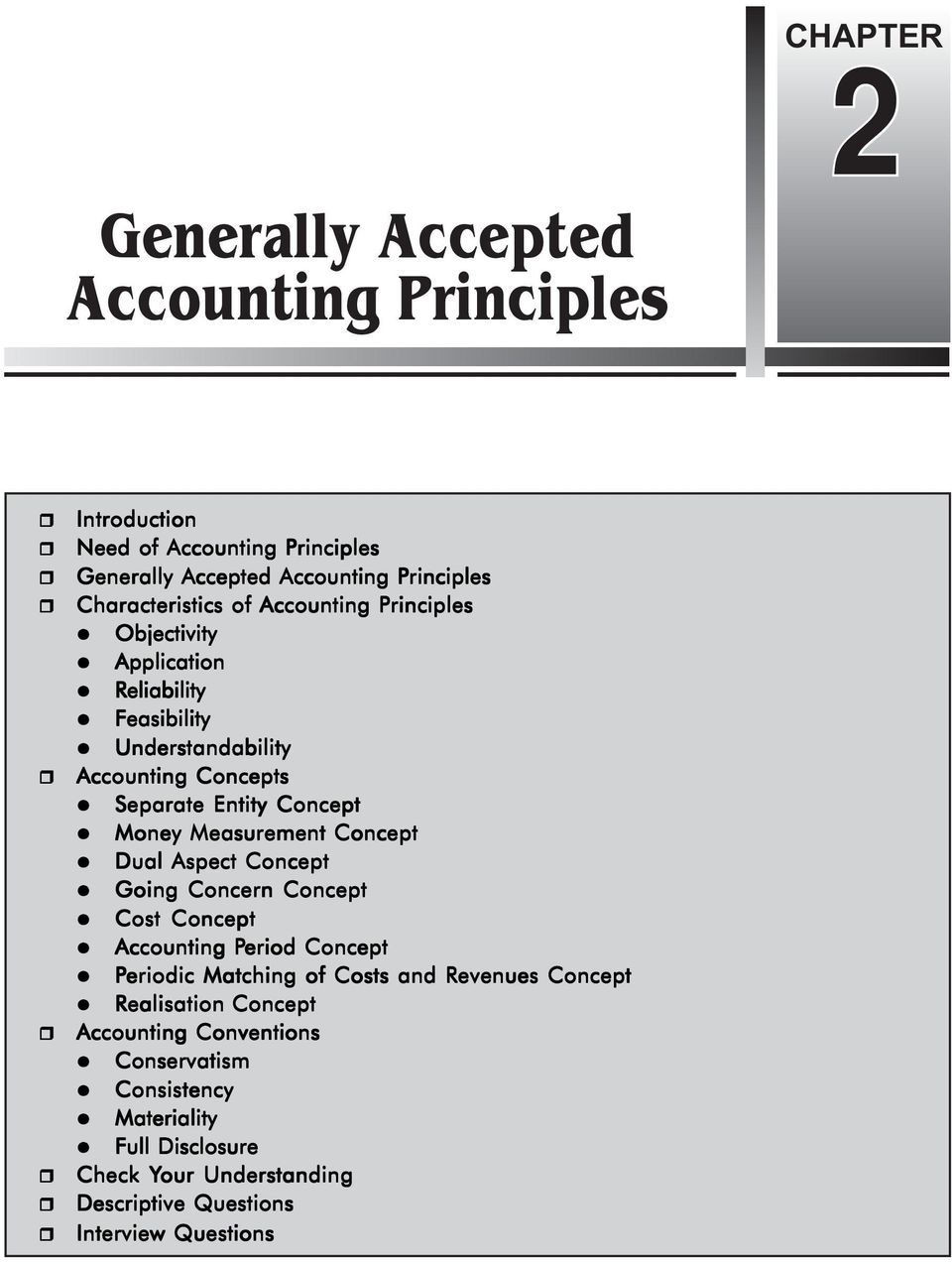

There are several key principles that make up the foundation of standard accounting. The first is the principle of accrual, which states that revenues and expenses should be recognized when they are earned or incurred, rather than when they are received or paid. This means that if a company provides a service or sells a product on credit, it should record the revenue in the period in which it was earned, rather than waiting until payment is received.

The principle of consistency requires that a company uses the same accounting methods from one period to the next. This helps to ensure that financial statements can be compared and analyzed over time.

The principle of materiality dictates that information included in financial statements should be relevant and significant enough to impact the overall financial position of the company. This helps to prevent the inclusion of unnecessary or misleading information.

The principle of full disclosure requires that all relevant information be included in financial statements, including both positive and negative aspects of a company's financial position. This helps to ensure that financial statements are complete and accurate.

The principle of prudence, also known as the "conservatism principle," requires that companies err on the side of caution when recording financial transactions. This means that they should record potential losses as soon as they are identified, even if the full extent of the loss is not yet known.

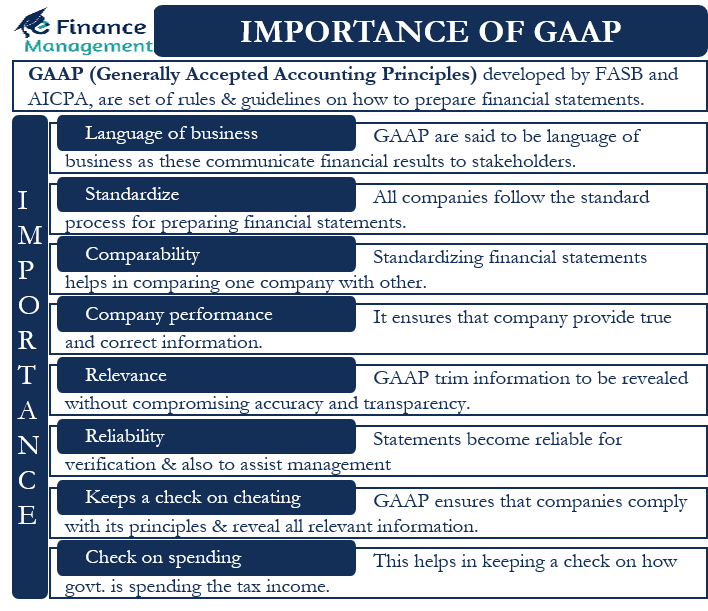

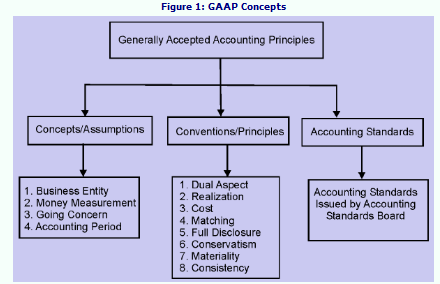

In addition to these principles, there are also several key accounting frameworks that are used to guide financial reporting. These include Generally Accepted Accounting Principles (GAAP) in the United States and International Financial Reporting Standards (IFRS) in many countries around the world. These frameworks provide detailed guidance on how to apply the standard accounting principles and ensure that financial statements are prepared in a consistent and reliable manner.

Overall, standard accounting principles play a vital role in ensuring the accuracy and transparency of financial statements. By following these principles, businesses and organizations can provide a clear and accurate picture of their financial position and performance, which is essential for investors, creditors, and other stakeholders.

:max_bytes(150000):strip_icc()/Term-a-accounting-standard_Final-aee795f23ecc42c28c183e9585aafdc1.png)