The stock market is a central component of modern economies, providing a means for companies to raise capital and for investors to buy and sell ownership stakes in those companies. Understanding how the stock market works and how to conduct research on potential investments is therefore an important skill for anyone interested in finance.

There are many different approaches to conducting stock market research. One common method is to analyze financial statements and other publicly available information about a company, in order to assess its financial health and prospects for future growth. This can involve looking at metrics such as revenue, earnings, and debt levels, as well as factors such as management quality, market trends, and competitive landscape.

Another important aspect of stock market research is studying macroeconomic trends and conditions, such as interest rates, inflation, and GDP growth. These factors can have a significant impact on stock prices and can help inform investment decisions.

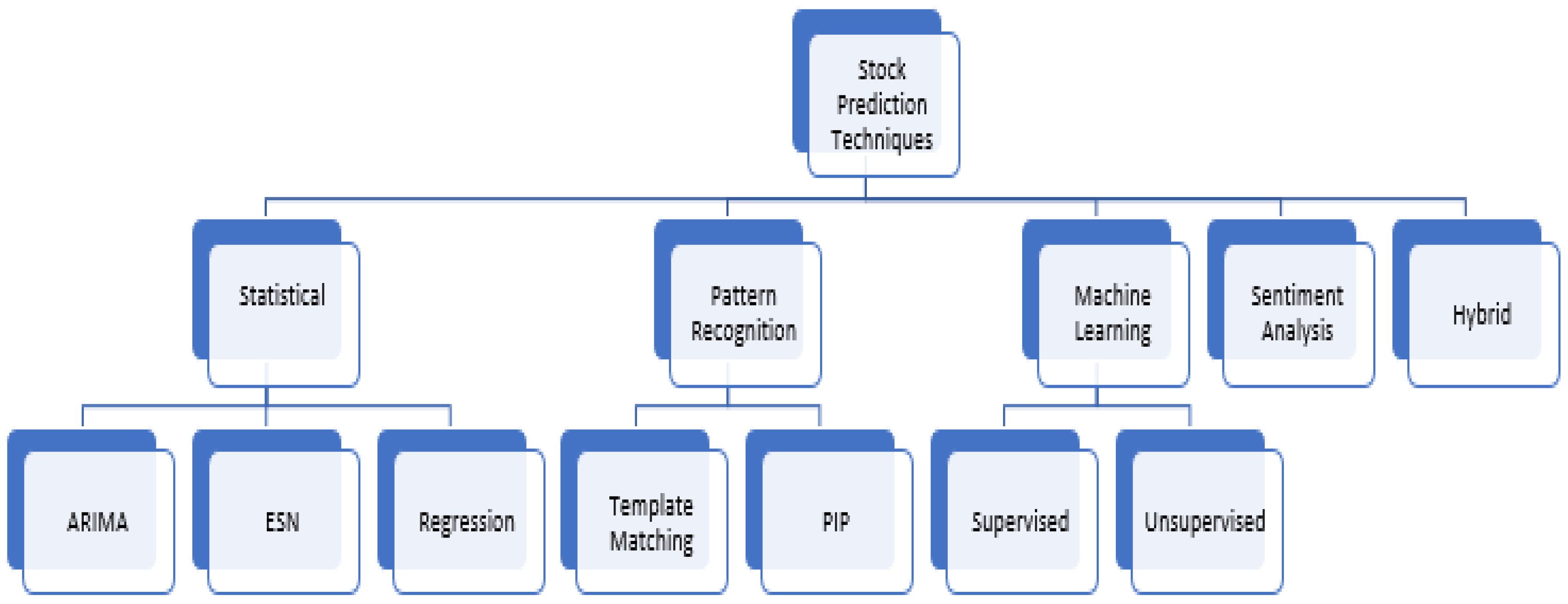

Technical analysis is another approach to stock market research, which involves studying charts and other data to identify patterns and trends that may indicate buying or selling opportunities. This can be a useful tool for identifying short-term trading opportunities, but it is important to remember that past performance is not necessarily indicative of future results.

Another important aspect of stock market research is staying up to date on news and events that may impact the performance of specific companies or sectors. This can include company-specific news such as earnings announcements or product launches, as well as broader market events such as political developments or natural disasters.

Overall, stock market research is a multifaceted process that requires a combination of financial analysis, economic analysis, and attention to current events. By conducting thorough research and staying informed, investors can make more informed decisions and potentially increase the chances of success in the stock market.