Tesco capital structure. Tesco Company's Capital Structure and Finance 2023-01-01

Tesco capital structure

Rating:

9,6/10

1885

reviews

Tesco is a British multinational grocery and general merchandise retailer headquartered in Welwyn Garden City, Hertfordshire, England. It is the third-largest retailer in the world measured by gross revenues and the ninth-largest retailer in the world measured by revenues. As of 2021, Tesco operates in 12 countries and has approximately 6,800 stores globally.

One aspect of Tesco's business that is of particular interest to investors and financial analysts is its capital structure. The capital structure of a company refers to the mix of debt and equity that it uses to finance its operations and investments. It is an important factor in a company's financial health and can have significant implications for its risk profile, creditworthiness, and financial performance.

Tesco's capital structure is relatively balanced, with a mix of both debt and equity. As of 2021, Tesco's debt-to-equity ratio was approximately 0.5, which indicates that the company has a moderate level of debt relative to its equity. This is generally considered to be a healthy capital structure, as it allows the company to take on some debt to finance growth while also maintaining a strong equity base.

In terms of the sources of its debt and equity, Tesco has a diverse mix. Its debt consists of a combination of short-term and long-term borrowings, including bank loans and bond issuances. The company's equity is primarily made up of shareholder equity, which includes both common and preferred stock.

One key aspect of Tesco's capital structure is its focus on maintaining a strong credit rating. The company has a investment-grade credit rating from major credit rating agencies, which reflects its ability to meet its financial obligations and its financial stability. This strong credit rating allows Tesco to access capital at favorable rates, which can help the company to finance its operations and investments more efficiently.

Overall, Tesco's capital structure is well-balanced and has allowed the company to maintain a strong financial position. The company's diverse mix of debt and equity, as well as its focus on maintaining a strong credit rating, have helped it to effectively manage its financial risks and support its growth.

Tesco Company's Capital Structure and Finance

But, in same way there is a chance of bankruptcy for the firm due to poor performance of company which may occur due to downturn in economy or improper management of resources. Here, managers have a narrow span of control and there is typically a long chain of command. And, analysis of the capital structure of the companies will be carried out to take a broad view and detail conclusions aimed at their performance. Since a subtle change increase or decrease in profit margin will induce a significant change in the overall profits, a 0. The cost of equity capital, cost of loan capital, current market value of all equity capital, current market value of all debt of Tesco and the WACC value are calculated by SPSS in figure 2 and table 3.

Next

What is Tesco capital structure?

How much money did Tesco make in 2019?. This practice is an adherence policy to laws of the UK for both internal and external perusal by government agencies, interest groups and potential investors. Besides, shareholders use these statements to project the viability of their investments in terms of expected dividend. It is usually where the business has many locations and therefore the head office is reasonably unable to control or make decisions for all the locations. Is Tesco using too much debt.

Next

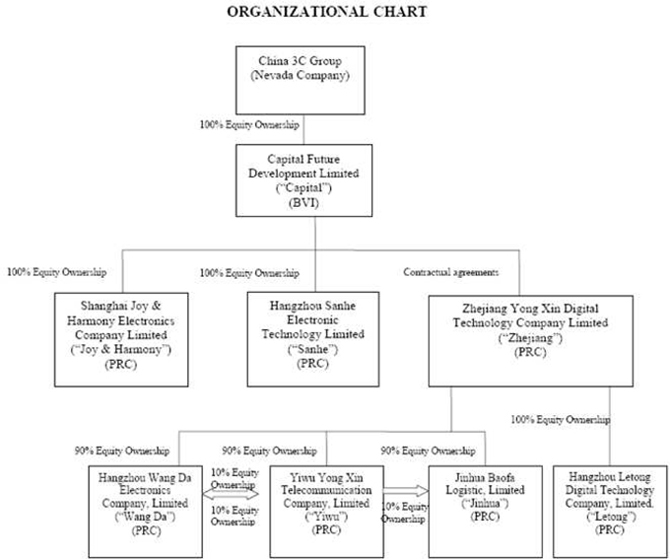

Tesco Organizational Structure

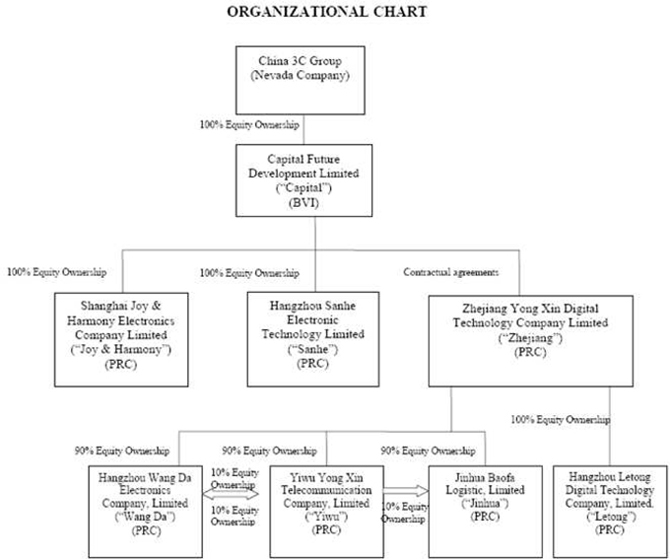

CO%3B2-D The Journal of Economic Perspectives is currently published by American Economic Association. Largest global grocery retailers TESCO, has successfully put into use Oracle and SAP Business Objects Polestar applications, because it is the retailer preferred enterprise system. Besides, they will be in a position to monitor returns from capital expenditure. But the most appropriate gearing ratio is dependent on more external and internal variables. It means that there are many leaders and layers of management. For instance, debt ratios are always low in firms with higher profitability than those with lower profitability.

Next

Capital structure tesco Free Essays

This is because external financing often takes debit form. Tesco Organizational Structure - StudySmarter Originals. And incontestably, this good news is inconsistent with the increase of the gross profit margin mentioned before. As a matter of fact, a levered company would provide a desirable opportunity for purchasing shares in order to achieve a desirable return on investment matrix. Thus, this research should help answer the question regarding capital structure decisions and how it matters to investors. Due to stiff competition, Tesco took over the mantle of market leadership from Sainsbury. What are the current liabilities of Tesco UK? A WACC calculation helps to determine how much capital costs for a company by proportionately weighing its categories.

Next

capital structure tesco essay

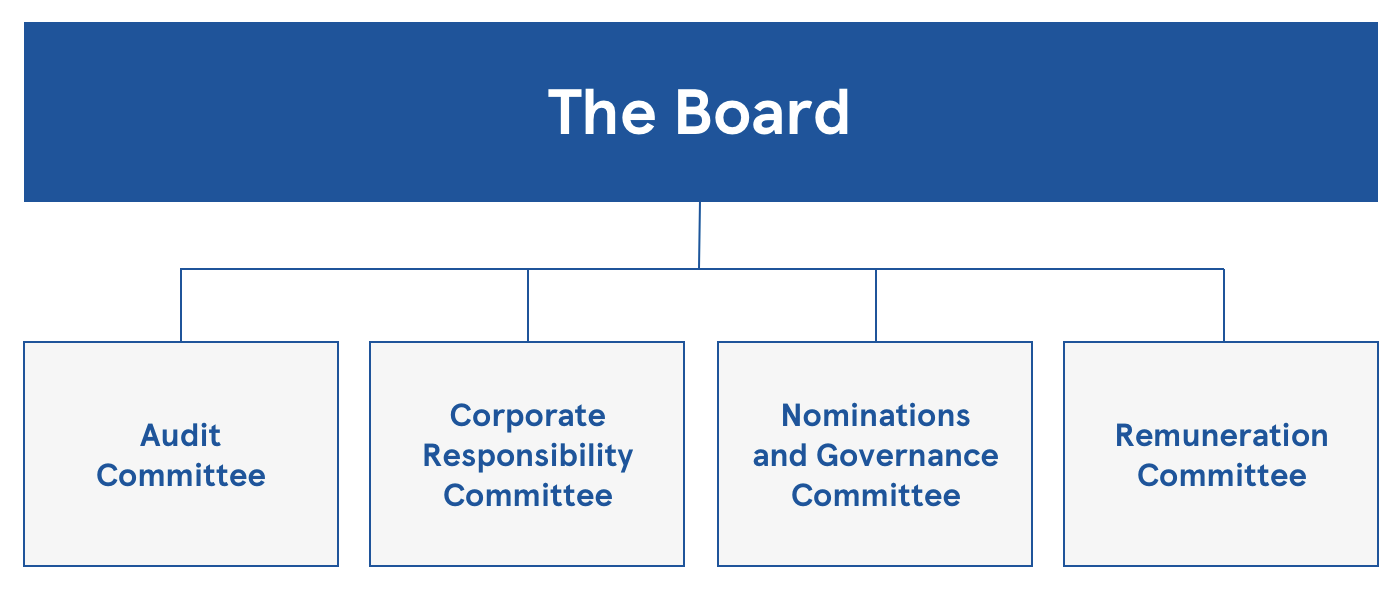

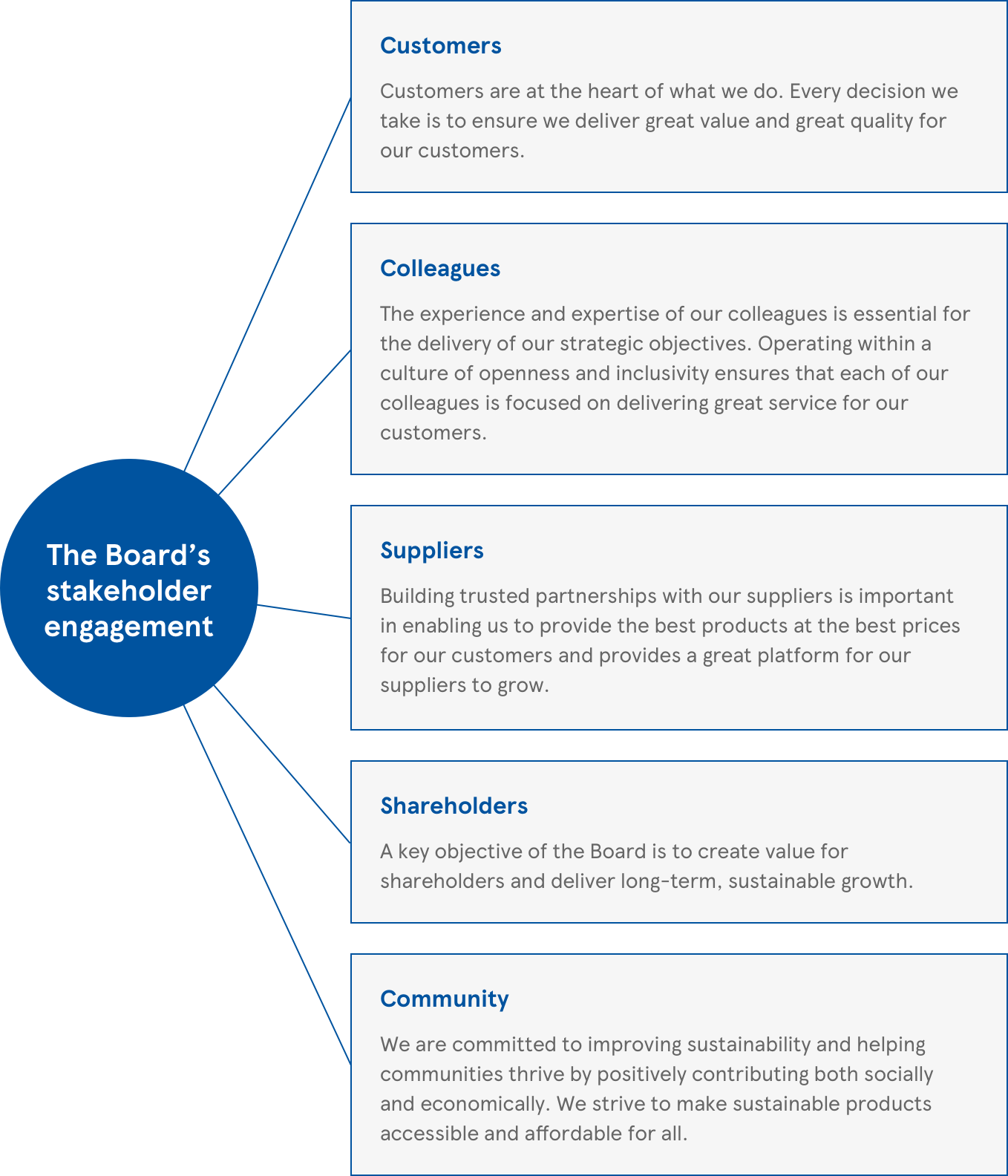

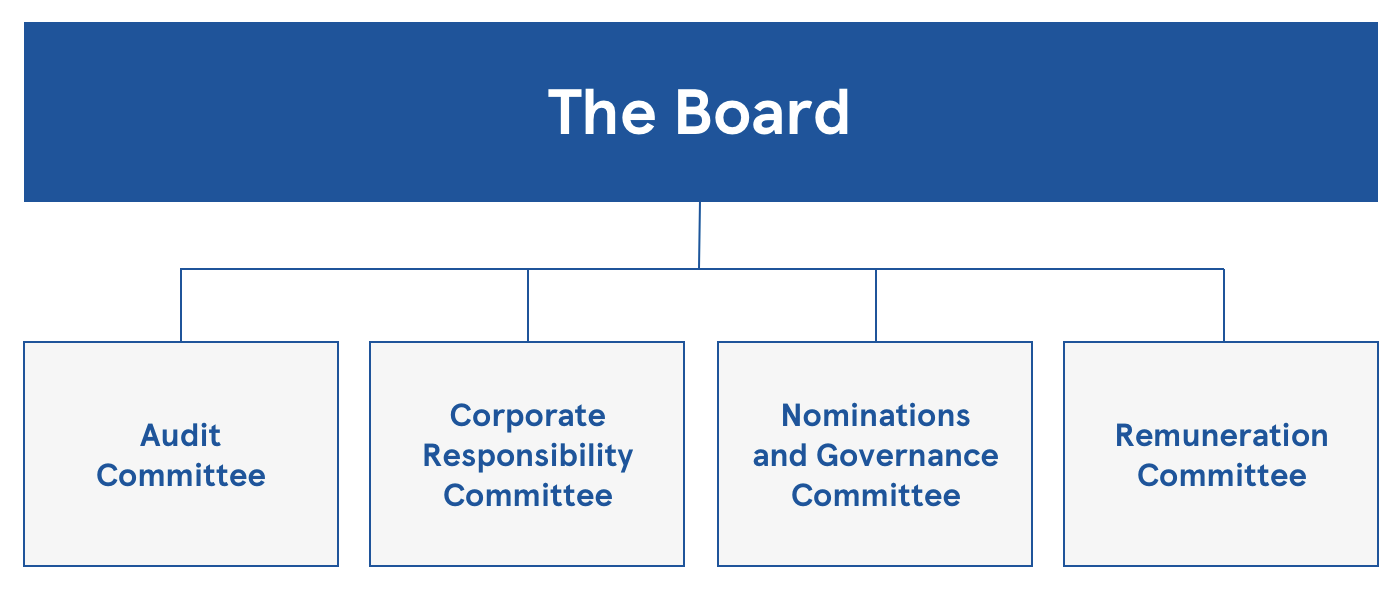

As the external and internal analysis are very useful for marketing a large enterprise, this essay will explore both external and internal analysis that Tesco Strategic Analysis of Tesco Plc Student ID: MODULE CODE: BC43001S MODULE TITLE: DYNAMICS OF STRATERGY WORD COUNT: 1. The big percentage of WACC exhibited in Sainsbury is not enough reason to conclude that investors in Sainsbury are likely to if they invest in Tesco. Equity capitalization rate of company U is 10% Find the following: a. The purpose of this report is to investigate the capital structure of two UK retail Tesco Plc and J Sainsbury Plc to determine their performance through capital structure. It is the third-largest retailer in the world dealing with general merchandise. There is an abundant number of issues which must be explored. For this reason, it would be impossible for the board and committees to control operations across all the locations.

Next

Tesco blog.sigma-systems.com

Fourthly, the interest cover also increased from 8. Some of the key trends in the capital structure of India Inc. Tesco has great progression opportunities and it is easier for the managers to perform their work. Both Tesco and Sainsbury capital structure seems to be the same. On the other hand, in a scenario of no taxation, that is there is no tax shield, there are no benefits attracted such as value creation, by increasing leverages Brealey, Stewart, and Franklin, 2008, p. It is commonly accepted that the increase of the gearing ratio will significantly couple with the increasing trend of EPS, and vice versa Rolf, 1981. Unquestionably, this can increase the confidence of existing investors and equally importantly, it can attract more potential investors.

Next

Tesco Organisational Structure: Overview, Chart & Advantages

This was because the retailer has been restructuring its shops and was in the middle of merging with Asda which did not went well. Businesses across the globe engage in transactions to maximise profit at minimal cost constraints. Therefore, a steady level of returned earnings should be maintained within a company in order to enable management to finance all its projects with positive NPV Mervin, 1958, p. Besides, Cash on equity such as dividends cannot be deducted as the proponents of this theory claim. As per this theory, capital structure mix that is used by firm in order to finance company operations does not affect company value. The different sources of finance available to firms depend to a very large extent on their legal status, their size and the management risk-taking ability Helfert, 2001, p. The sample used for this study are automobile firms listed on the A-share section of Shanghai and Shenzhen Stock Exchanges.

Next

Tesco’s Capital Structure

However, by increasing a share of debt in its capital structure, a company raises the amount of interest it has to pay out of its profits, thereby putting its ability to pay dividends at risk. Tesco is a company that serves numerous different customers on a daily basis. Fourthly, the interest cover also increased from 8. The supermarket giant is the leading grocery market in the UK with a market share of around 30% in 2010 and announced a profit of £3. In the analysis, we use financial data for Tesco Company and Sainsbury Company. It also operates in several other countries in Europe such as Hungary, Czech Republic and Poland, and some countries in Asia such as Thailand and Malaysia.

Next

Capital Structure Theory For TESCO

Differences It can be easily deduced from the table above that out of the two companies, reliance on debt is relatively high. Under the risk of interest rates, the company is exposed to fluctuations in the market, considering the fact that some of its stores are outside the UK. To assess the capital structure of Tesco, the debt-to-equity ratio will be used. According to the company's annual report from 2021, its group sales that year equalled £53. Virtually, the company has increase the utility of the capital employed in its businesses. . Through this report and analysis project, we will know the detail of how the company is running and how well or badly the company performed in last 3 years.

Next

Tesco's Optimal Capital Structure

Every region has their regional manager. As mentioned above, some traditional theories focus on the positive relationship between the leverage ratio and earnings per share, however, the situation of Tesco is the reverse version. As of February 2017, the company had a total debt-to-equity ratio of 1. As shown above, optimal capital structure is created when leverage debt-equity ratio increases, creating a trade-off position between bankruptcy and tax shield Helfert, 2001, p. Those assumptions began to be released from 1958, when Franco Modigliani and Merton Miller put forward their theory of capital structure.

Next