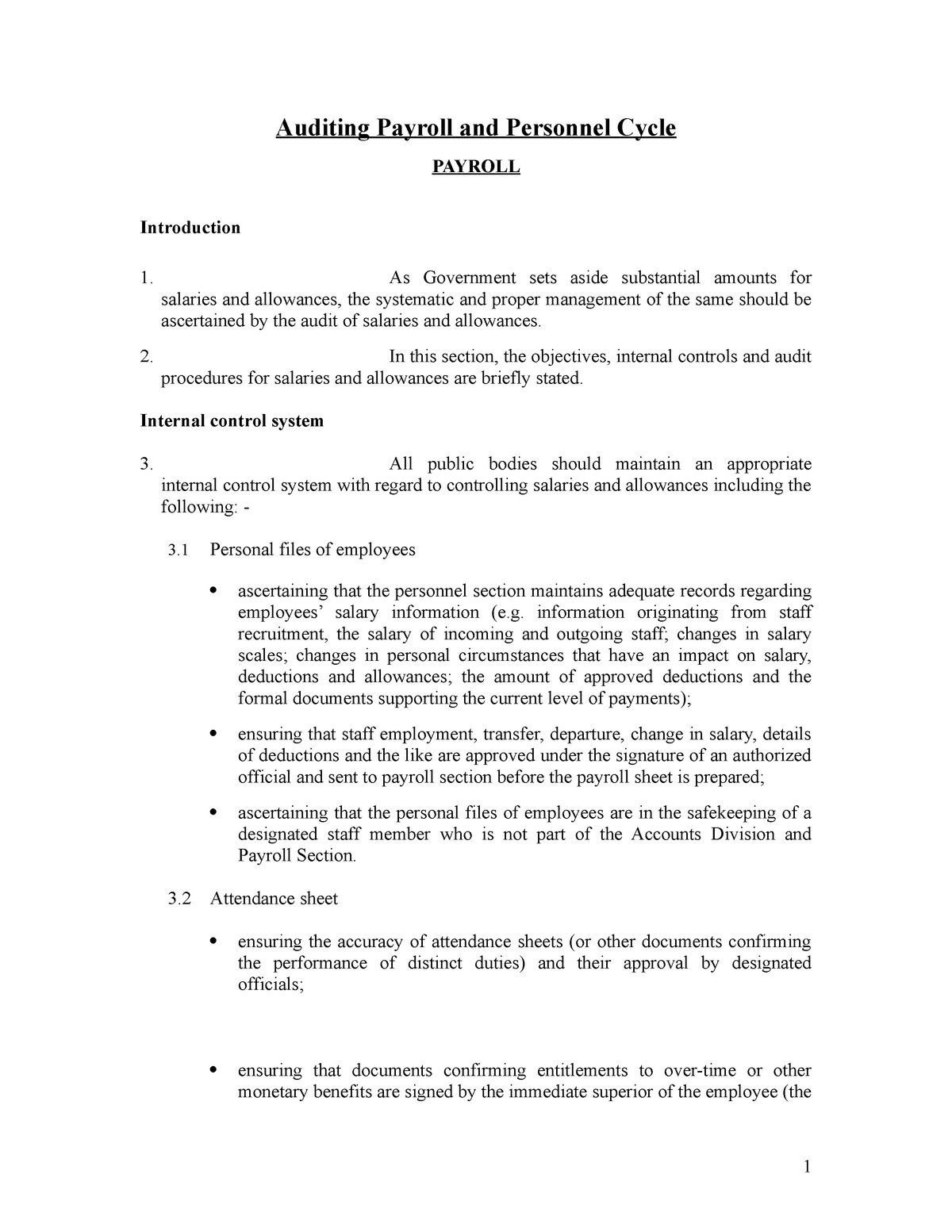

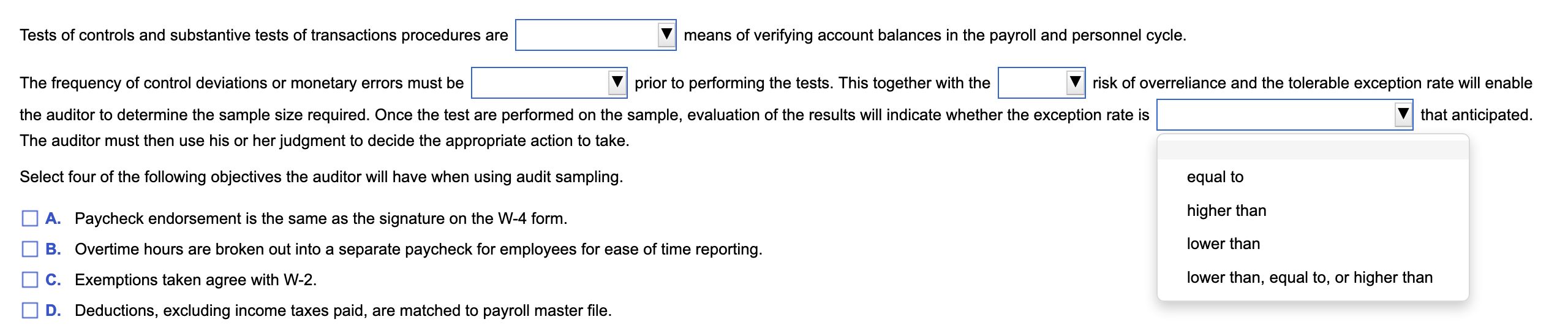

Tests of controls are an important aspect of auditing, as they help to ensure the reliability and accuracy of financial statements. In the payroll and personnel cycle, tests of controls are used to evaluate the effectiveness of the controls in place to ensure that payroll and personnel transactions are properly recorded, processed, and reported.

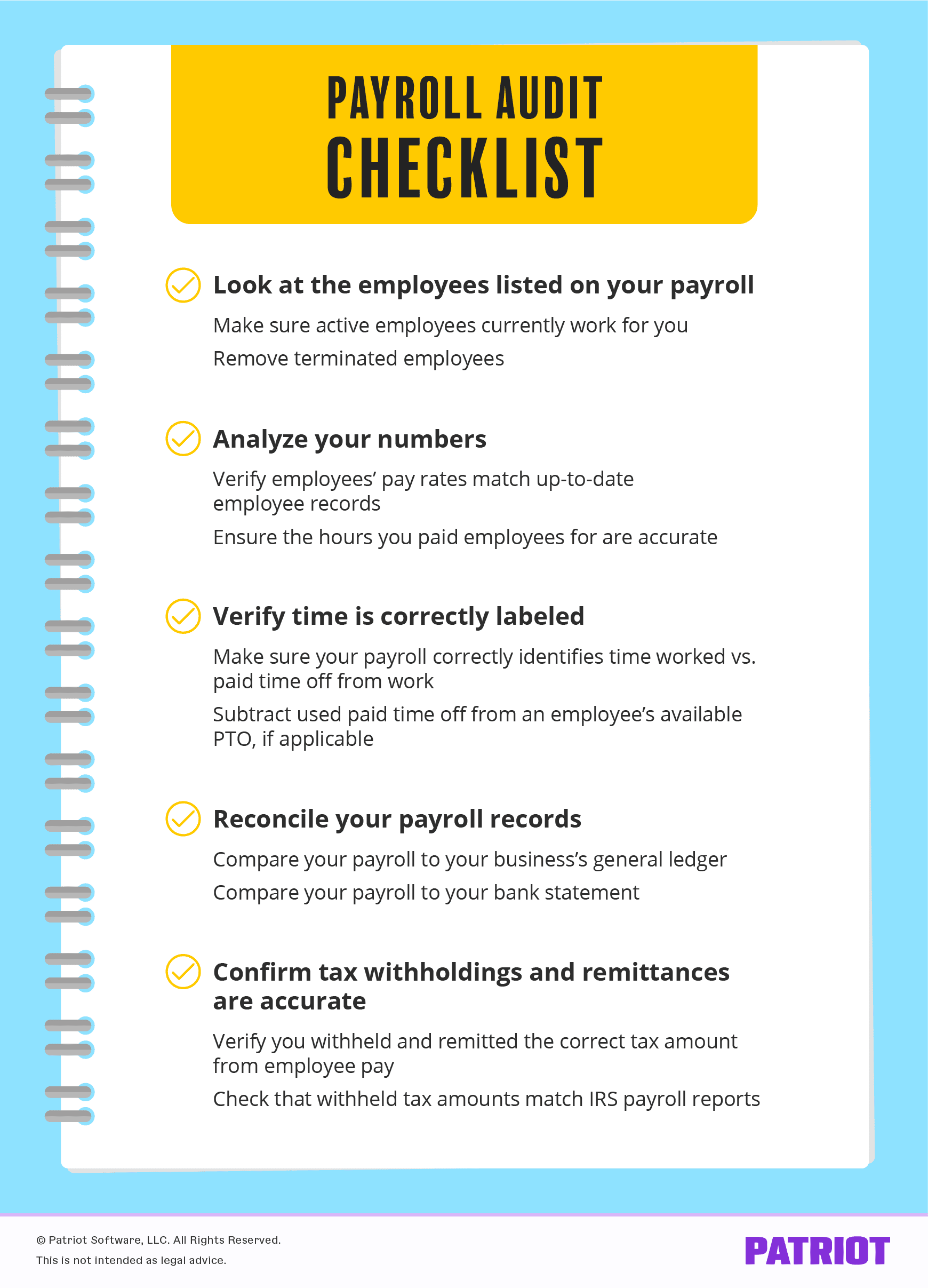

There are several types of tests of controls that can be used in the payroll and personnel cycle. One common test is the substantive test of transactions, which involves reviewing a sample of payroll and personnel transactions to determine if they are properly recorded in the accounting records. This may include reviewing time sheets, payroll records, and other documentation to ensure that the transactions are accurately reflected in the financial statements.

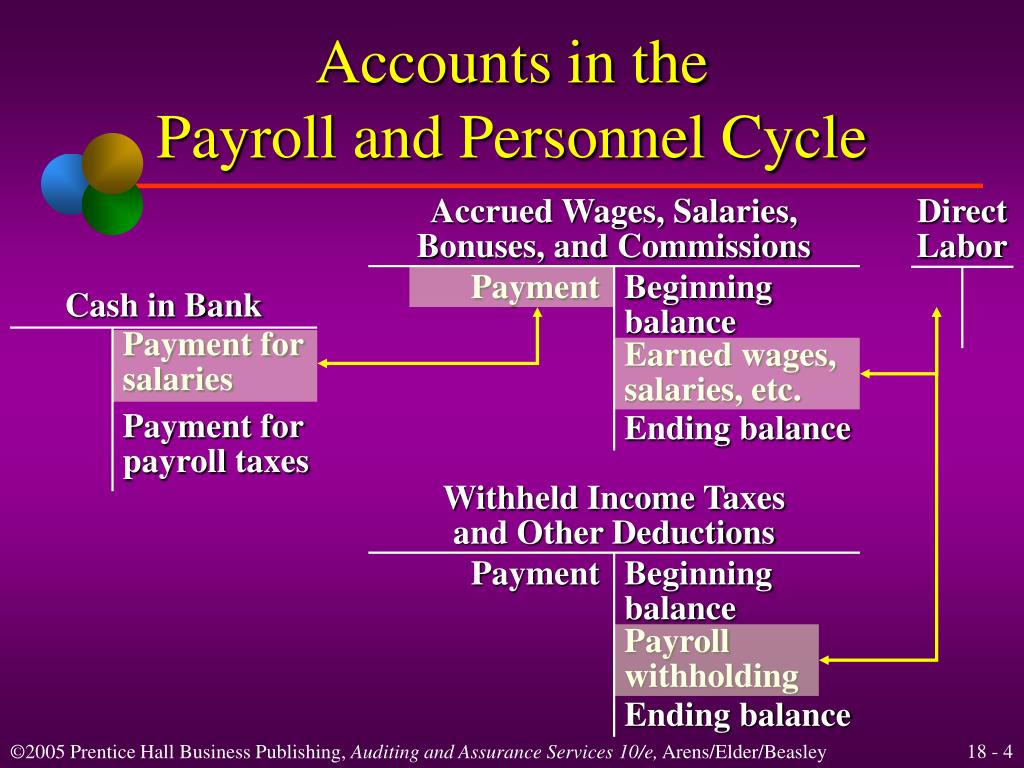

Another type of test of controls in the payroll and personnel cycle is the substantive test of balances. This involves reviewing the balances of various accounts related to payroll and personnel transactions, such as employee salaries and benefits, to ensure that they are accurately reflected in the financial statements. This may include reviewing supporting documentation, such as contracts and agreements with employees, to ensure that the balances are correct.

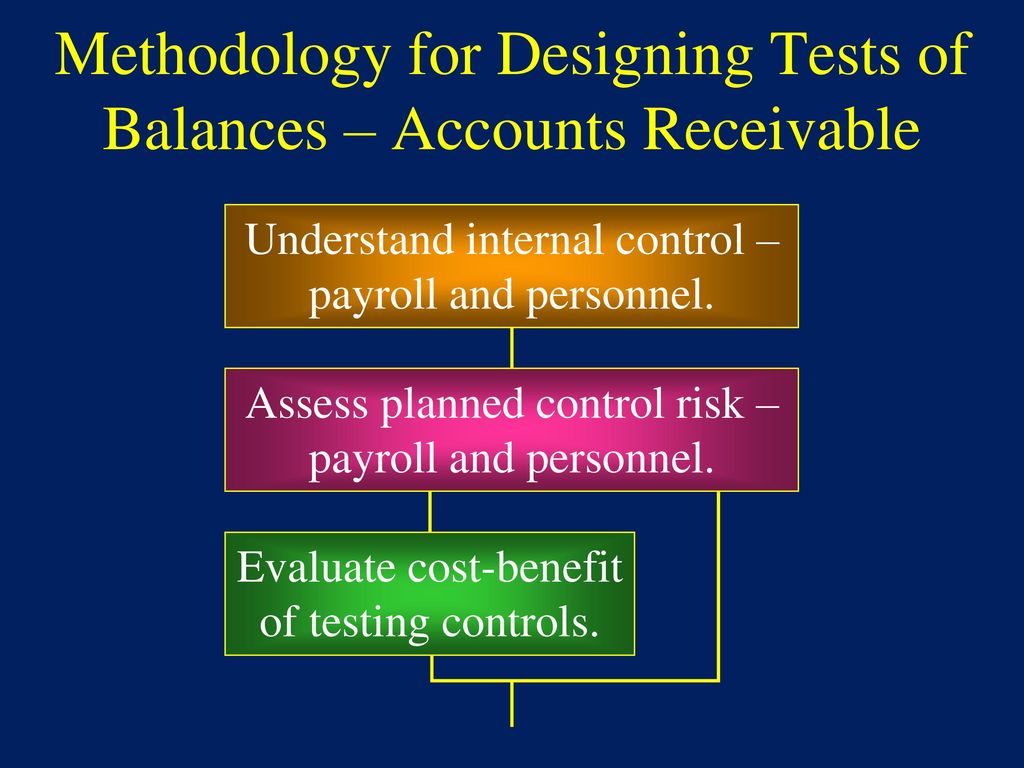

In addition to these substantive tests, auditors may also conduct tests of controls at a higher level, such as evaluating the overall design and effectiveness of the controls in place to ensure the accuracy of payroll and personnel transactions. This may include reviewing policies and procedures, as well as testing the controls through simulation or other means.

Overall, tests of controls in the payroll and personnel cycle are important for ensuring the reliability and accuracy of financial statements. By evaluating the controls in place and performing substantive tests of transactions and balances, auditors can provide assurance that payroll and personnel transactions are properly recorded, processed, and reported.