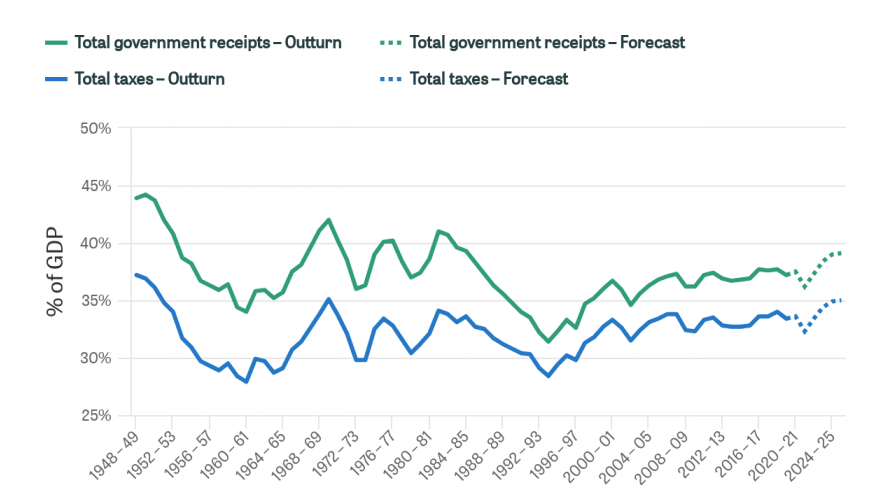

Taxation plays a crucial role in the development of a country, particularly a developing one. It is a key source of revenue for the government, which can be used to fund various development initiatives such as infrastructure projects, education and healthcare programs, and social welfare schemes.

In a developing country, where the government may not have sufficient resources to fund these initiatives, taxation can help bridge the gap. By collecting taxes from the citizens, the government can generate the necessary funds to invest in the development of the country.

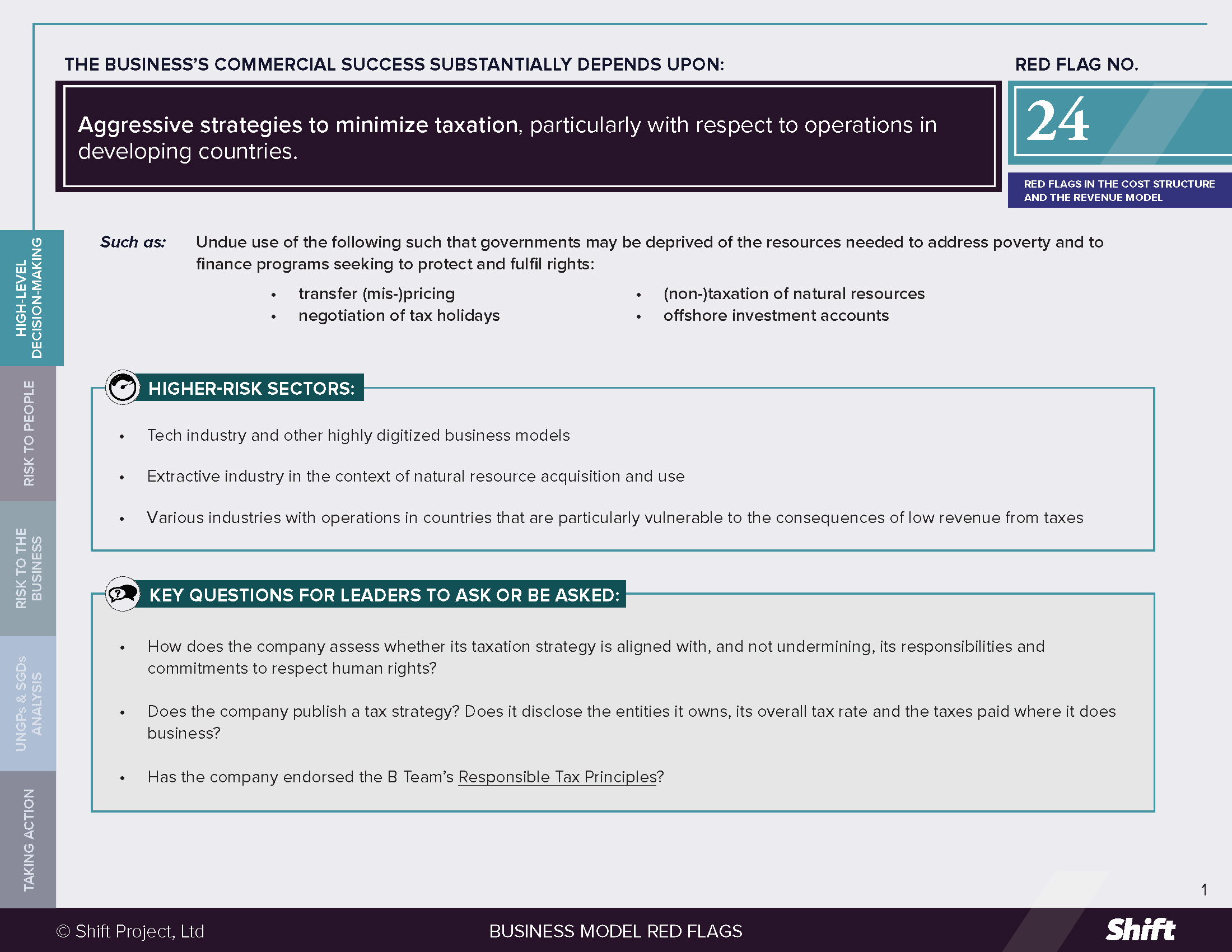

However, taxation can also have negative impacts on a developing country if it is not implemented and administered in an equitable and efficient manner. High tax rates can discourage entrepreneurship and investment, leading to a slowdown in economic growth. Similarly, if the tax system is complex and burdensome, it can discourage compliance and lead to widespread evasion, resulting in a loss of revenue for the government.

To ensure that taxation plays a positive role in the development of a country, it is important that the tax system is designed in a way that is fair, simple, and transparent. This can be achieved through the implementation of progressive taxation, where higher income earners are taxed at a higher rate, and the provision of tax incentives and exemptions for certain sectors of the economy.

In addition, it is important that the government invests the tax revenue wisely, focusing on initiatives that will have a lasting impact on the development of the country. This could include projects that promote economic growth, such as infrastructure development and support for small businesses, as well as programs that address social issues, such as education, healthcare, and poverty reduction.

In conclusion, taxation plays a vital role in the development of a developing country. It is a key source of revenue for the government, which can be used to fund various development initiatives. However, it is important that the tax system is designed and administered in a way that is fair, simple, and transparent, and that the tax revenue is invested wisely in initiatives that will have a lasting impact on the development of the country.