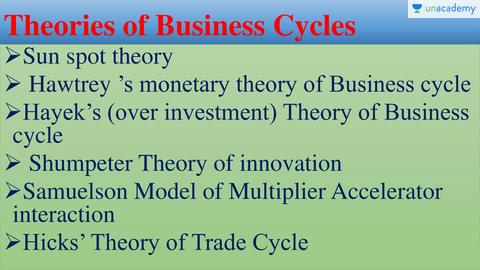

The trade cycle, also known as the business cycle, refers to the fluctuations in economic activity that occur over time. These fluctuations can be observed in a variety of economic indicators such as employment, production, and investment. The trade cycle is a natural part of the market economy and can have significant impacts on businesses, households, and governments.

There are several phases of the trade cycle, including expansion, peak, contraction, and trough. During the expansion phase, the economy is growing and there is an increase in employment, production, and investment. This is typically a time of prosperity and optimism.

The peak is the highest point of the trade cycle, when economic activity is at its strongest. This is followed by a contraction phase, where there is a slowdown in economic activity and a decrease in employment, production, and investment. This is typically a time of uncertainty and pessimism.

The trough is the lowest point of the trade cycle, when economic activity is at its weakest. This is followed by a recovery phase, where the economy begins to grow again and there is an increase in employment, production, and investment.

There are several factors that can contribute to the trade cycle, including changes in monetary and fiscal policy, changes in consumer and business confidence, and external economic shocks such as natural disasters or wars.

The trade cycle can have significant impacts on individuals and businesses. During times of expansion, businesses may experience increased demand for their products or services, leading to increased profits and hiring. However, during times of contraction, businesses may experience decreased demand, leading to decreased profits and layoffs.

Governments also play a role in managing the trade cycle through the use of monetary and fiscal policy. Monetary policy refers to the actions of a central bank, such as setting interest rates, to influence the supply and demand of money in the economy. Fiscal policy refers to the actions of the government, such as tax and spending decisions, to influence the level of economic activity.

In conclusion, the trade cycle is a natural part of the market economy and is characterized by fluctuations in economic activity. These fluctuations can have significant impacts on individuals, businesses, and governments, and can be influenced by various factors such as monetary and fiscal policy, consumer and business confidence, and external economic shocks.

:max_bytes(150000):strip_icc()/TermDefinitions_Economiccycle_finalv1-31b7daeadd56484e867f21ff8cf034ba.png)