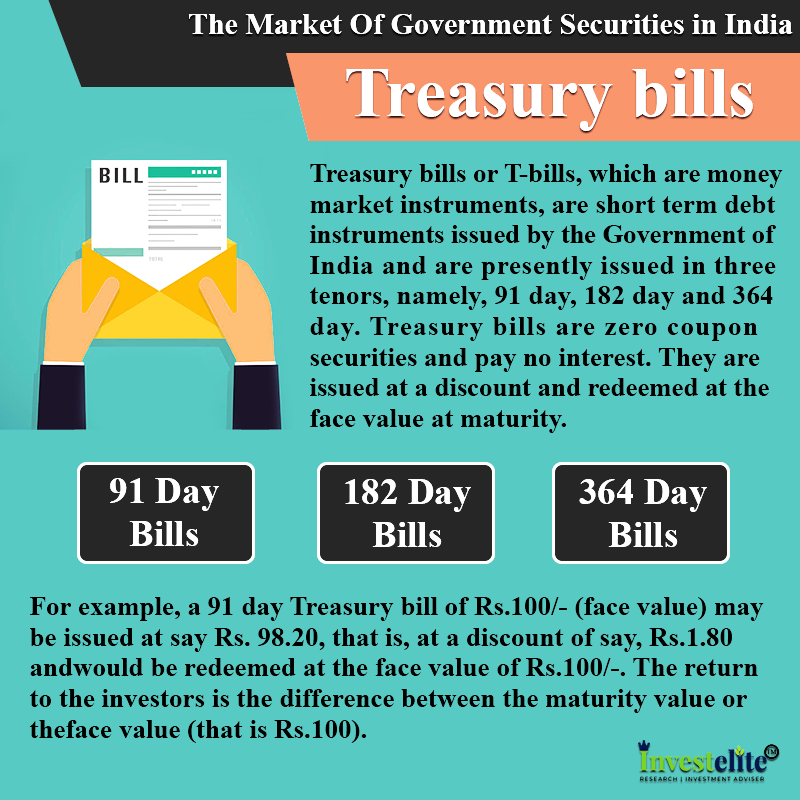

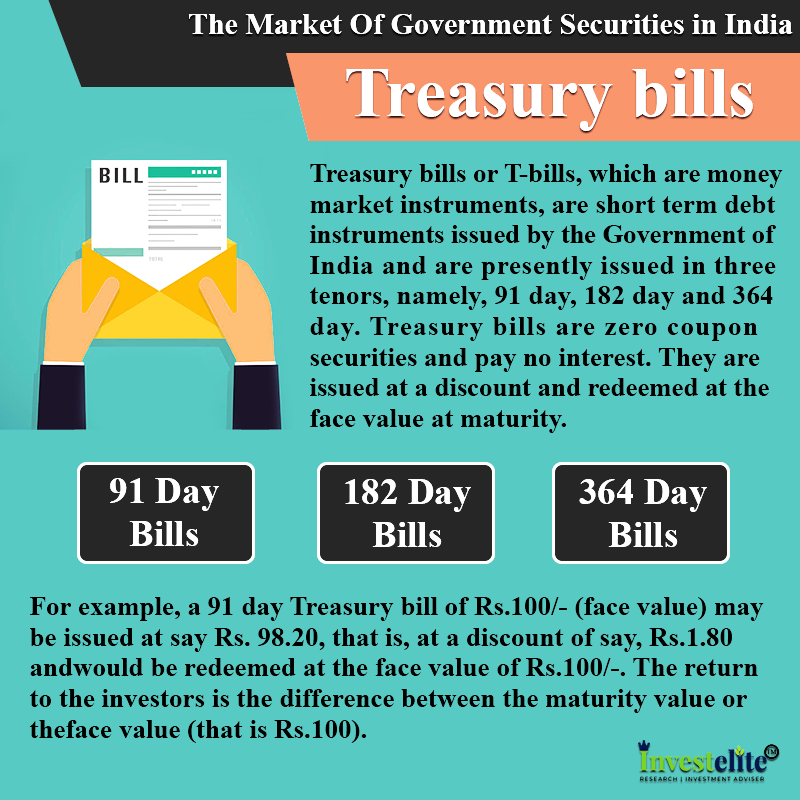

Treasury bills, also known as T-bills, are short-term debt securities issued by the government of India to raise capital for various purposes. They are considered to be one of the safest investment options in the country due to their low risk and high liquidity.

T-bills are issued in three tenures: 91 days, 182 days, and 364 days. They are auctioned by the Reserve Bank of India (RBI), the central bank of the country, on behalf of the government. The interest rate on T-bills is determined through an auction process, where investors submit their bids for the amount they are willing to pay for the T-bill. The RBI then selects the lowest bids and allocates the T-bills accordingly.

Investors can purchase T-bills either directly from the RBI or through a commercial bank or a brokerage firm. T-bills are also available in demat form, which means they can be held in a demat account just like shares.

One of the main advantages of investing in T-bills is their low risk. As they are issued by the government, there is very little likelihood of default. T-bills also have a high degree of liquidity, as they can be easily sold in the secondary market before their maturity date. This makes them an attractive option for investors looking to park their money in a safe and liquid instrument.

T-bills are also tax-efficient, as the interest earned on them is exempt from tax under the Income Tax Act. This makes them a popular choice for investors in higher tax brackets.

However, T-bills also have some drawbacks. One of the main disadvantages is their low return compared to other debt instruments such as corporate bonds. T-bills also have a limited tenure and do not offer the option of rolling over the investment, which means that investors have to reinvest their money after the T-bill matures.

In conclusion, T-bills are a low-risk and liquid investment option that offer tax-efficient returns. They are an attractive choice for investors looking to park their money in a safe and short-term instrument. While they may not offer the highest returns, they provide a degree of security and stability that is hard to find in other investment options.

All that you should be familiar with Treasury Bills

Newly-issued debt securities usually sell at, or close to, their face value. In India, Government of India through RBI issued IIBs linked to WPI in June 2013. Adequate caution, therefore, need to be observed for undertaking the derivatives transactions and such transactions should be undertaken only after having complete understanding of the associated risks and complexities. The interest rate on these bills is established by market forces; they are issued solely by the central government. In return, the investors receive interest. T-bills are money market instruments.

Treasury Bills (T

As per the government regulations, you must have a Demat account to participate in buying and selling of shares, mutual funds, and bonds. They are also to be reported on the clearing house of any of the exchanges for the purpose of clearing and settlement. Foreign Portfolio Investors FPIs are allowed to participate in the G-Secs market within the quantitative limits prescribed from time to time. For instance, a treasury bill worth Rs 100 can be obtained for Rs 95, but the buyer receives Rs 100 when the T-Bill matures. The investors have to pay the Federal income tax over the interest earned on such securities. The Bonds shall bear interest at the rate of 2. Currently, the shut period for the securities held in SGL accounts is one day.

India Treasury Bills (over 31 days)

A market maker provides firm two way quotes in the market i. Phone: 022 6175 7187 SBI DFHI Ltd 3rd Floor, Voltas House, 23, J. Also, the total amount of investment should be in multiples of Rs. On the other hand, T-Bills or Treasury Bills offer short term tenures such as 91 Days, 6 Months and 9 months, etc. The market participants are required to place their bids in e-kuber giving the amount of the source security and the price of the source and destination security expressed up to two decimal places. Owners of bonds are debt holders, or creditors, of the issuer. Conversely, if interest rates or market yields decline, the price of the bond rises.

Treasury bills in India: Meaning and Details of t

So, at the time of investment, you already know how much money you will get on maturity. Yield Curve The graphical relationship between yield and maturity among bonds of different maturities and the same credit quality. All State Governments have issued General notifications which specify the terms and conditions for issue of SDL. The Indian government provides Treasury Bills, which are ideal for investors seeking a secure and profitable investment. Zero Coupon Bonds — Zero coupon bonds are bonds with no coupon payments. PMs, however, may recover the actual charges paid by them to CCIL for settlement of trades or any other charges like transaction cost, annual maintenance charges AMC etc.