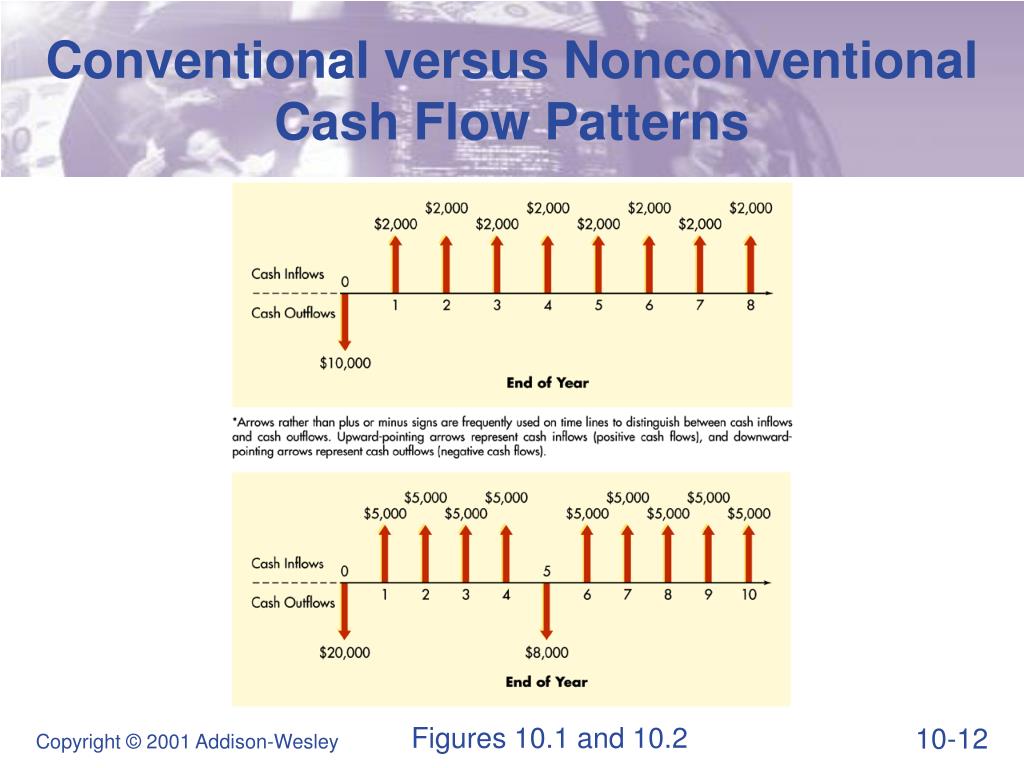

Unconventional cash flow refers to the sources of funds that a company or individual can use to finance their operations or investments that are not traditional methods such as loans or equity financing. These sources of funding can be creative and innovative, and often require thinking outside of the box to identify and secure.

One example of unconventional cash flow is crowdfunding, which is the practice of raising small amounts of money from a large number of people, typically through the internet. Crowdfunding platforms, such as Kickstarter and GoFundMe, allow individuals or businesses to pitch their ideas or projects to a large audience and request financial support in the form of small donations. This approach can be particularly useful for startups or entrepreneurs who may not have access to traditional forms of financing, or for projects that may not fit the criteria for traditional funding sources.

Another example of unconventional cash flow is the use of trade credits, which are essentially short-term loans extended by suppliers to their customers. This can be a valuable source of funding for companies that have a good relationship with their suppliers and are able to negotiate favorable terms. In this scenario, the supplier agrees to provide goods or services to the customer without requiring immediate payment, and the customer agrees to pay the supplier at a later date. This allows the customer to use their cash flow more efficiently and can be a useful tool for managing cash flow during times of financial uncertainty.

Another unconventional source of cash flow is the sale of assets, such as property or equipment. This can be a quick way to generate cash, but it should be approached with caution as it can have long-term consequences if the assets being sold are critical to the company's operations.

In conclusion, unconventional cash flow refers to non-traditional sources of funding that can be used to finance operations or investments. These sources can include crowdfunding, trade credits, and the sale of assets, and can be valuable tools for companies or individuals looking to secure financing. However, it is important to carefully consider the risks and consequences of using unconventional cash flow and to choose the right approach based on the specific needs and circumstances of the company or individual.