My favourite book is "To Kill a Mockingbird" by Harper Lee. This classic novel tells the story of Scout Finch, a young girl growing up in the Deep South during the 1930s. The book is narrated by Scout, who tells the story of her childhood and the lessons she learned about race, prejudice, and injustice.

One of the things I love most about this book is the way it tackles complex and difficult themes in a way that is both thought-provoking and accessible. Through the eyes of Scout, we see the world of Maycomb County and the people who live there in all its complexity and humanity. Scout's observations and insights about the people and events around her are honest and insightful, and they help us to understand the world in a deeper and more meaningful way.

Another thing I love about this book is the way it portrays the relationship between Scout and her father, Atticus Finch. Atticus is a compassionate and fair-minded lawyer who takes on a controversial case in defense of a black man accused of raping a white woman. Despite facing hostility and persecution from his community, Atticus stands up for what he believes in and sets a powerful example for his children. Through Atticus, we see the importance of standing up for what is right and fighting for justice, even when it is difficult or unpopular.

Overall, "To Kill a Mockingbird" is a beautifully written and deeply moving book that has had a lasting impact on me. It has taught me to be more understanding and empathetic towards others, and to stand up for what I believe in. I highly recommend it to anyone who enjoys thought-provoking literature that addresses important social issues in a meaningful way.

National Insurance Co. Ltd., Varistha

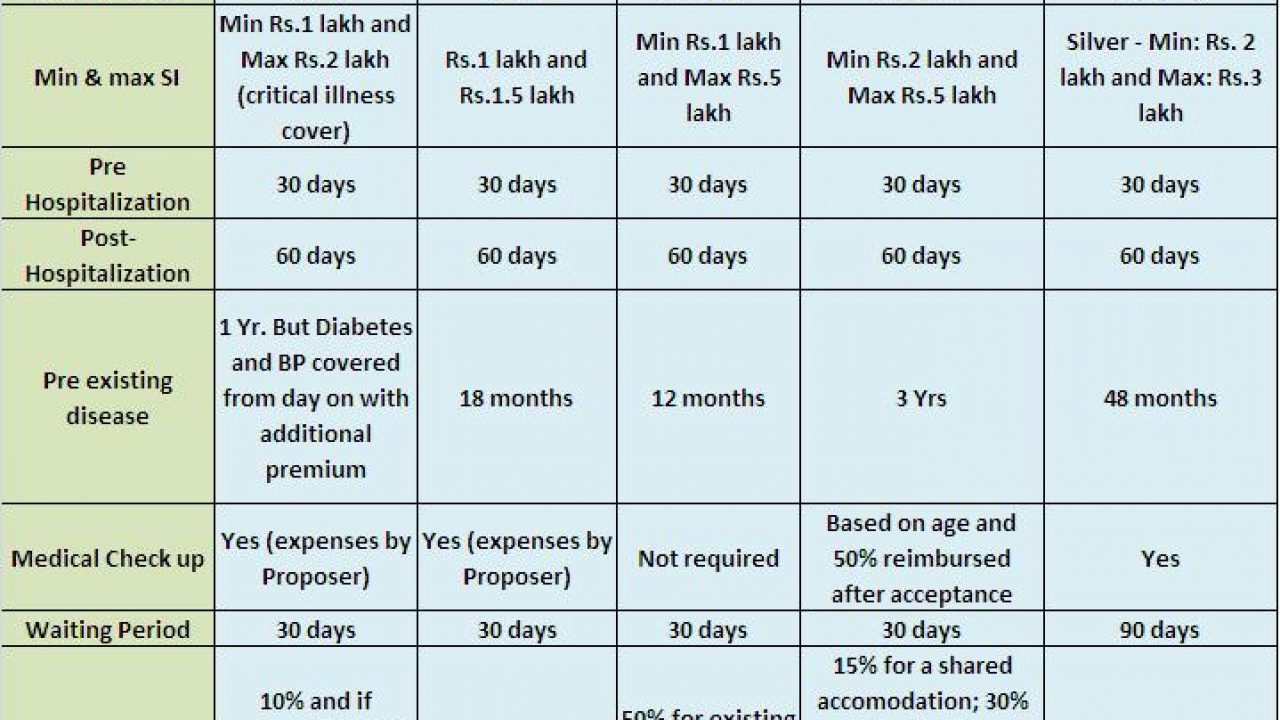

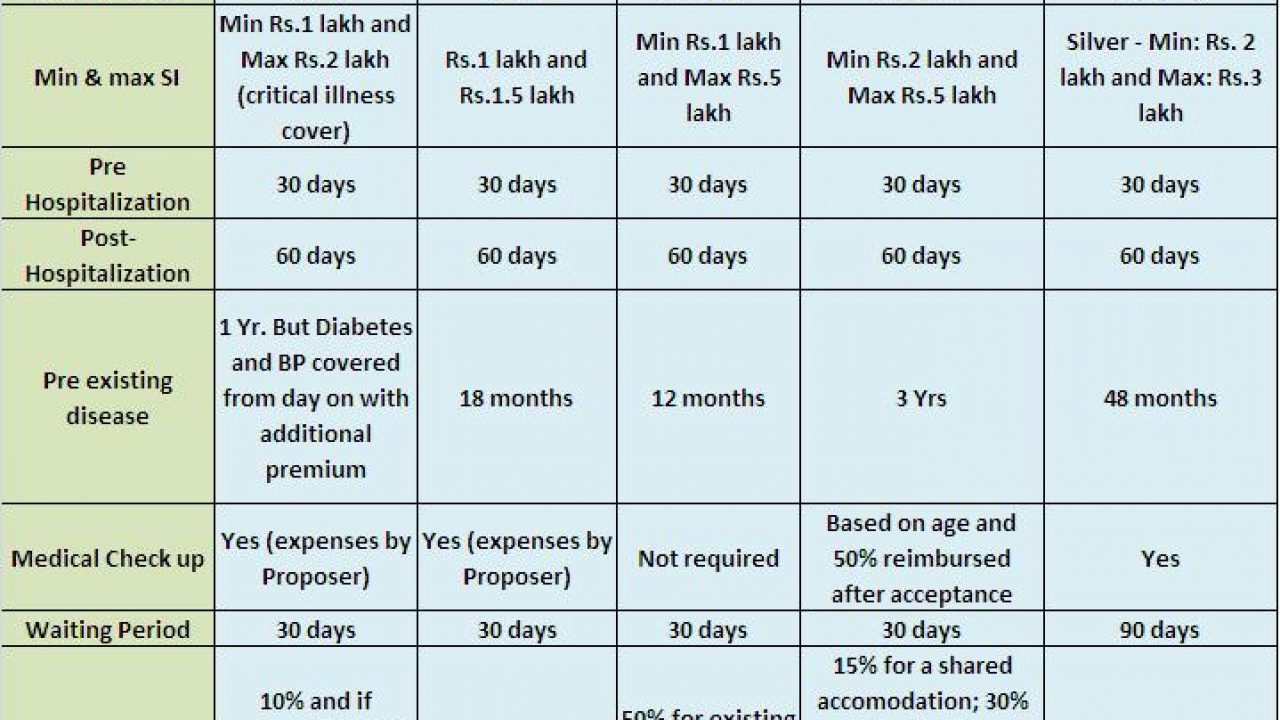

However, policyholders need to pay extra premium to avail additional coverage. Such action shall render this policy null and void and all claims hereunder shall be forfeited. This policy offers to cover pre-existing diabetes and hypertension for extra premium. However, you need to remember that the policy can be renewed per year throughout the lifetime of the insured person. Individuals can choose a policy period of 1 year. If the medical report indicates occurrence of any such consequential complication, those proposals will be declined.

National Insurance

However, you still need medical insurance to help you with those never-ending medical bills and protect your savings. India, this bonus can also be added to the sum insured with policy renewal. It comes with a tonne of attractive bonuses and special inclusions to give residents financial security as they age. When renewing the policy, this incentive may be cumulatively added to the amount insured. Should you have any objection to use of public information on this site, please contact us and we shall remove the content that you feel is not in public interest or has a copyright which prevents it to be displayed on eMediclaim. What are the Exclusions from the National Insurance Varistha Mediclaim Policy? It offers additional coverage for critical illness only if policyholder opts for it.

VARISTHA Mediclaim for Senior Citizens

The TPA is a third party, which is licensed by the IRDA Third Party Administrators - Health Services Regulations, 2001. The due payment of premium and the observance and fulfilment of the terms, provisions, conditions and endorsements of this policy by the Insured Person in so far as they relate to anything to be done or complied with by the Insured Person shall be condition precedent to any liability of the Company to make any payment under this policy. Hospitals that would be recognized as eligible for treatment of the insured should specify some criteria. Be signed and mediclaim for There was no reason given by Reliance on increase in premium. The one year period also applies to certain conditions like cataract, piles, and hernia. What makes this policy stand out are the following benefits: I will consider Best policy as the one whose premium is nominal and coverage has least limits etc.

National Insurance Varistha Mediclaim Policy

The benefits under this policy shall be in excess of the benefits available under the Cancer Insurance Policy. Downloads for Varishtha Health Policy by National Insurance Co. No waiver of any terms, provisions, conditions and endorsements of this policy shall be valid, unless made in writing and signed by an authorised official of the Company. Clear your browser's cache and cookies for Seniority. This condition 2 shall not however apply in case of the Insured Person having been covered under this Scheme or group insurance scheme with any one of the Indian Insurance Companies for a continuous period of preceding 12 months without any break. The Overall limit of coverage of National Insurance Varistha Mediclaim Policy is 25% of Sum Insured for every illness. Insured that have not opted for critical illness cover are entitled to hospitalization and domiciliary expenses for diseases under critical illness but only up to the sum insured according to the scope of the policy.

Varistha Mediclaim Policy For Senior Citizens Premium

Also, AIDS, HIV will broadly be interpreted to include all mutants, derivatives, or variations for non-payment. Note: Please refer to the policy documents for the complete Insurance Policy subject to the insurance Company. Sum Insured: Sum Insured is fixed per person. The National Varistha Mediclaim health insurance comes into play here. National Insurance Varistha Mediclaim Policy also comes with the option of covering critical illness treatment expenses. Note: Please refer to the policy documents for the complete Insurance Policy subject to the insurance Company.