Walmart is a multinational retail corporation that operates a chain of supermarkets, discount department stores, and hypermarkets. Founded by Sam Walton in 1962, Walmart has become one of the largest and most successful retail companies in the world. The company operates in numerous countries and has over 11,500 stores globally, making it the largest retailer in the world by revenue.

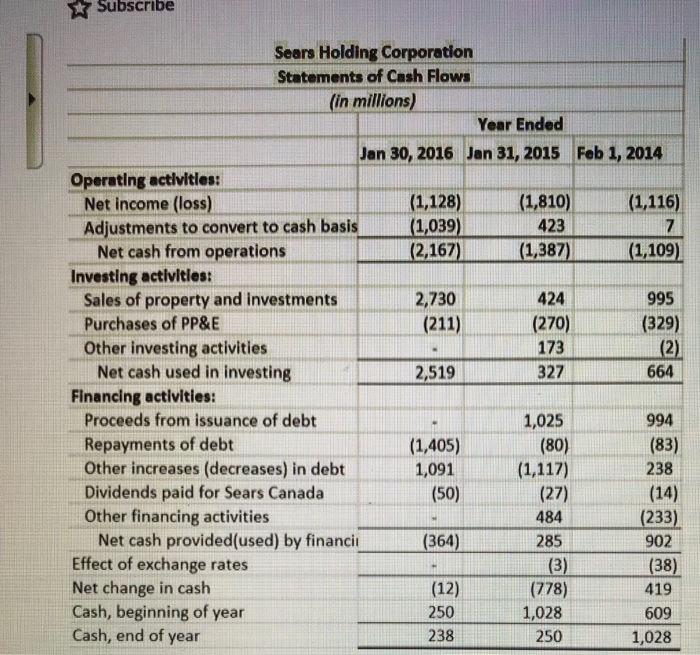

A cash flow analysis is a financial tool that is used to understand the inflow and outflow of cash in a business. It is a crucial aspect of financial management that helps companies understand their financial position and make informed decisions. For a company like Walmart, a cash flow analysis is especially important as it has a large and complex global supply chain and a wide range of products and services.

To conduct a cash flow analysis of Walmart, we will need to gather financial data on the company's revenues, expenses, and investments. This information can be found in the company's financial statements, which are typically published annually or quarterly.

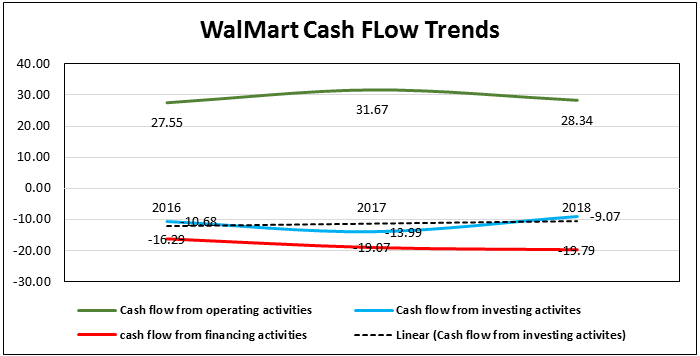

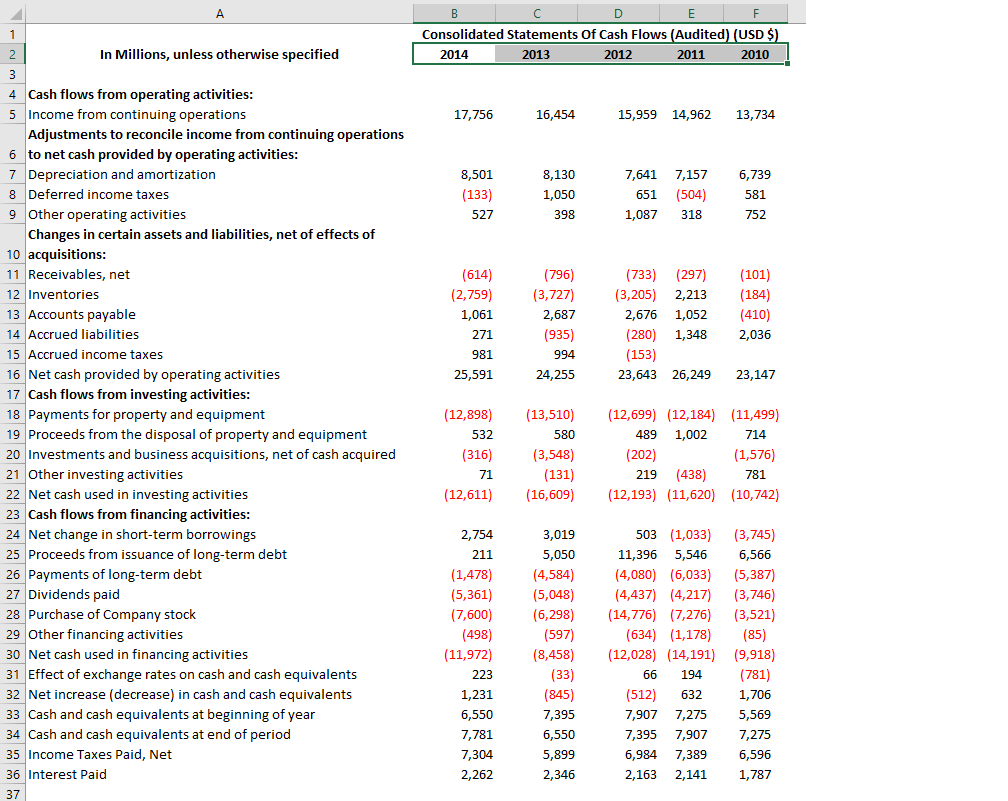

One of the key components of a cash flow analysis is the net cash flow, which is calculated by subtracting the company's total cash outflows from its total cash inflows. Walmart's net cash flow can be further broken down into three categories: operating activities, investing activities, and financing activities.

Operating activities refer to the company's day-to-day business operations, such as the sale of goods and services, the payment of salaries and wages, and the payment of expenses. Walmart's operating activities generate the majority of the company's cash flow.

Investing activities refer to the company's investments in long-term assets, such as property, plant, and equipment. These investments are typically financed through the use of cash or debt. Walmart's investing activities typically consume a large portion of the company's cash flow.

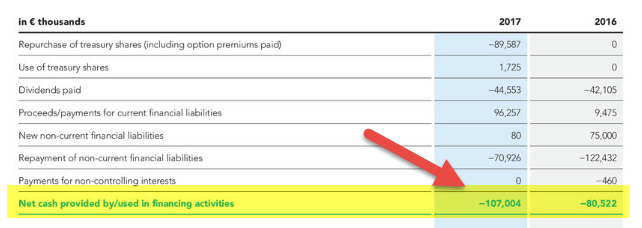

Financing activities refer to the company's borrowing and repayment of debt, as well as the issuance and repurchase of shares. Walmart's financing activities also impact the company's cash flow, although to a lesser extent compared to operating and investing activities.

Overall, a cash flow analysis of Walmart can provide insight into the company's financial health and help management make informed decisions about the allocation of resources. By understanding the sources and uses of cash, management can identify areas for improvement and optimize the company's cash flow to maximize profitability and shareholder value.

:max_bytes(150000):strip_icc()/cashflow_final-c3af6d2c837542149167b21b3f664681.png)