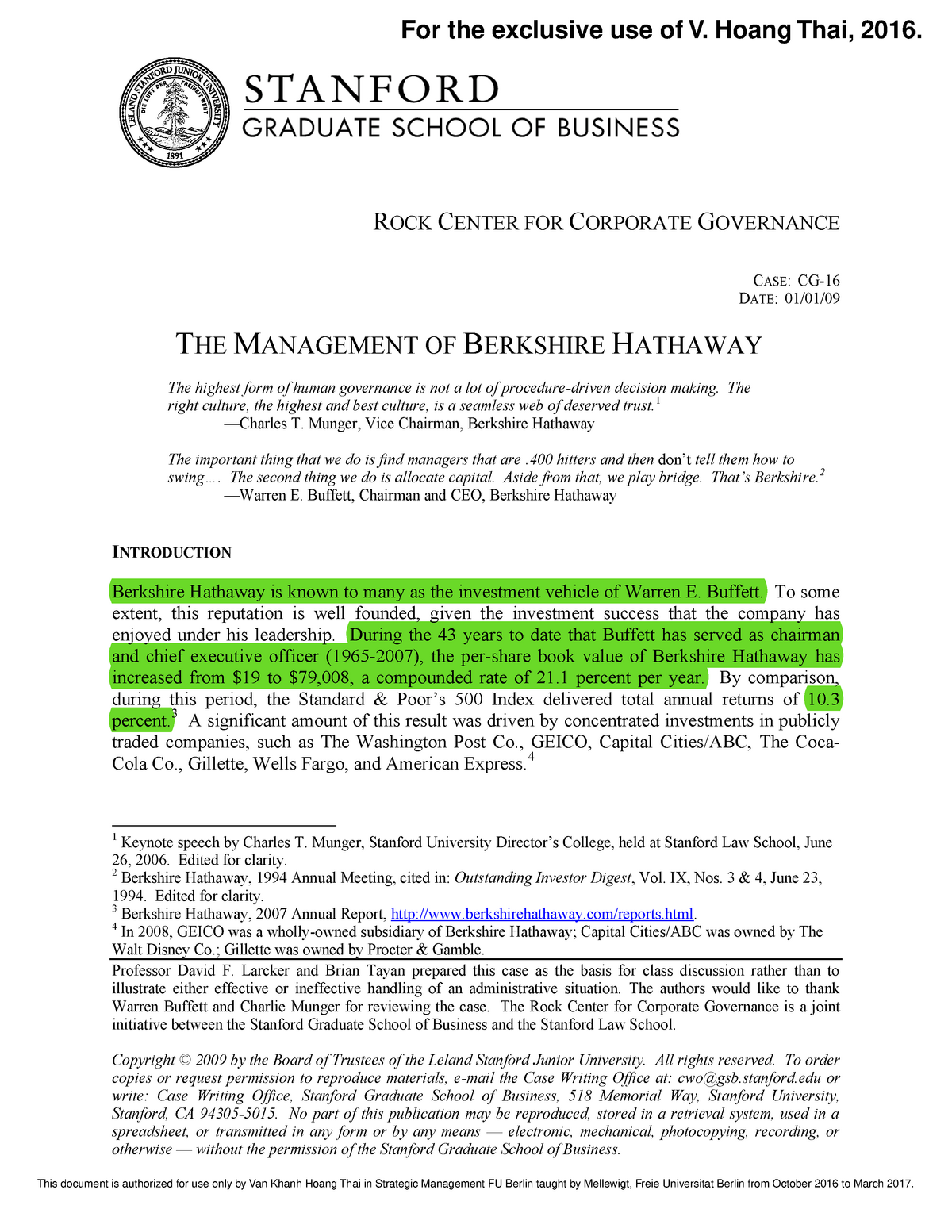

Warren Buffett is an American investor, businessman, and philanthropist who is widely considered one of the most successful investors in history. Born in Omaha, Nebraska in 1930, Buffett developed an early interest in business and finance and began investing in stocks and other securities at a young age. He eventually attended the University of Nebraska and later received a Master's degree in Economics from Columbia University.

After completing his education, Buffett began his professional career by working as a securities analyst and eventually became a partner at an investment firm. In the mid-1960s, he founded his own investment company, Berkshire Hathaway, which has grown into a successful and diversified conglomerate with holdings in a wide range of industries, including insurance, retail, and finance.

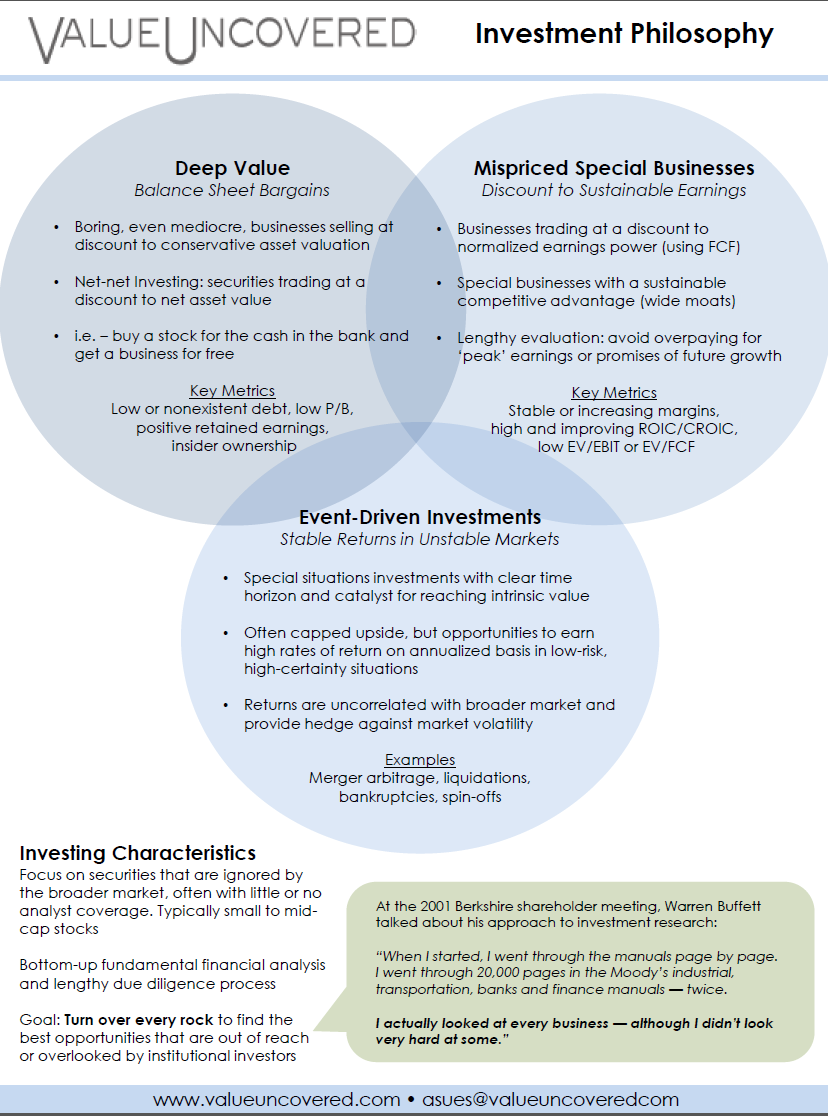

One of the key reasons for Buffett's success as an investor is his approach to investing, which is often referred to as "value investing." This approach involves carefully analyzing a company's financials, management, and industry to determine its intrinsic value and then making investment decisions based on that analysis.

Buffett is known for his patience and discipline as an investor and his willingness to hold onto investments for the long term. He is also known for his ability to identify undervalued companies and to invest in them before the market recognizes their true worth.

In addition to his successful business career, Buffett is also known for his philanthropy. He has pledged to give away the majority of his wealth to charitable causes, including the Bill and Melinda Gates Foundation.

Overall, Warren Buffett is a case study in the importance of careful analysis, discipline, and long-term thinking in the world of investing. His success serves as a testament to the power of these principles and the rewards that can come from applying them consistently.

:max_bytes(150000):strip_icc()/buffetts-road-to-riches-503bf79a9c444047840ea156fd648143.png)

:max_bytes(150000):strip_icc()/forbes-media-centennial-celebration-849890542-b08b238779db42b78bc66c694a31258f.jpg)