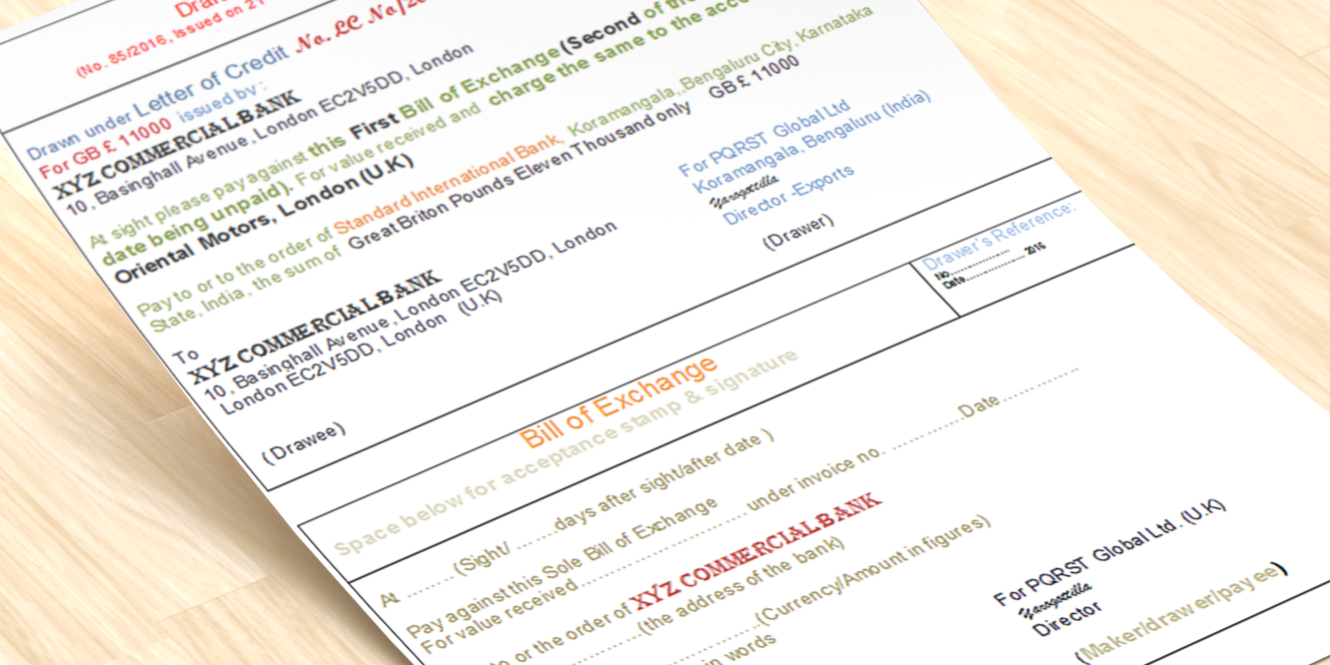

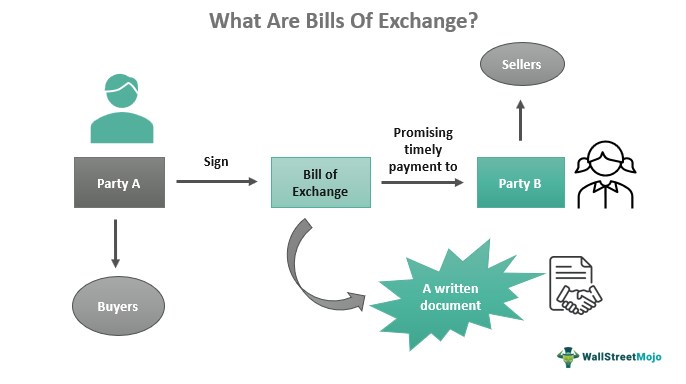

A bill of exchange is a financial instrument that is used in international trade and banking as a means of payment. It is a document that orders one party, known as the drawee, to pay a specific sum of money to another party, the payee, on demand or at a predetermined date.

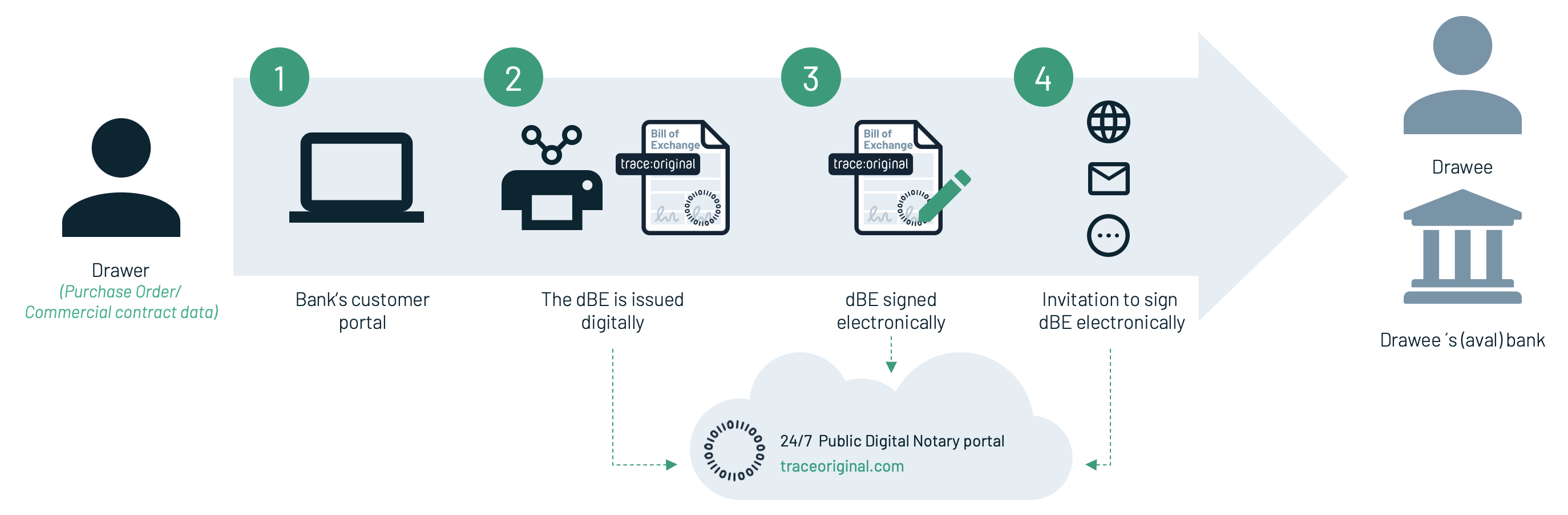

A bill of exchange typically consists of three parties: the drawer, the drawee, and the payee. The drawer is the party that issues the bill of exchange and instructs the drawee to pay the payee. The drawee is the party that is ordered to pay the payee, and the payee is the party that is to receive the payment.

Bills of exchange can be either domestic or international, depending on the parties involved and the location of the transaction. Domestic bills of exchange are typically used for transactions within a single country, while international bills of exchange are used for transactions between different countries.

There are two main types of bills of exchange: sight drafts and time drafts. A sight draft is a bill of exchange that requires the drawee to pay the payee immediately upon presentation of the bill. A time draft, on the other hand, allows the drawee to pay the payee at a later date, which is typically specified in the bill.

Bills of exchange have several advantages in international trade and banking. They provide a secure and efficient means of payment, as they are guaranteed by the drawee and can be easily transferred from one party to another. They also reduce the risk of fraud and provide protection against non-payment, as the drawee is legally obligated to pay the payee according to the terms of the bill.

In conclusion, a bill of exchange is a financial instrument that is used in international trade and banking as a means of payment. It consists of three parties: the drawer, the drawee, and the payee, and can be either domestic or international in nature. Bills of exchange provide a secure and efficient means of payment and reduce the risk of fraud and non-payment in international transactions.

Who uses bills of exchange?

When Interest is Included in a Bill of Exchange In most cases, a bill of exchange will not necessitate the payment of interest on the outstanding balance. These entities want to conduct business between themselves. ABC drafts an international bill of exchange for Mr. It is a big win. In the context of international commerce, an exporter has the ability to retain ownership of the items being exported through the use of a sight draft until the importer takes delivery of the products and immediately pays for them. For example, you can create setup lines for methods of payment, payment specifications, currencies, and time periods. OVERVIEW Bill of exchange is a type of negotiable instrument in which a written, unconditional order made by one party drawer is transferred to another the drawee to pay a certain sum of money, either immediately or on a fixed date as mentioned in the bill, for payment of goods or services received.

Bill of Exchange: How it Works, Examples & All You Need

Because of this, a promissory note can never be written so that it is payable to the bearer. So, generating a hefty income for an exchange bank is not that hard. In international trade, the exporter, or seller, presents a bill of exchange to the buyer, or importer, who must sign the bill for it to be valid. Because to make money, one has to spend some money. In the Liabilities for discount account field, select the account to post the discount amount for remittances for discount to.

What is a Bill of Exchange? Definition and types

Discounting a Bill of Exchange In order to get funds before the date of payment that is mentioned on the bill of exchange, the payee of the bill of exchange may sell the bill to another party for a price that is reduced from its face value. Ram draws a bill for Rs. Promissory notes, in the form of banknotes, are extremely prevalent. A guarantee may be given by any person, who may or may not already be a party. Not only that, they can sometimes invest as a financial entity. In case of dishonour of these bills, the drawer cannot file a suit against the drawee. On top of that, they also provide other banking solutions like saving and deposit, loans, credit card facilities, locker systems, and so on.