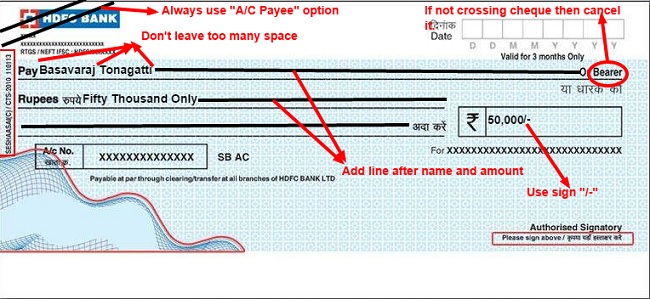

A cross cheque, also known as a crossed check, is a type of check that has two parallel lines drawn across the face of the check, usually with the words "and company" written between the lines. This feature is used to prevent the check from being cashed at a bank or financial institution. Instead, the check must be deposited directly into the payee's account or presented to the payee for payment.

The purpose of a cross cheque is to increase the security and traceability of the check. By requiring the check to be deposited directly into the payee's account, it becomes much harder for the check to be stolen or misused. Additionally, the fact that the check is deposited directly into the payee's account allows for easier tracking and reconciliation of the transaction.

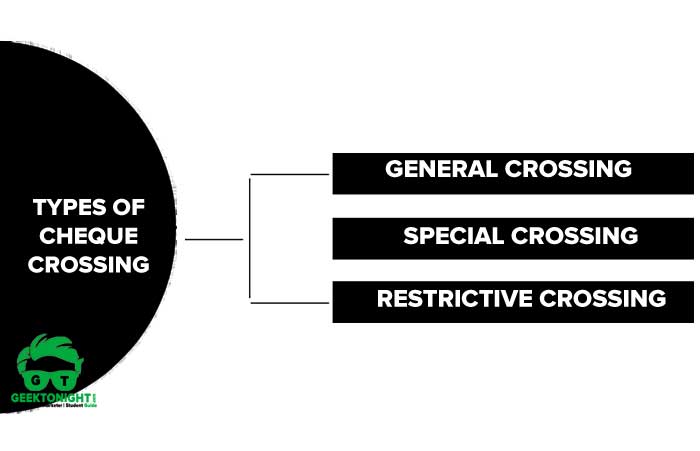

There are two types of cross cheques: general and special. A general cross cheque can be deposited into any account at any bank, whereas a special cross cheque can only be deposited into a specific account at a specific bank. Special cross cheques are often used when the payee does not have an account at the issuing bank, or when the payee wishes to ensure that the funds are deposited into a specific account.

Cross cheques are commonly used in business transactions, as they offer a higher level of security and traceability than regular checks. They are also often used in real estate transactions, as they offer a way for buyers to transfer large sums of money securely and without the risk of the funds being misused.

In summary, a cross cheque is a type of check that is marked with two parallel lines and the words "and company" written between the lines. It is used to increase the security and traceability of the check and is often used in business and real estate transactions.