Profit maximization and wealth maximization are two concepts that are frequently discussed in the field of economics and business. These concepts refer to the goals that businesses and organizations seek to achieve in order to succeed and thrive. While these goals may seem similar at first glance, there are actually some key differences between profit maximization and wealth maximization that are worth exploring.

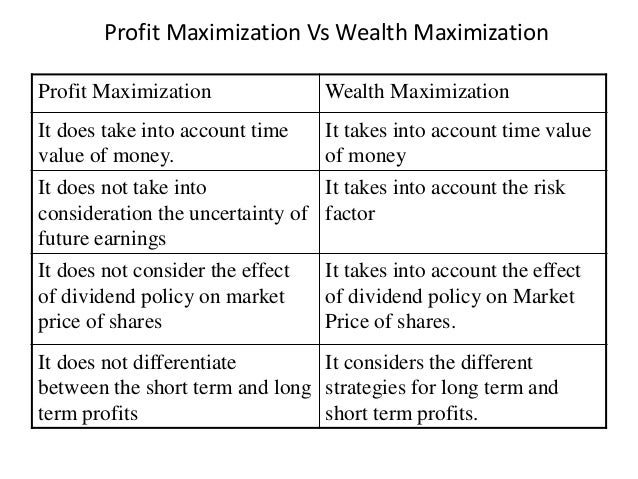

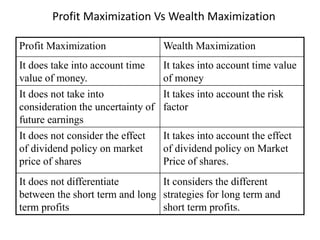

Profit maximization is a business strategy that focuses on maximizing the profits of a company or organization. This goal is often pursued by increasing revenue, reducing costs, or a combination of both. Profit maximization is a short-term goal that is typically measured in terms of a company's profits over a specific period of time, such as a quarter or a year.

There are several ways that a company can pursue profit maximization. One approach is to focus on increasing sales and revenue by expanding the company's customer base or introducing new products or services. Another approach is to reduce costs by streamlining operations, cutting expenses, or negotiating lower prices for materials and supplies.

While profit maximization is an important goal for businesses, it is not the only goal that they should consider. This is where the concept of wealth maximization comes into play.

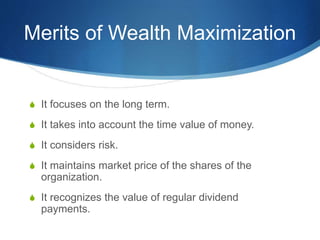

Wealth maximization is a business strategy that focuses on maximizing the wealth of a company's shareholders over the long term. This goal is achieved by maximizing the company's profits and increasing the value of its assets. Wealth maximization is a long-term goal that takes into account the impact of a company's actions on its future profitability and growth.

In order to pursue wealth maximization, a company must consider a wide range of factors, including market trends, economic conditions, and the impact of its decisions on stakeholders such as employees, customers, and the community. A company that is focused on wealth maximization may choose to invest in research and development, build strong relationships with customers, or diversify its operations in order to minimize risk and increase its long-term growth potential.

In conclusion, profit maximization and wealth maximization are two important goals that businesses and organizations strive to achieve. While profit maximization is a short-term goal that focuses on maximizing profits over a specific period of time, wealth maximization is a long-term goal that takes into account the impact of a company's actions on its future profitability and growth. Both of these goals are important for the success and sustainability of a business, but it is important for companies to strike a balance between the two in order to achieve long-term success.