Buying on credit refers to the practice of purchasing goods or services using a loan or line of credit, rather than paying for them upfront in cash. This option is often offered by retailers, banks, and other financial institutions as a way for consumers to make purchases they may not have the funds to pay for immediately. While buying on credit can have some advantages, it also carries certain risks and disadvantages that should be carefully considered before making the decision to do so.

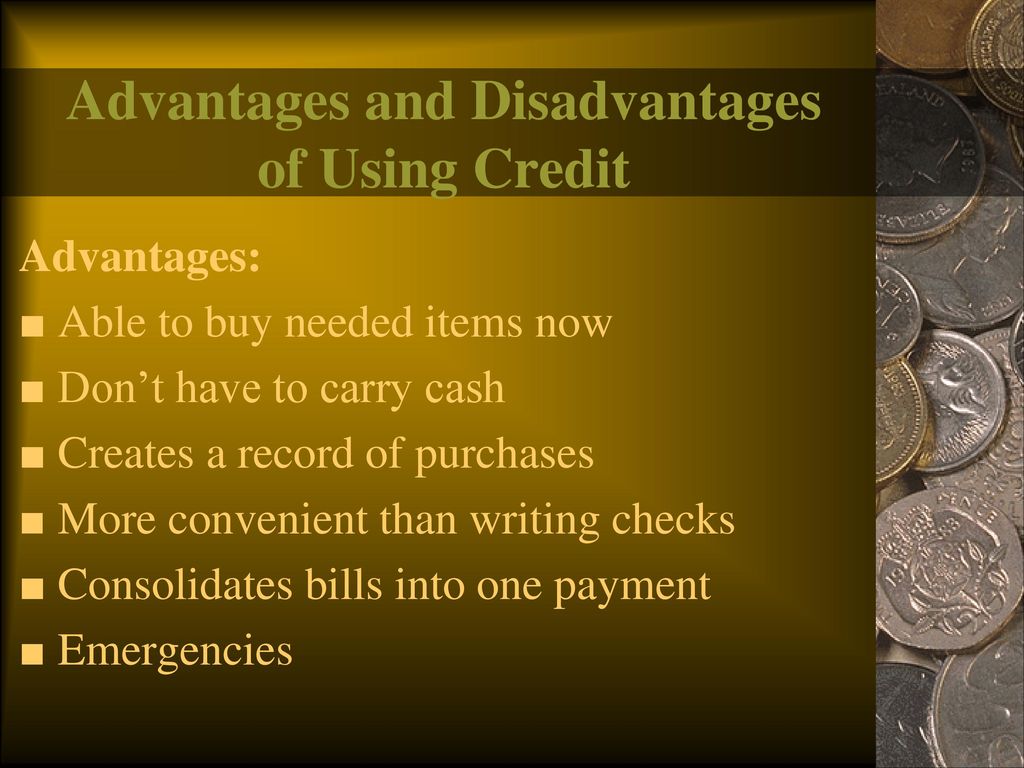

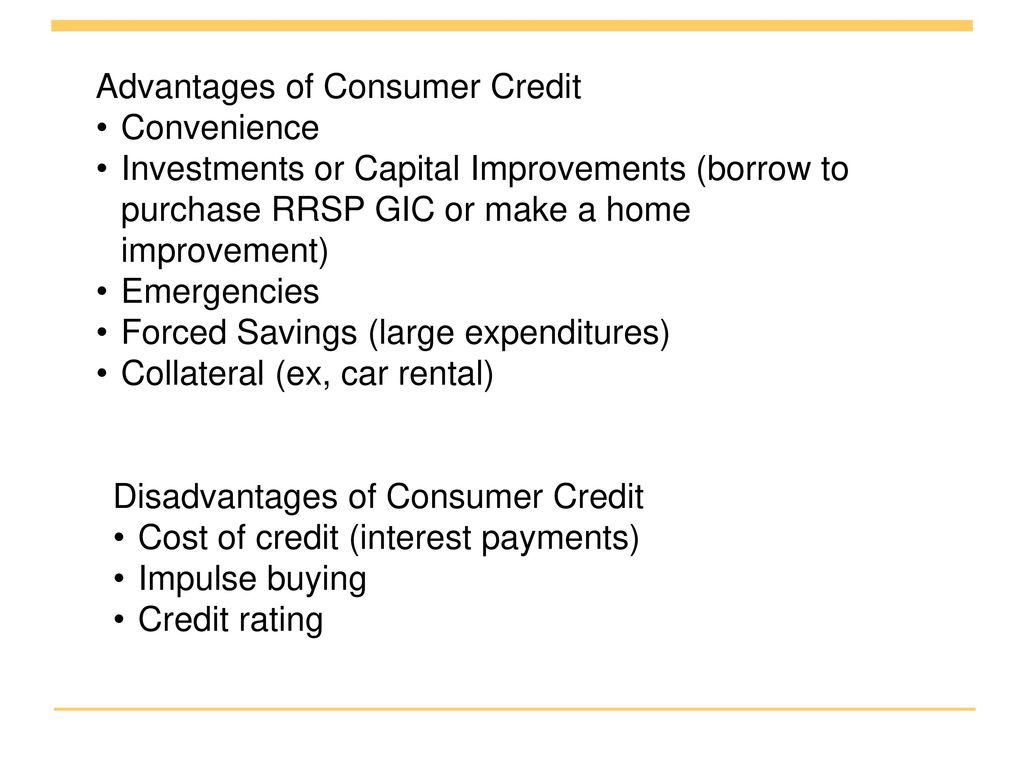

One advantage of buying on credit is that it allows consumers to make purchases they may not have been able to afford otherwise. For example, if someone needs to make a large purchase, such as a new appliance or furniture, but does not have the money to pay for it upfront, buying on credit can be a convenient way to make the purchase and pay for it over time. This can be particularly useful for people who need to make an important purchase but are unable to save up enough money to pay for it all at once.

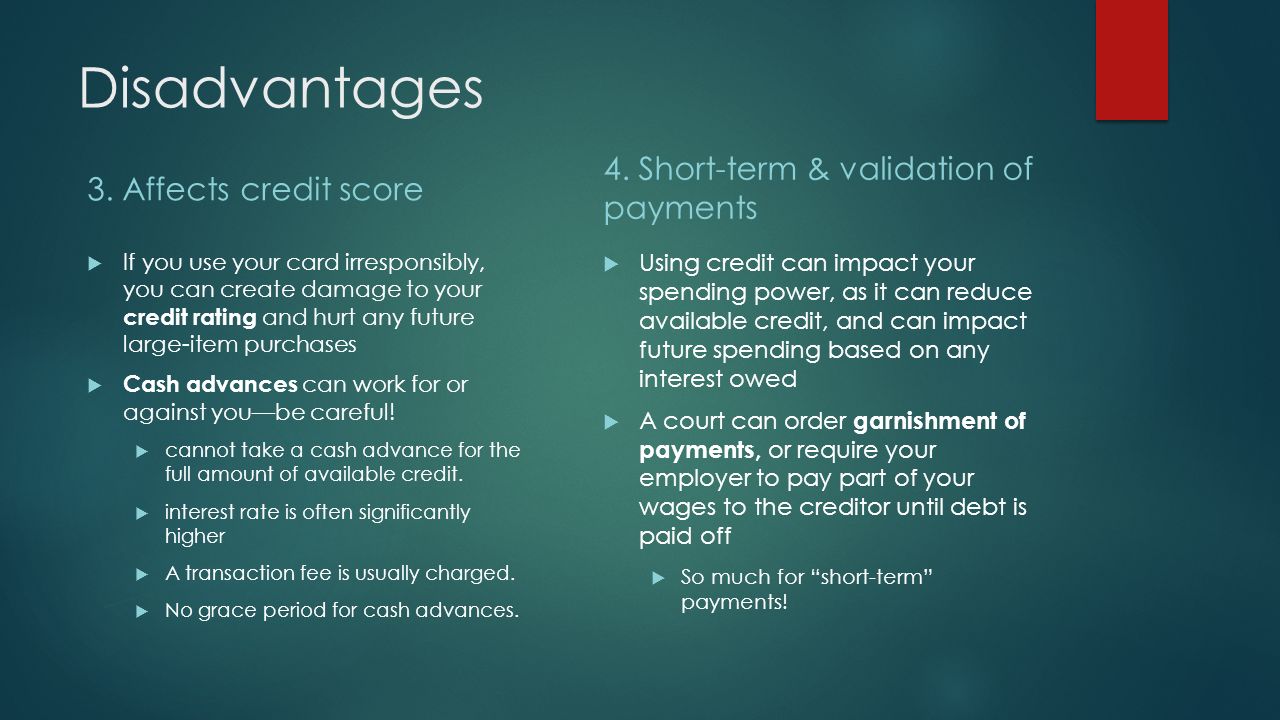

Another advantage of buying on credit is that it can help consumers build their credit scores. Credit scores are used by lenders to determine the creditworthiness of a borrower, and a higher credit score can make it easier for a consumer to qualify for loans, credit cards, and other financial products with lower interest rates. By using credit responsibly and making timely payments, consumers can improve their credit scores, which can be beneficial in the long run.

However, buying on credit also carries certain risks and disadvantages that should be carefully considered. One of the main disadvantages is the potential for high interest rates. Many credit cards and loans charge interest on the balance owed, which can significantly increase the overall cost of the purchase. For example, if someone makes a purchase on a credit card with a high interest rate and takes a long time to pay off the balance, the interest charges alone could end up costing more than the original purchase price.

Another disadvantage of buying on credit is that it can be tempting to make impulsive or unnecessary purchases. When consumers are able to make purchases without paying for them immediately, they may be more likely to buy items they do not really need or cannot afford to pay for in cash. This can lead to overspending and accumulating debt, which can be financially burdensome and difficult to pay off.

In conclusion, buying on credit can have both advantages and disadvantages. It can be a useful way for consumers to make purchases they may not have been able to afford otherwise, and it can help them build their credit scores. However, it also carries the risk of high interest rates and the temptation to overspend, which can lead to financial problems. Therefore, it is important for consumers to carefully consider the pros and cons of buying on credit before making a decision, and to use credit responsibly if they do choose to do so.