External equity refers to the practice of using external sources of capital, such as loans or investments from external investors, to finance a business or project. This can be an attractive option for businesses and organizations, as it allows them to access additional funds without having to use their own capital or resources. There are several advantages to using external equity, which are discussed below.

One advantage of external equity is that it can provide access to larger amounts of capital than a business or organization may have access to internally. This can be especially useful for businesses that are growing rapidly or seeking to expand into new markets. By accessing external equity, businesses can fund their expansion efforts and take advantage of new opportunities that may not have been possible with their internal resources alone.

Another advantage of external equity is that it can provide a source of capital that is not tied to the performance of the business or organization. This can be particularly useful in times of economic downturn or other challenging circumstances, as it allows businesses to continue operating and investing in their growth despite difficult conditions.

External equity can also provide a source of capital that is not tied to the personal assets of the business or organization's owners or shareholders. This can be beneficial in protecting the personal assets of the business's owners in the event of financial difficulties or legal issues.

In addition, using external equity can help a business or organization to diversify its sources of funding. By relying on a mix of internal and external sources of capital, a business can reduce its risk and increase its financial stability.

Finally, external equity can also be a way for businesses to bring in new expertise and resources. For example, external investors may have valuable industry experience or connections that can help a business to grow and succeed.

In conclusion, external equity can provide access to larger amounts of capital, a source of capital that is not tied to the performance of the business, protection of personal assets, diversification of funding sources, and access to new expertise and resources. These advantages make external equity an attractive option for businesses and organizations seeking to finance their growth and expansion efforts.

What are the advantages and disadvantages of external sources of finance?

I hope now everything is clear and you have learned what you wanted to learn from this post. The sources for external finances that are available are export credit, world bank group, foreign direct investment. At American Institutes for Research, their benefits brochure boasts the market competitive salaries they offer to their employees along with an extensive benefits program. This is referred to as poaching or raiding. Poor communication may cause employees to become confused and disillusioned, further driving disengagement, Why is Fair Pay Important? This is considered to be a time-consuming, as well as an expensive task. Right shares are the shares that are preserved for the existing equity shareholders. Increase in value: One of the important and major advantages of equity shares is that it has the ability to increase in value.

Advantages of External Equity

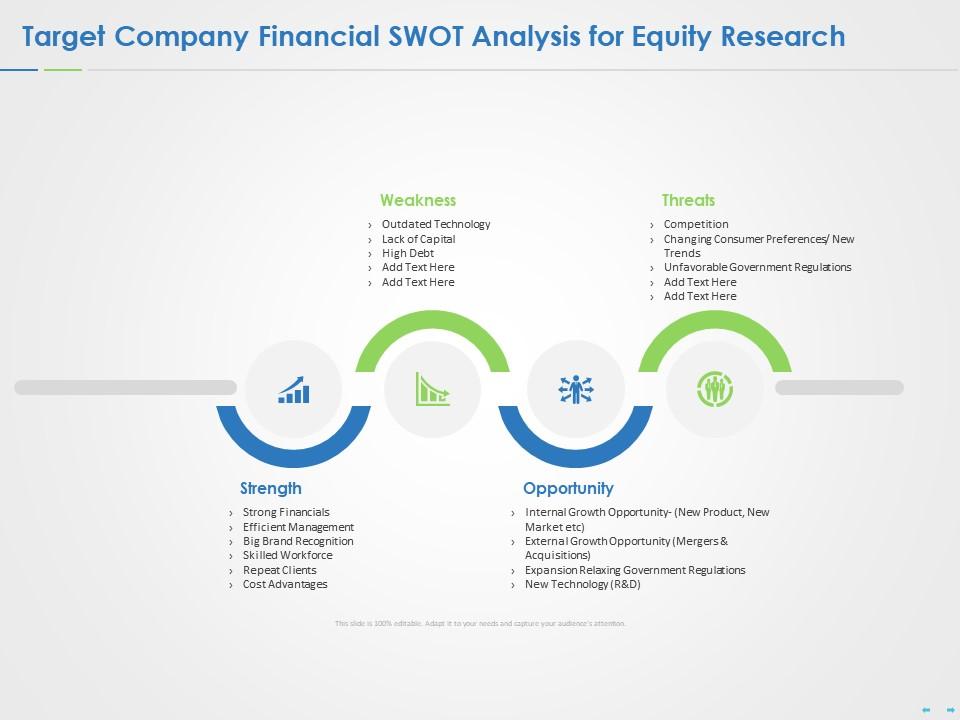

A Bit Risky Investment Option Equities are a hazardous investment option because they are considered the owner of the company. So in order to make an informed decision, benefiting the whole of your business, understanding the advantages and disadvantages of external sources of finance is of the utmost importance. What are the advantages of source of finance? In equity financing, the business owner is selling shares of the company and often retains majority ownership, albeit diluted on a pro rata basis tied to the valuation of the company. Internal Influences Internal influences involve employees doing the same job, a difference in job responsibilities, or even a specific department but for the same company. How will they compete with the other organizations in the areas? We are a credit broker, not a lender and may receive commission or remuneration for introducing you to lenders.

External Sources of Finance: Advantages and Disadvantages

The owners of equity shares enjoy several benefits and bear some risks of their own in the business. The mere To start, your organization can inhibit negative perceptions of pay by providing managers with internal pay ranges, market data, and job descriptions for the roles they oversee. However, doing this is often a risky strategy that could prove problematic in the long-run. With equity financing, there is no loan to repay. Creditors typically look at businesses with lower debt-to-equity ratios more favorably, although the ideal amount of debt depends on the industry. And if there is a remaining balance only, then the company is liable to pay its equity investors.

Advantages and disadvantages of internal and external... Free Essays

:max_bytes(150000):strip_icc()/core-competencies-4198742-01-FINAL-be20b48f4d2240db808ce88dea54b9f9.png)

If you use an internal equity structure, you may not pay much attention to the competition in these areas, which eventually could lead to your company being outdated. Hence shareholders earn profit by selling some portion of their holdings. Therefore, equity shareholders can earn a high level of profit or dividend. Geographical location, competition within the local market, and the availability of a qualified workforce to name a few. The total yield to maturity is considered with the passage of time. In this, the shareholder who is a fractional owner is capable to take the maximum risk of the business. Those who already keep a significant percentage of equity shares dominate in the annual general meetings.

Advantages and Disadvantages of Equity Financing

:max_bytes(150000):strip_icc()/CapitalStructureV3-f35fe15141e6459989ddc22ecd181162.png)

Examining external equity can assist you in developing more competitive job offers, salary structures, and adjustments. Step 3: Create a compensation strategy that incorporates a risk management strategy. A solid and well put together compensation package is a valuable tool for an organization. Human Resource Managers is responsible to assess the outside competition properly in regard to the above mentioned to maintain a competitive advantage with similar companies. As such, external sources of finance could help to speed up your growth, acquire new equipment, purchase property, support uneven cash flow, release equity, fund marketing campaigns, replenish supplies, provide emergency relief and much more. What are external and internal equity? Compensation rates above the market rate will attract more potential employees, but there is no guarantee these individuals are better than those paid at the market rate. Advantages of Equity Shares Get Dividend The investor of equity shares is entitled to get a dividend from the profit remaining after paying the preference shares and debts.

:max_bytes(150000):strip_icc()/core-competencies-4198742-01-FINAL-be20b48f4d2240db808ce88dea54b9f9.png)

:max_bytes(150000):strip_icc()/CapitalStructureV3-f35fe15141e6459989ddc22ecd181162.png)