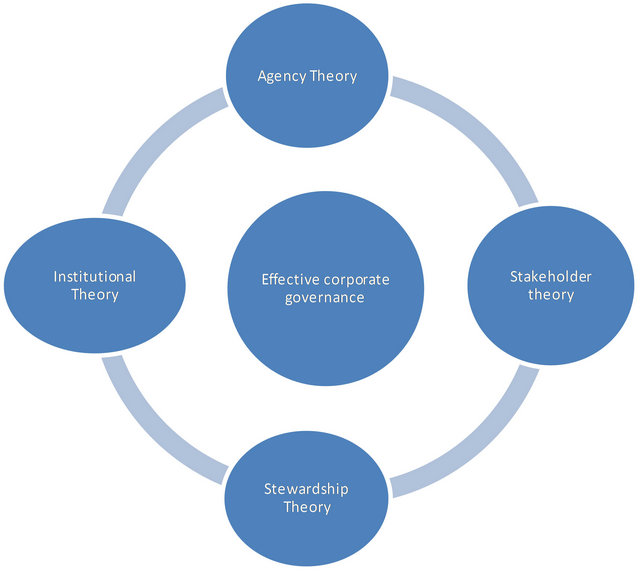

Agency theory and stakeholder theory are two distinct approaches to understanding the relationships and responsibilities within a business or organization. While both theories have their own strengths and weaknesses, they offer different perspectives on the role of corporate governance and the management of a company's resources.

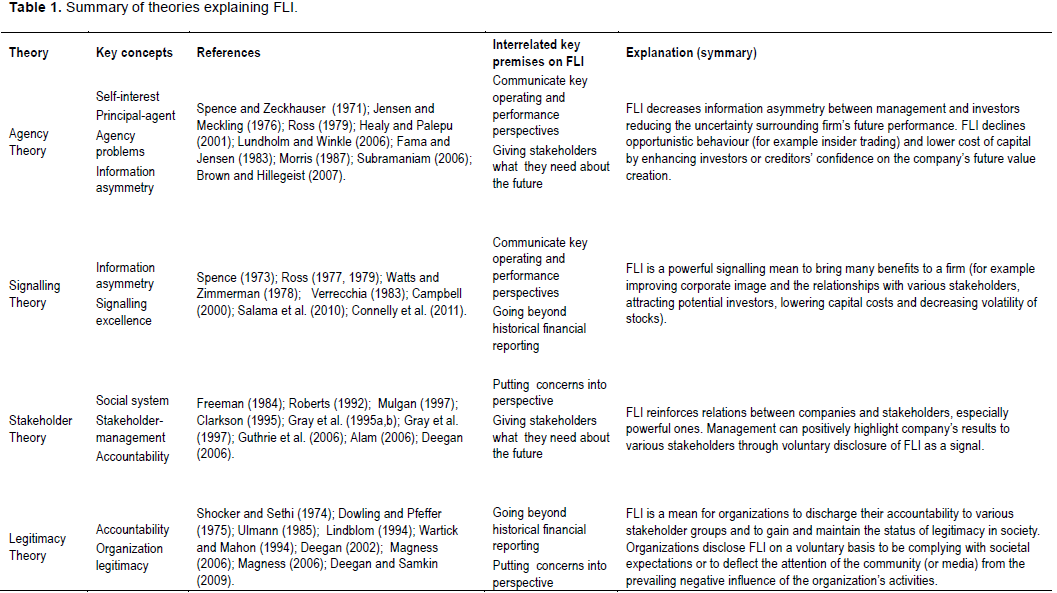

Agency theory is based on the idea that the primary goal of a business is to maximize shareholder value. Under this theory, the management of a company is seen as an agent acting on behalf of the shareholder, who is the principal. The shareholder is typically the owner of the company and holds a financial stake in its success.

The purpose of agency theory is to align the interests of the management and the shareholder, so that the management's actions are in the best interest of the shareholder. To achieve this alignment, the shareholder can use various forms of compensation and incentives, such as stock options and performance-based bonuses, to motivate the management to act in their best interests.

One of the key assumptions of agency theory is that the management and the shareholder have conflicting interests, and it is the role of the shareholder to ensure that the management's actions are aligned with their own interests. This can be achieved through the use of mechanisms such as board oversight and performance evaluation.

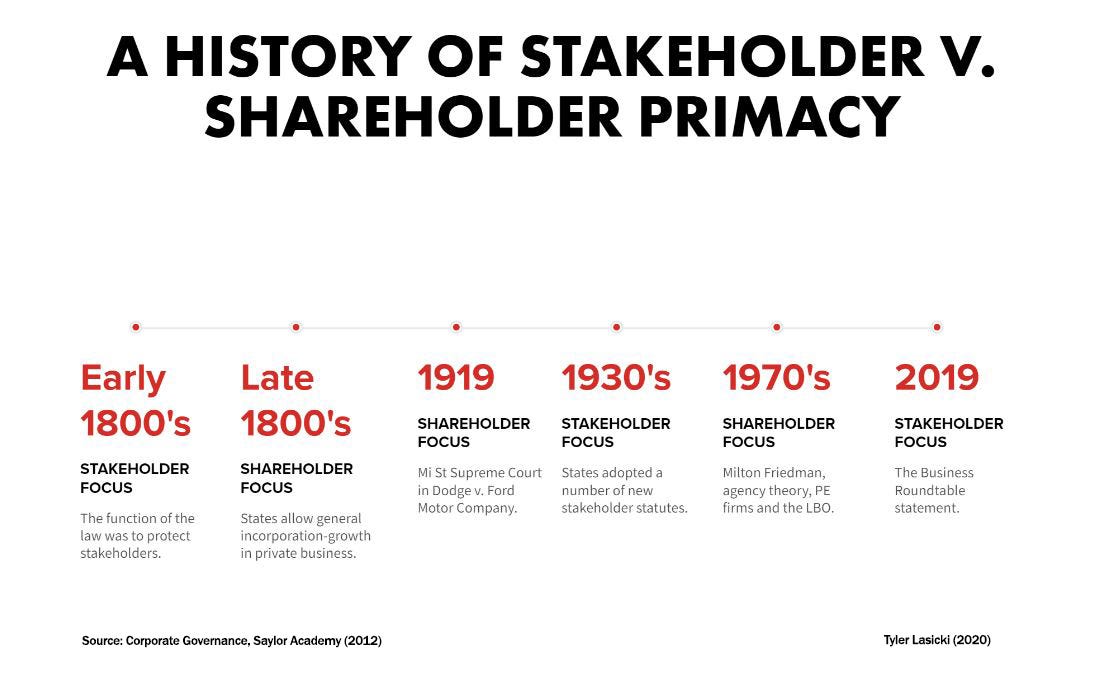

However, agency theory has been criticized for its narrow focus on shareholder value and its disregard for the interests of other stakeholders, such as employees, customers, and the community. This criticism has led to the development of alternative theories, such as stakeholder theory.

Stakeholder theory is based on the idea that a business has a responsibility to all of its stakeholders, not just its shareholders. Stakeholders include not only shareholders, but also employees, customers, suppliers, and the community.

Under stakeholder theory, the management of a company is responsible for balancing the interests of all stakeholders and ensuring that the company's actions are in the best interests of the overall stakeholder community. This can involve making decisions that may not maximize shareholder value in the short term, but that are in the long-term interests of the company and all of its stakeholders.

One of the key benefits of stakeholder theory is that it recognizes the interdependence of a company and its stakeholders and the need for a business to consider the impact of its actions on all stakeholders. This can lead to more sustainable and responsible business practices, as the company takes into account the needs and concerns of all stakeholders.

However, stakeholder theory has also been criticized for its lack of a clear and objective way to prioritize the interests of different stakeholders and for its potential to lead to conflicting interests and decision-making.

In conclusion, agency theory and stakeholder theory are two different approaches to understanding the role of corporate governance and the management of a company's resources. While agency theory focuses on maximizing shareholder value, stakeholder theory recognizes the interdependence of a company and its stakeholders and the need for a business to consider the impact of its actions on all stakeholders. Both theories have their own strengths and weaknesses, and the appropriate approach will depend on the specific context and goals of a business.