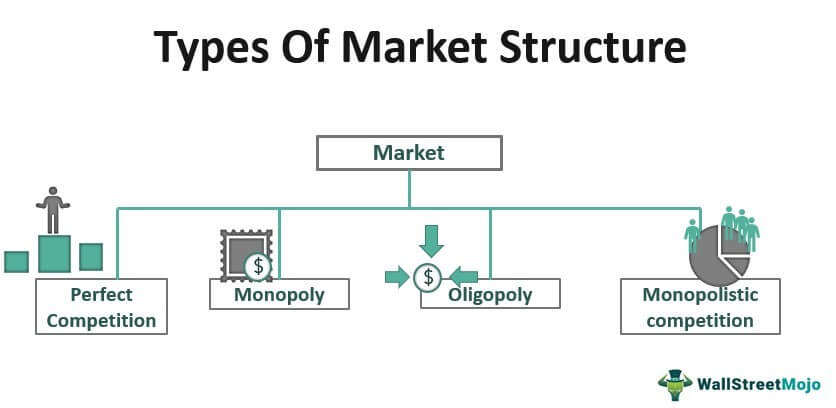

An oligopoly is a market structure characterized by a small number of firms that dominate the market and engage in strategic interactions with each other. The airline industry is often considered an oligopoly, as a few major firms control a significant portion of the market.

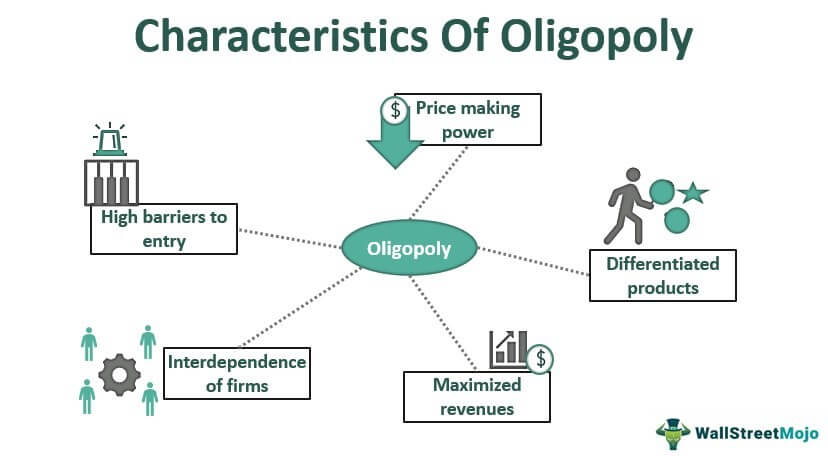

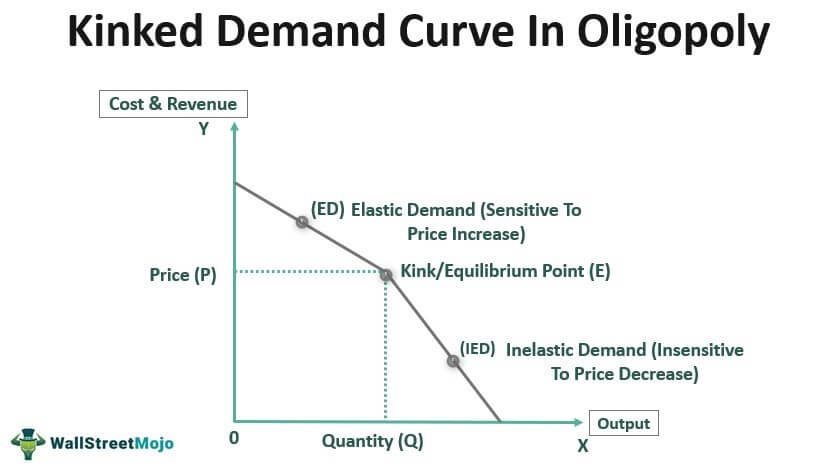

One of the main features of an oligopoly is that the firms in the market have a high degree of interdependence, meaning that the actions of one firm can significantly affect the profits and market position of the other firms. In the airline industry, this interdependence is evident in the way that firms compete with each other on price and other factors such as route network and service quality. For example, if one airline lowers its prices, other airlines may feel pressure to match the price cut in order to remain competitive.

Another characteristic of an oligopoly is that firms may engage in non-price competition, such as advertising and product differentiation, in order to differentiate themselves from their rivals and capture a larger share of the market. In the airline industry, non-price competition can take the form of marketing campaigns that emphasize the comfort and amenities of the airline's planes, or loyalty programs that reward frequent flyers with perks such as free flights or upgraded seating.

In addition to competition between firms, the airline industry is also subject to competition from external sources such as low-cost carriers and other modes of transportation. Low-cost carriers, which offer lower fares by cutting costs in areas such as onboard services and loyalty programs, have disrupted the traditional business model of major airlines and led to increased price competition in the market.

Despite the competitive nature of the airline industry, the barriers to entry for new firms are quite high, which helps to maintain the oligopolistic market structure. These barriers include the high fixed costs of purchasing planes and obtaining necessary licenses and approvals, as well as the strong brand recognition and customer loyalty that incumbent firms have established over time.

Overall, the airline industry exhibits many of the characteristics of an oligopoly, with a small number of dominant firms engaging in strategic interactions with each other and facing competition from external sources. Despite the challenges posed by this market structure, the industry has also seen significant innovation and growth over the years, with new technologies and business models emerging to meet the evolving needs of travelers.