The classical theory of income determination is a macroeconomic theory that explains how the overall level of income, or aggregate output, in an economy is determined. It is based on the idea that the economy is in a state of long-run equilibrium, in which all markets, including the labor market, are in balance.

According to the classical theory, the level of income in an economy is determined by the interplay of three main factors: the quantity of labor, the quantity of capital, and the level of technology. The quantity of labor refers to the number of people available to work, while the quantity of capital refers to the amount of physical capital, such as machines and equipment, available to be used in the production of goods and services. The level of technology refers to the state of technological advancement in the economy, which can affect the efficiency with which labor and capital are used to produce output.

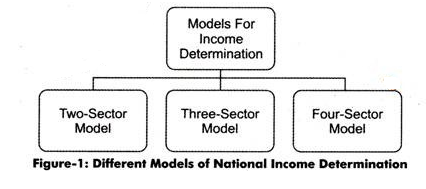

The classical theory suggests that the level of income in an economy is determined by the intersection of the aggregate supply curve and the aggregate demand curve. The aggregate supply curve represents the relationship between the level of income and the quantity of output that firms are willing and able to produce at a given price level. The aggregate demand curve represents the relationship between the level of income and the quantity of output that households, firms, and the government are willing to purchase at a given price level.

According to the classical theory, in the long run, the economy will always be in equilibrium at the level of output where the aggregate supply curve and the aggregate demand curve intersect. At this point, the level of income will be determined by the quantity of labor, capital, and technology available in the economy. If the economy is experiencing a recession and the level of income is below the equilibrium level, firms will experience excess capacity and will be willing to produce more output at the current price level. This will lead to an increase in the aggregate supply curve and a rise in the level of income. On the other hand, if the economy is experiencing an expansion and the level of income is above the equilibrium level, firms will experience excess demand and will be able to charge higher prices for their goods and services. This will lead to a decrease in the aggregate supply curve and a fall in the level of income.

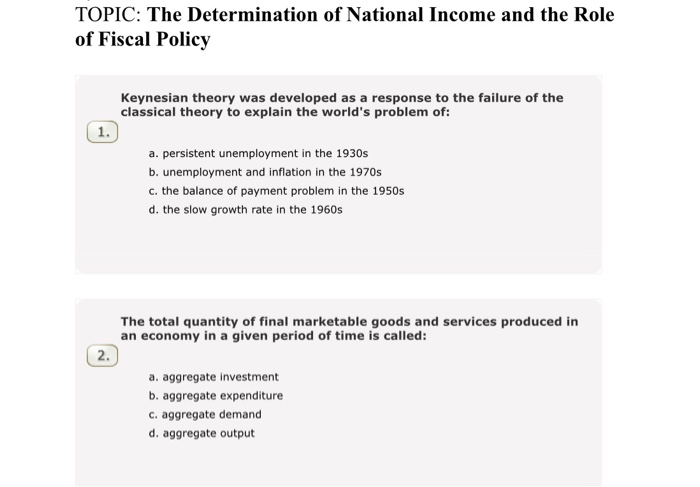

The classical theory of income determination has been influential in shaping economic policy and has had a lasting impact on macroeconomic thinking. However, it has also been criticized for its assumptions about the economy being in long-run equilibrium and for its lack of consideration of factors such as monetary policy and government intervention. Despite these criticisms, the classical theory remains an important foundation for understanding how the overall level of income in an economy is determined.