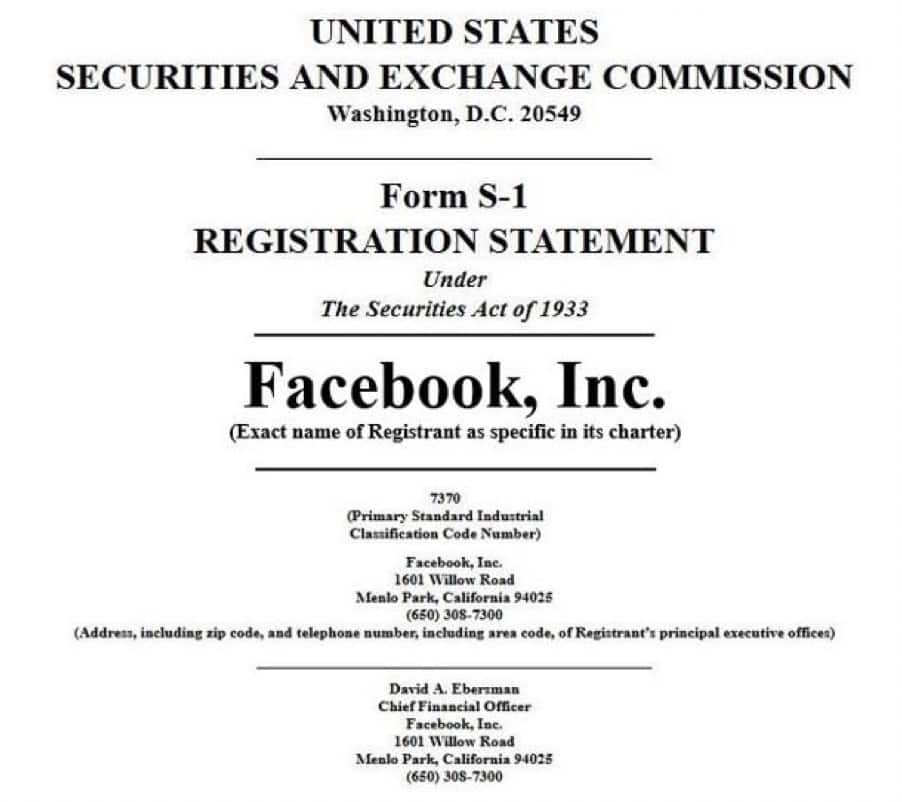

A prospectus is a document that provides detailed information about a company and its securities offerings to potential investors. In company law, a prospectus is typically required to be filed with regulatory authorities before the sale of securities, such as stocks or bonds, to the public. The purpose of a prospectus is to provide potential investors with the necessary information to make an informed decision about whether to invest in the company.

A prospectus typically includes information about the company's history, management team, financial condition, and business strategy. It also includes details about the securities being offered, including the number of shares or bonds being sold, the price at which they will be sold, and the terms of the offering. In addition, a prospectus may include information about any risks associated with investing in the company, as well as any legal or regulatory issues that may affect the company's operations.

Prospectuses are required to be accurate and complete, and companies can be held liable for any false or misleading information contained in them. This is intended to protect investors from being misled or uninformed about the risks associated with investing in the company.

In addition to being used in connection with the sale of securities, prospectuses may also be used in connection with other transactions, such as mergers and acquisitions. In these cases, the prospectus may include information about the terms of the transaction and the potential impact on the company and its shareholders.

Overall, the prospectus is an important document that provides investors with the information they need to make informed decisions about whether to invest in a company. It is a key element of company law that helps to ensure the transparency and integrity of the securities market.

Prospectus Law Definition

The term amount, when used in regard to securities, means the principal Associate. Remedies against the Directors, promoters and the authorized persons who issued the prospectus: 1. Damages for non-disclosure- Fine of Rs. The term automatic shelf registration statement means a registration statement filed on Form S-3, Form F-3, or Form N-2 Business combination related shell company. The main difference between a DRHP and RHP is that DRHP is not an official offer to sell the security. The validity period of the prospectus should not be more than a year and from the commencement of the first offer made its validity period starts. It provides a chronology of events that have occurred over the years, such as those that have helped the company experience growth.

What is abridged prospectus in company law?

Thus, the prospective of the company makes sure that there is effective and efficient working in the company. If you would also like to contribute to my website, then do share your articles or poems at adv. When a company is making a proposal for an offer of securities, then prior to issuing a prospectus, it may issue a red herring prospectus. The money will be refunded to him, which he paid to the company.  Types of the prospectus as follows. Image Source: Flickr This article has been written by  a student of Banasthali Vidyapith, Rajasthan. A prospectus is constantly joined by execution history and monetary data of the company.

Prospectus under Companies Act: Meaning, Contents and Kinds of Prospects

But, the same is not required for a private company. For example, an international mutual fund may include a disclosure detailing the currency risks that investors face when investing in the fund. Typically, the preliminary prospectus is used to gauge interest in the market for the security being proposed. After the data reminder has been documented, if any offer or protections is made, the update alongside the shelf prospectus is considered as a prospectus. Presentation about the issue of allotment letters and refunds inside the endorsed time. Features of Prospectus Prospectus is considered to be an extremely important document that needs to be prepared by stock exchanges and the equity overlooking body. Topics covered in a prospectus include risk, financial history, a description of the management team, the security's value and amount, whether the offering is public or priviate, number of shares offered, and how investment proceeds will be used.

Definition of PROSPECTUS • Law Dictionary • blog.sigma-systems.com

A subsidiary of a specified person is an majority owned subsidiary, significant subsidiary, totally held subsidiary, and wholly owned subsidiary. TYPES OF PROSPECTUS There are four types of prospectus according to the Companies Act, 2013. If you would like any further information, please get in touch with your usual Bedell Cristin contact or one of the contacts listed. LIABILITY FOR MISSTATEMENT WITHIN THE PROSPECTUS The one who gives the consent and signs the prospectus is to blame for any misstatement in a prospectus. The Bottom Line In general, a prospectus is a document that provides details about an offering made available to the public. THE CONTENTS OF A PROSPECTUS The detailed contents of a prospectus are given in Section 26 of the Companies Act, 2013. The company provides prospectus with capital raising intention.

Company Prospectus Definition

The expert for the issue and the subtleties of the goal passed along these lines. The final prospectus includes any finalized background information, as well as the number of shares or certificates to be issued and the offering price. The term certified, when used in regard to financial statements, means examined and reported upon with an opinion expressed by an independent public or Charter. If this number was exceeded, then the company would be circulating a prospectus. When any company or a person has received an application for the allotment of securities with advance payment of subscription before any changes have been made, then he must be informed about the changes. A parent of a specified person is an Predecessor. In keeping with the previous definition, a prospectus is still defined to mean an invitation to the public to become a member of a company or to acquire or apply for any securities.