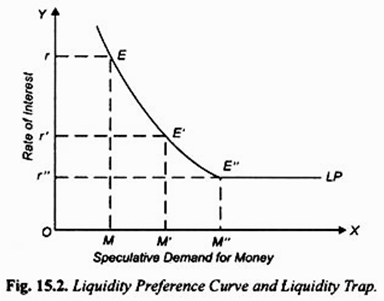

The asset demand for money is downsloping because people are willing to hold a smaller amount of money at higher interest rates. This is due to the opportunity cost of holding money, which is the potential return that could be earned by investing the money instead.

At lower interest rates, the opportunity cost of holding money is lower, so people are willing to hold a larger amount of money. This is because the potential return from investing the money is lower, so there is less of an incentive to invest it. As a result, the demand for money is higher at lower interest rates.

On the other hand, at higher interest rates, the opportunity cost of holding money is higher, so people are willing to hold a smaller amount of money. This is because the potential return from investing the money is higher, so there is more of an incentive to invest it. As a result, the demand for money is lower at higher interest rates.

This relationship between the demand for money and interest rates is known as the asset demand for money, and it is downsloping because the demand for money decreases as interest rates increase.

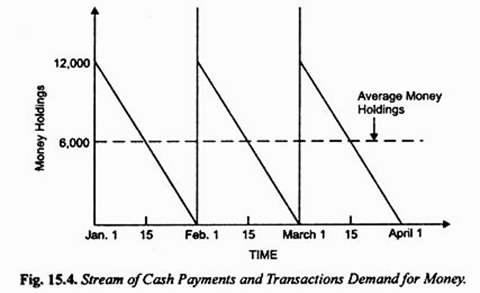

There are several factors that can influence the asset demand for money, including inflation expectations, the level of economic activity, and the availability of alternative investments. For example, if people expect inflation to be high in the future, they may be more willing to hold a larger amount of money in order to protect their purchasing power. On the other hand, if there are many attractive investment opportunities available, people may be more willing to invest their money instead of holding it in cash.

In conclusion, the asset demand for money is downsloping because people are willing to hold a smaller amount of money at higher interest rates due to the opportunity cost of holding money. This relationship is influenced by a variety of factors, including inflation expectations, economic activity, and the availability of alternative investments.