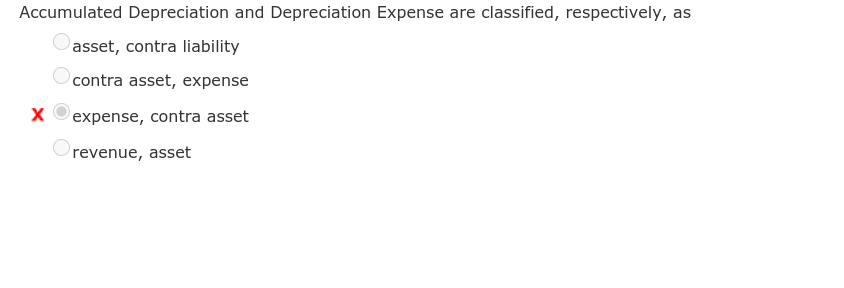

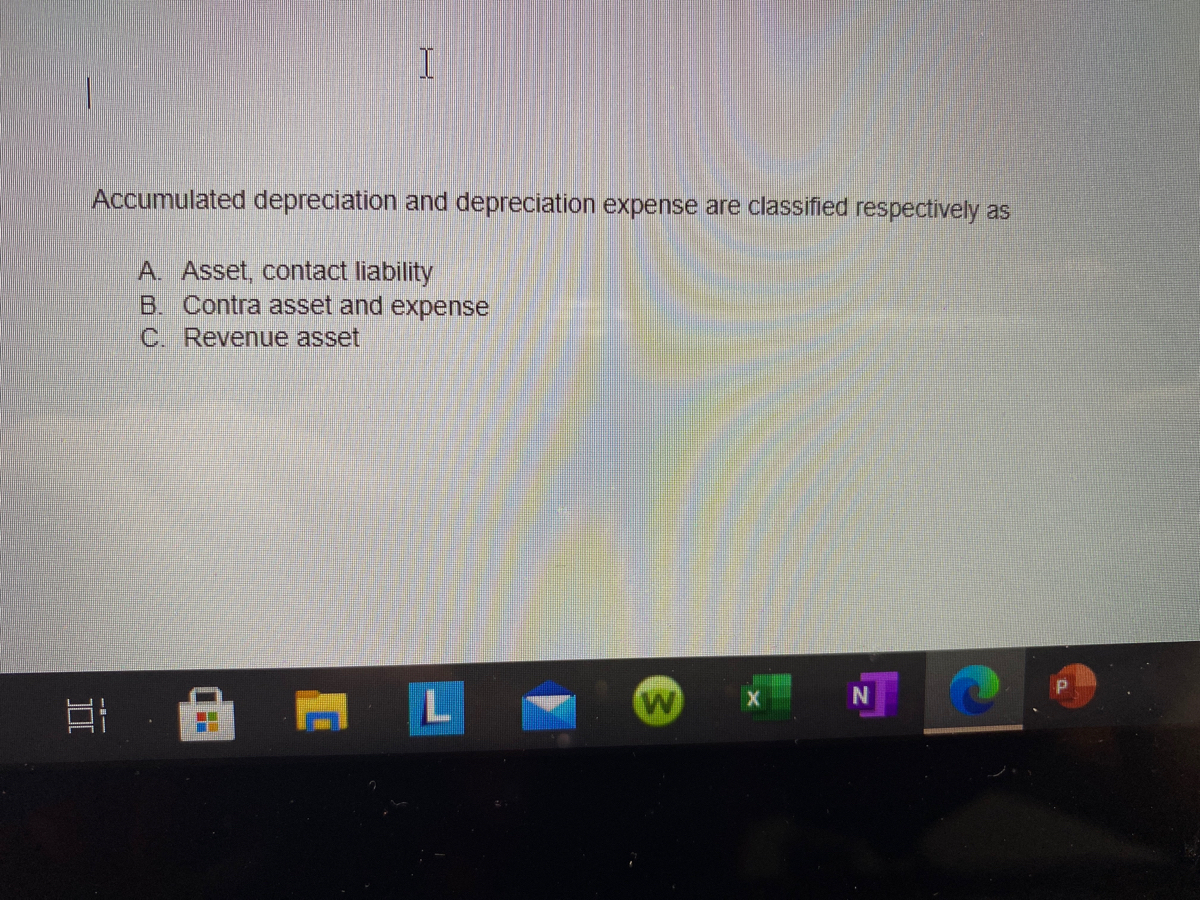

Depreciation expense and accumulated depreciation are two important concepts in accounting that pertain to the allocation of the cost of a long-term asset over its useful life. Understanding these concepts is important for businesses, as they can significantly impact a company's financial statements and its overall financial health.

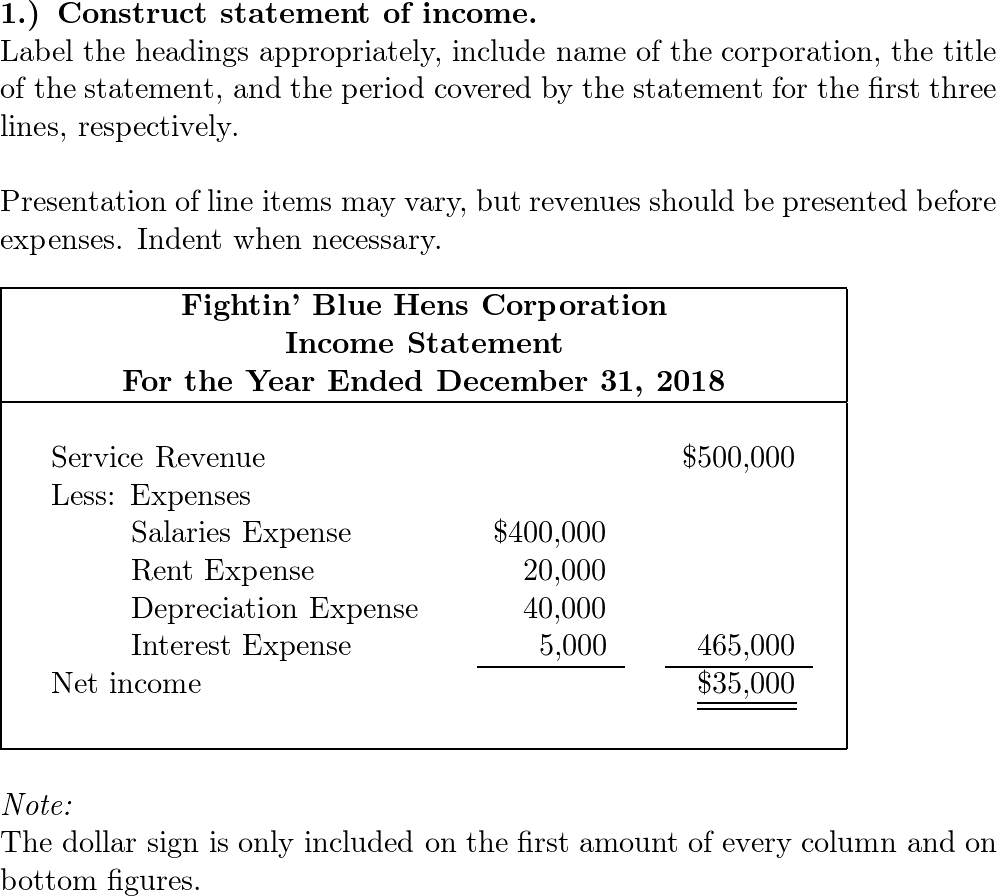

Depreciation expense is the amount that a company charges against its earnings each year to allocate the cost of a long-term asset over its useful life. This is done because the asset is expected to provide benefits to the company over a period of time, rather than all at once. For example, if a company purchases a machine for $100,000 and expects it to have a useful life of 10 years, it can charge $10,000 per year in depreciation expense to reflect the fact that the asset is providing benefits to the company over a 10-year period.

Accumulated depreciation, on the other hand, is the total amount of depreciation that has been charged against an asset over its useful life. This is an important concept because it reflects the amount of an asset's cost that has already been expensed, and therefore the amount that remains to be expensed in the future. For example, if a company has charged $30,000 in depreciation expense against an asset over a three-year period, the accumulated depreciation for that asset would be $30,000.

Both depreciation expense and accumulated depreciation are classified as non-cash expenses, meaning that they do not involve any actual outflow of cash. This is because the cost of the asset has already been paid for and the depreciation expense is simply a way of allocating that cost over the asset's useful life.

In conclusion, depreciation expense and accumulated depreciation are important concepts in accounting that pertain to the allocation of the cost of a long-term asset over its useful life. Understanding these concepts is important for businesses, as they can significantly impact a company's financial statements and its overall financial health.