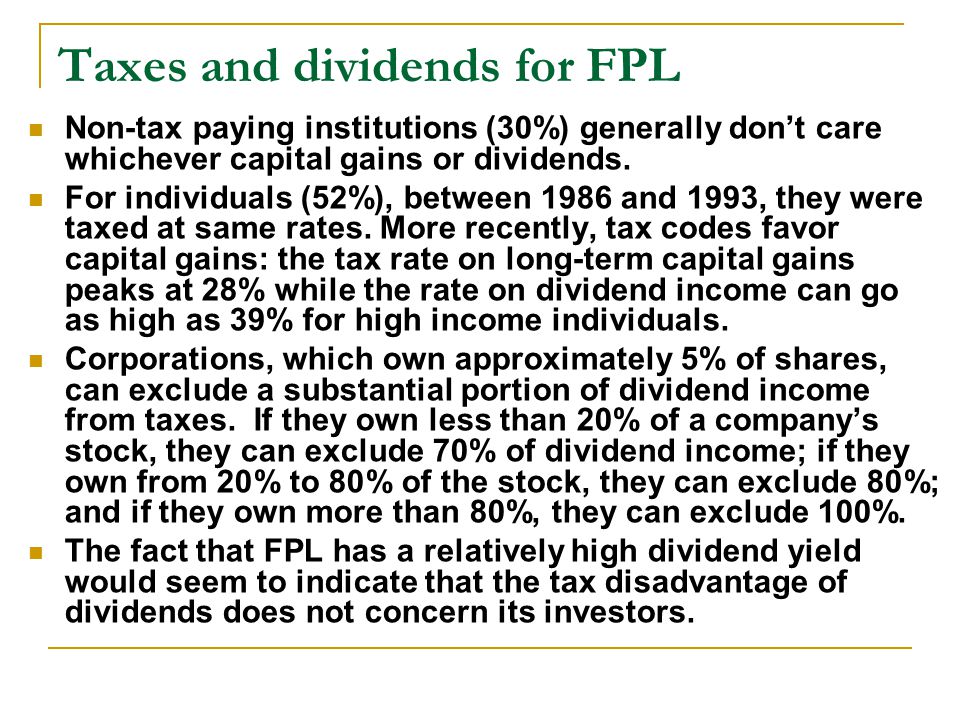

Dividend policy refers to the way a company distributes profits to its shareholders in the form of dividends. Dividend policy can be an important factor for investors when deciding whether to buy a company's stock, as it can provide insight into the company's financial health and future prospects.

The FPL Group, also known as NextEra Energy, is a leading energy company based in Juno Beach, Florida. The company is known for its focus on renewable energy sources, such as wind and solar power. In terms of dividend policy, the FPL Group has a strong track record of consistently paying dividends to shareholders.

Since 2006, the FPL Group has increased its dividend every year, making it a popular choice for income-oriented investors. As of 2021, the company has a dividend yield of around 2.5%, which is higher than the average dividend yield for the S&P 500. This suggests that the FPL Group is committed to returning value to shareholders through dividends.

One reason for the FPL Group's strong dividend policy is the company's financial stability. The energy industry can be volatile, but the FPL Group has consistently generated strong financial results, thanks in part to its focus on renewable energy sources. This financial stability has allowed the company to consistently pay dividends to shareholders, even during times of economic uncertainty.

In addition to its financial stability, the FPL Group's dividend policy is also supported by the company's conservative financial management. The company maintains a strong balance sheet and has a debt-to-equity ratio that is well below the industry average. This conservative financial approach helps to ensure that the company has the financial flexibility to continue paying dividends to shareholders.

In summary, the FPL Group's dividend policy is a key factor that has contributed to the company's success and popularity with investors. The company's consistent dividend increases, strong financial performance, and conservative financial management all contribute to its ability to return value to shareholders through dividends.