Deficit financing refers to the practice of a government or other entity borrowing money in order to finance its spending, rather than relying solely on current revenues. This can be a useful tool for governments to stimulate economic growth and address short-term financial needs, but it can also have negative effects if not managed properly.

One potential positive effect of deficit financing is that it can provide a boost to the economy. When a government increases its spending, it can create jobs and stimulate demand for goods and services, leading to economic growth. This can be particularly beneficial during times of economic downturn, when private sector investment may be insufficient to drive growth.

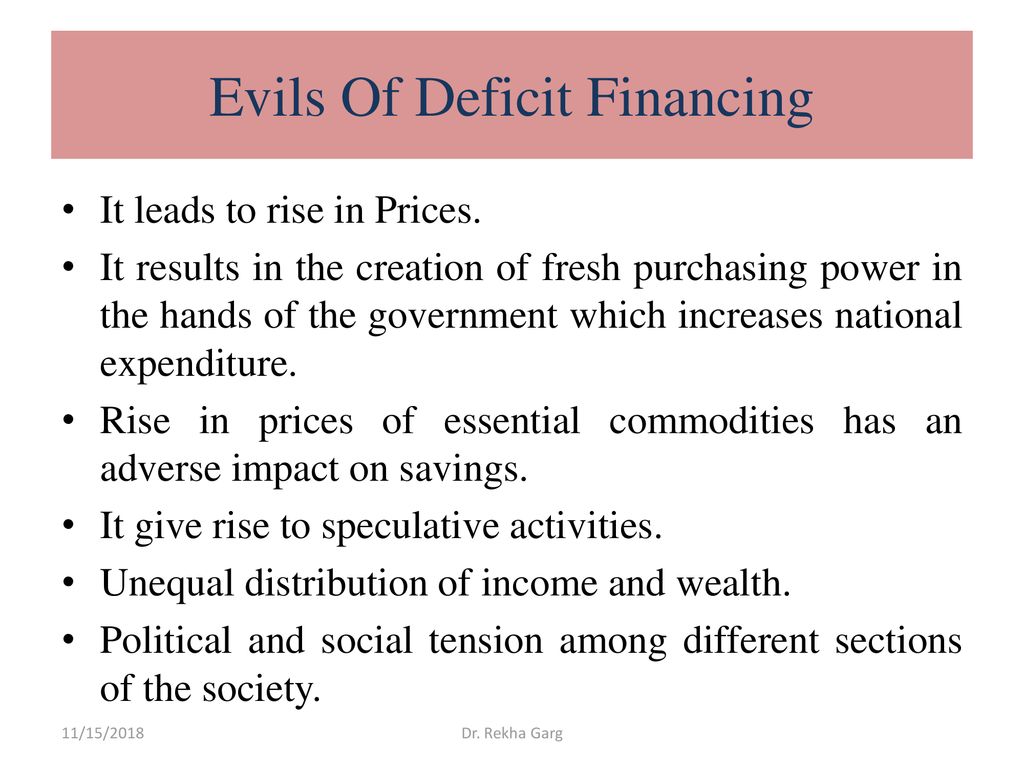

However, deficit financing can also have negative effects if not managed carefully. One concern is that it can lead to increased government debt, which may need to be paid off in the future. This can put a burden on future generations, who may be required to pay back the debt through higher taxes or reduced government services. Additionally, if a government is consistently running a deficit, it may become reliant on borrowing to finance its operations, which can lead to a cycle of increasing debt.

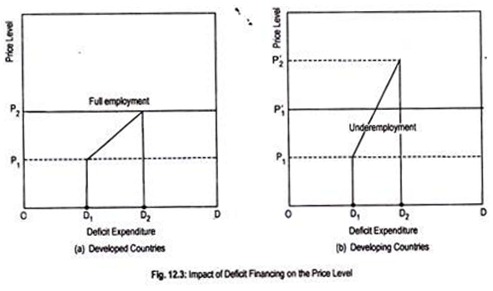

Another potential negative effect of deficit financing is that it can lead to inflation. If a government increases its spending without a corresponding increase in tax revenues or other sources of funding, it may need to print more money to cover the costs. This can lead to an increase in the money supply, which can in turn lead to higher prices for goods and services.

It is important for governments to carefully consider the potential effects of deficit financing before implementing it as a policy tool. In some cases, deficit financing can be a useful tool for stimulating economic growth and addressing short-term financial needs, but it is important to ensure that it is managed responsibly in order to avoid negative consequences.

Causes and Effects of Deficit Financing

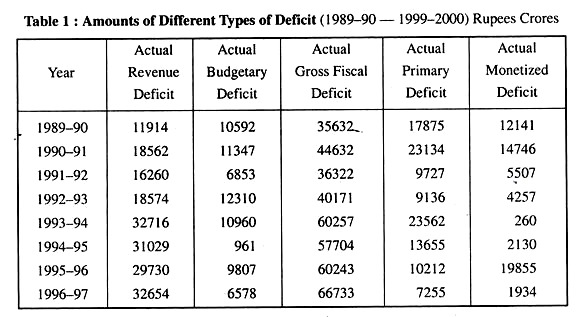

The problem to be solved here is: i Whether income creating finance should be adopted for increasing total effective demand. ADVERTISEMENTS: Again, when the government borrows from the RBI, the latter gives loan by printing additional currency. It is due to lack of complementary resources and various types of bottlenecks that actual production falls short of potential output. ADVERTISEMENTS: Again, a persistent deficit financing policy would soon directly lead to inflationary price rise. ADVERTISEMENTS: Keynes suggested that, during deep depression and severe unemployment, a budgetary deficit should be deliberately incurred, taxes being reduced in order to make more purchasing power available as a stimulus to demand.

[Solved] What is the effect of deficit financing on economy?

As a result, the government finds this measure handy. A public misconception is that during economic downturns, increasing government expenditure will worsen the deficit. Deficit financing is stated to have been practiced if state adopts any one or all the methods discussed listed below: a The government brings into play the cash money balances of the past. Economic growth can influence future tax revenues If the government borrow in a recession as part of expansionary fiscal policy then it can help accelerate an economic recovery and reduce unemployment. But if a developmental expenditure is made, deficit financing may not be inflationary although it results in an increase in money supply. The interest paid to the RBI comes back to the government in the form of profit. Anyway, much depends on the volume of deficit financing.

Economic effects of a budget deficit

In order to collect financial resources, government relies on profits of public sector enterprises. In developing economies the main objective of deficit financing is to remove the vital issue such as unemployment, poverty and income inequality. This in turn raises the demand for the goods and services. They are: a Existence of excess capacity in industrial as well as agricultural sector, and b Relative elastic supply of working capital. However surprise that deficit financing is used for development activities, which in turn produce more goods and services in future. Instead, he argued that once an economic downturn set in, for whatever reason, the fear and gloom that it engenders among businesses and investors would tend to become self-fulfilling. Another objective of deficit financing is to raise the level of effective demand and thereby to stimulate private spending in a depression economy.