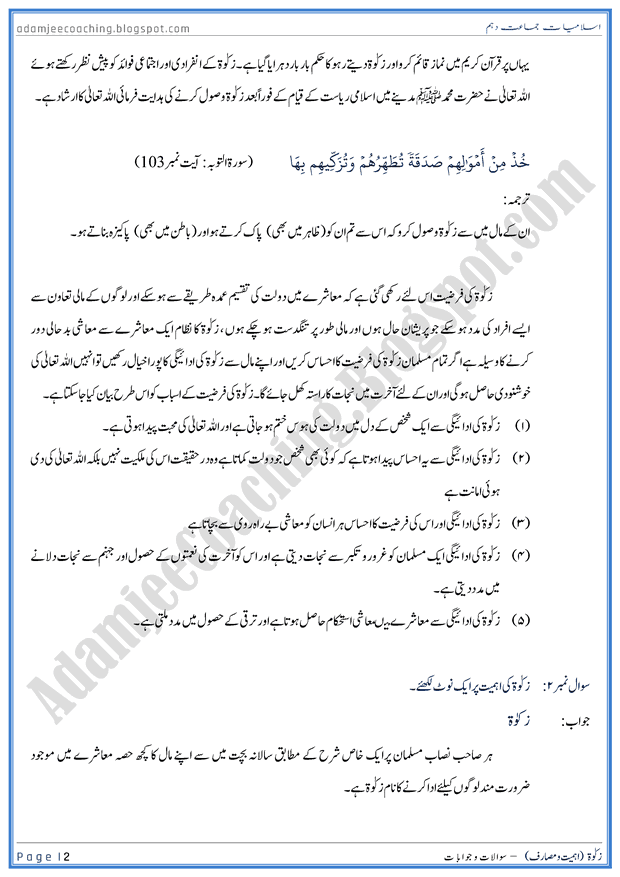

Zakat, also known as almsgiving or charity, is one of the Five Pillars of Islam and an important aspect of the Muslim faith. It is the act of giving a fixed percentage of one's wealth to those in need, and is considered a religious obligation for all Muslims who meet the necessary criteria.

Zakat is based on the principle of sharing one's wealth with others, as a way to purify one's wealth and to show gratitude to God for the blessings that have been received. It is seen as a way to promote social justice and reduce inequality in society. The Qur'an and Hadith (sayings and actions of the Prophet Muhammad) make it clear that zakat is an essential part of the Islamic faith, and that it is a duty of every able-bodied Muslim to pay it.

The amount of zakat that must be paid is based on a person's net worth, and is typically 2.5% of one's wealth. There are certain exemptions, however, such as debts and expenses that must be paid before zakat can be calculated. There are also specific categories of people who are eligible to receive zakat, including the poor, the needy, and those who are working to spread Islam.

One of the main goals of zakat is to help those who are in need, whether they are struggling financially, physically, or emotionally. It is seen as a way to provide support to those who are less fortunate, and to help them improve their lives and become self-sufficient. Zakat is also used to fund Islamic causes and charities, such as building mosques and schools, and supporting the education of children and the elderly.

In addition to the spiritual and social benefits of zakat, it is also seen as an important economic tool. By redistributing wealth from those who have more to those who have less, zakat can help to reduce poverty and inequality, and stimulate economic growth. It can also help to create a sense of community and solidarity among Muslims, as they come together to support one another and work towards a common goal.

In conclusion, zakat is a central aspect of the Muslim faith and an important way for Muslims to show their gratitude to God and to support those in need. It is a way to promote social justice, reduce inequality, and foster a sense of community and solidarity among Muslims. By paying zakat, Muslims are fulfilling a religious obligation and contributing to the well-being of their fellow believers and the broader society.