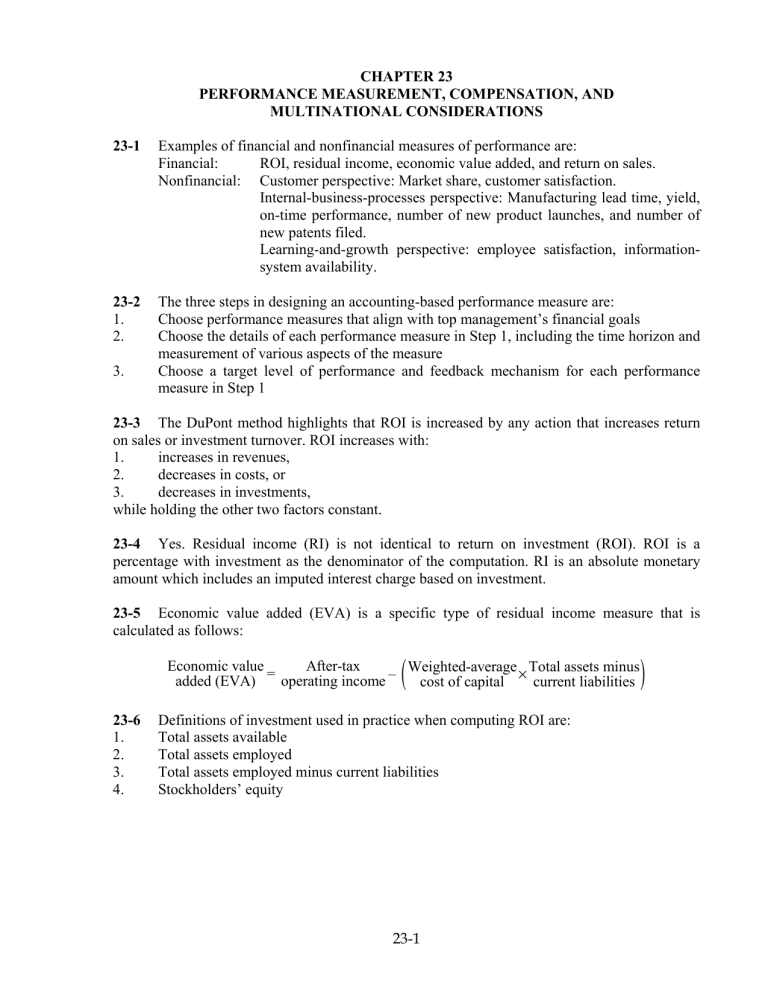

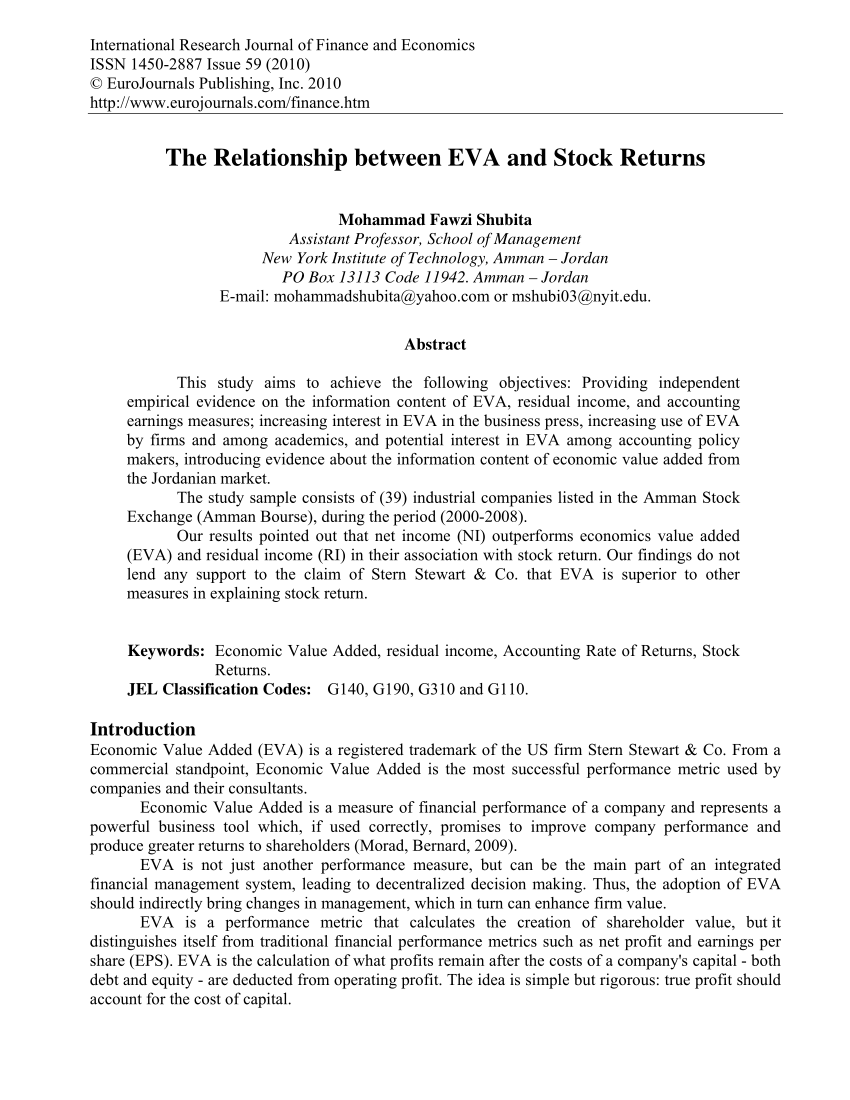

EVA, or Economic Value Added, is a financial performance measure that assesses the profitability of a company by calculating the difference between its operating profit and the required rate of return on its invested capital. It is used to evaluate the efficiency of a company's use of its resources and to determine whether the company is generating sufficient value for its shareholders.

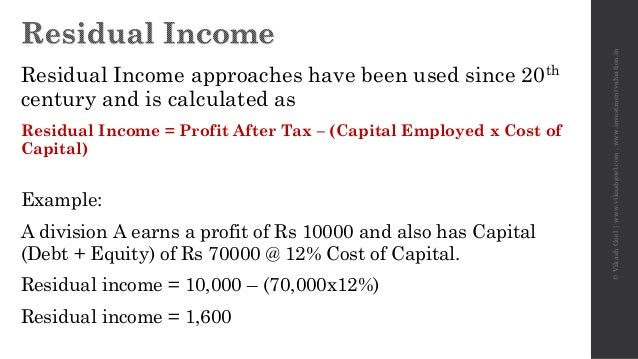

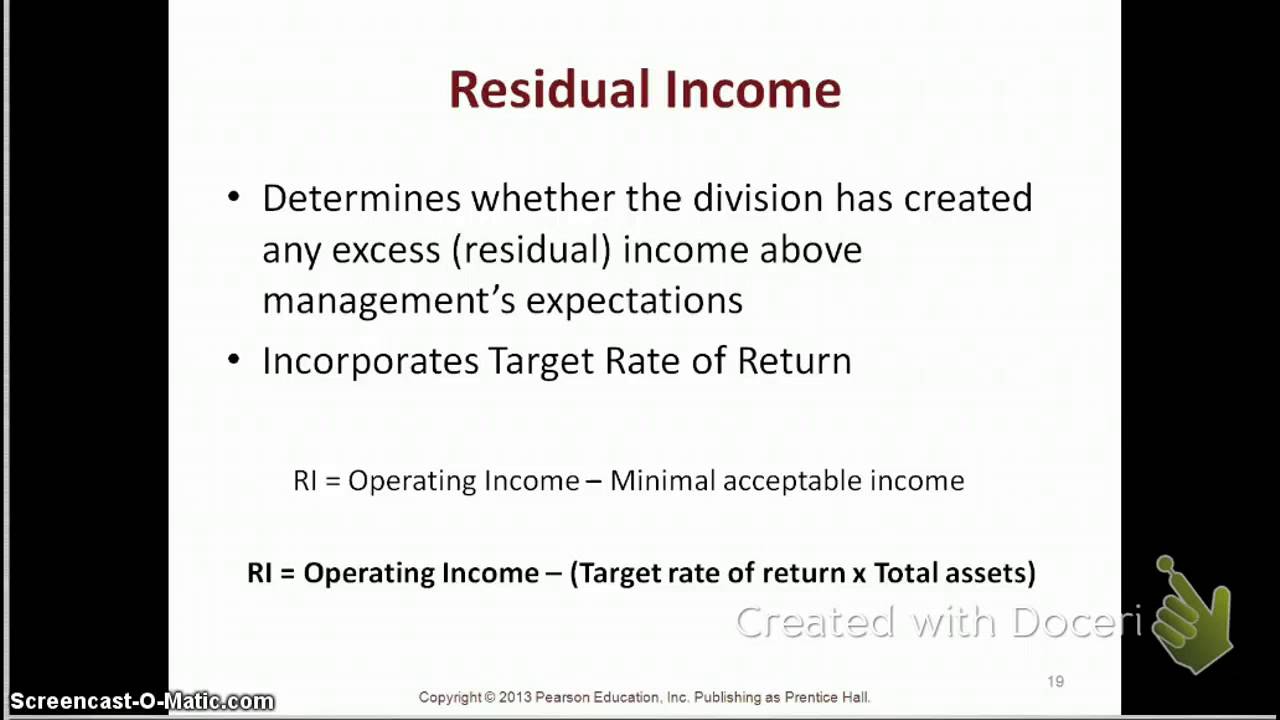

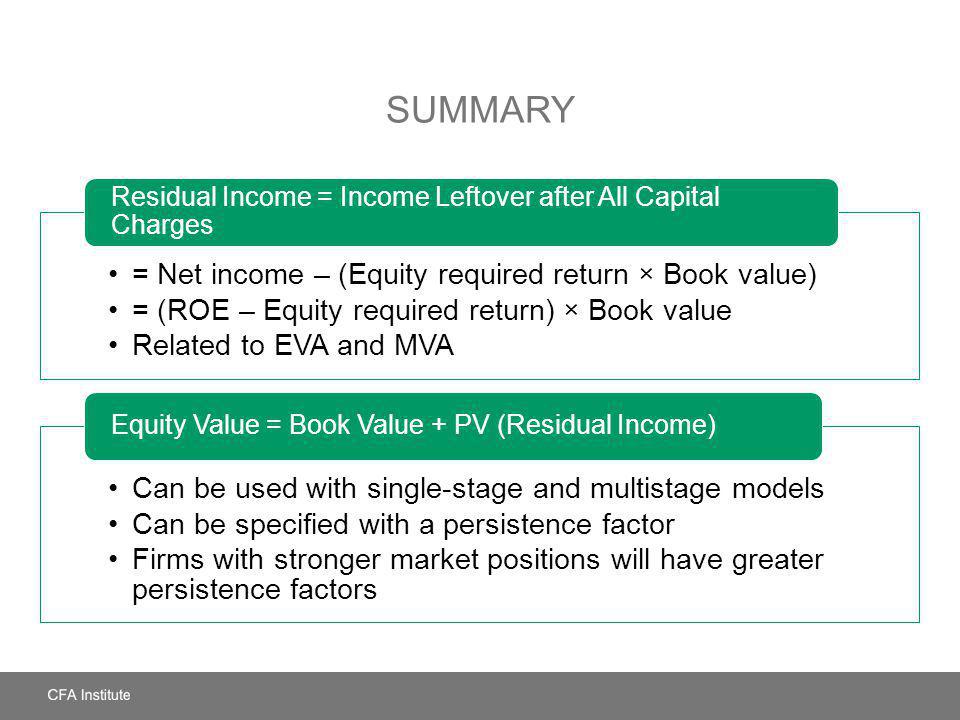

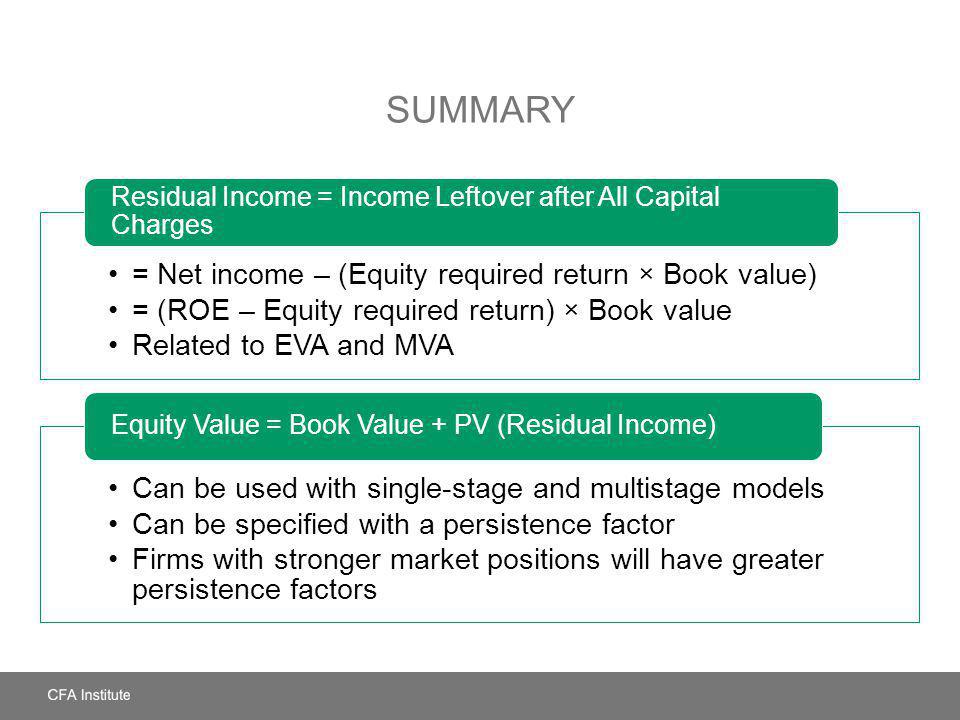

One key component of EVA is residual income, which is the excess profit a company generates after accounting for the required rate of return on its invested capital. In other words, it is the profit that is left over after the company has paid off all of its debts and met its required rate of return on its invested capital.

Residual income is an important measure of a company's financial performance because it represents the amount of value the company is creating for its shareholders beyond what is required to meet its financial obligations. Companies with high residual income are able to generate value for their shareholders without having to rely on additional investment, and they are generally considered to be more financially healthy than companies with low residual income.

One way that companies can increase their residual income is by increasing their operating profit. This can be achieved through a variety of means, such as improving efficiency, increasing sales, or reducing costs. Another way that companies can increase their residual income is by reducing the required rate of return on their invested capital, which can be achieved through strategies such as paying down debt or increasing the value of the company's assets.

In conclusion, EVA and residual income are important financial measures that can be used to assess the profitability and financial health of a company. By focusing on increasing operating profit and reducing the required rate of return on invested capital, companies can improve their residual income and create more value for their shareholders.

EVA

Also, when an entity improves its revenue and liquidity, it will decrease the interest rates. To judge the net contribution to value, we need to deduct the cost of capital contributed to the plant by the parent company and its stockholders. A growing number of analysis and consultants think there is an answer — Economic Value Added EVA. The deduction, called the equity charge, is equal to equity capital multiplied by the required rate of return on equity the cost of equity capital in percent. Analysts must compare the resulting figures with similar entities in the same industry and of the same size.

Economic Value Added (EVA)

EVA, economic profit, and other residual income measures are clearly better than earnings or earnings growth for measuring performance. Then estimate and subtract your income tax. VA residual income by geographic regions The amount of residual income you will need is based on where you will buy the home. We use it as an indicator of how profitable projects are and it serves as a reflector of management performance. Complex Formula — When Discussed in Detail The EVA formula has three components only; NOPAT, WACC, and Invested Capital.

Economic Value Added (EVA) Break

For instance, a family of two in the midwest United States needs less money each month than a family of five on the west coast. EVA sometimes pops up with different labels. It means the WACC of the business would further increase. For companies with no debt, NOPAT is the net profit. If you have a low credit score, a high debt-to-income ratio, or other negative credit factors in your loan file, a high residual income might help you qualify.

Pros and Cons of Economic Value Added (EVA)

Residual income guidelines vary by household size and geographic region. But in most cases, lenders want your residual income to compensate for your high DTI. The clearest measure of success for any business is continued existence and expansion. Once the bonds are purchased, the owner has a stream of cash available until the bonds reach their maturity. The translations are automatically generated "AS IS" and "AS AVAILABLE" and are not retained in our systems. Tying compensation to Second, accounting earnings and rates of return can be severely biased measures of true profitability. When firms calculate income, they start with revenues and then deduct cost, such as wages, raw material costs, overheads and taxes.

VA Loan Residual Income Charts and Requirements with Example Calculation

So the Department of Veterans Affairs bases residual incom e on these two factors. Having the NOPAT and the Invested Capital, we only need to calculate the Weighted Average Cost of Capital WACC. Also, the accounting practices of an entity may change over the years which would further make it difficult to calculate NOPAT, WACC, Capital, and eventually EVA. For example, the calculation of NOPAT is still subject to some accounting manipulations when we adjust the one-time gains or losses incurred by an entity. Residual income requirements vary by location, loan amount and family size. This functionality is provided solely for your convenience and is in no way intended to replace human translation. It is a substitute for explicit monitoring by top management.