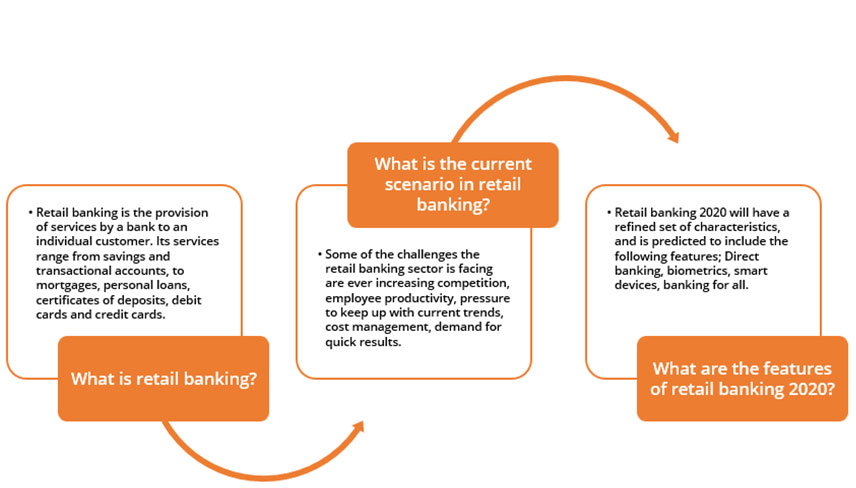

Retail banking refers to the banking services provided by financial institutions to individual customers, rather than to businesses or other organizations. Retail banks offer a wide range of financial products and services, including checking and savings accounts, loans, credit cards, and investment options, to meet the diverse needs of their customers.

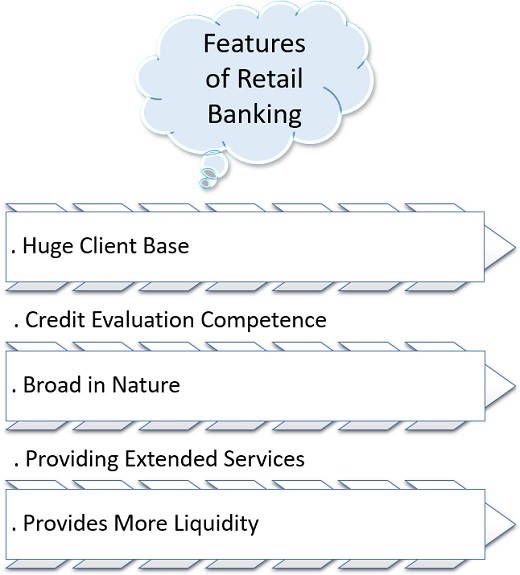

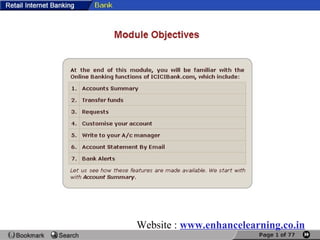

One of the key features of retail banking is convenience. Retail banks are typically open for extended hours, and many offer online and mobile banking platforms that allow customers to access their accounts and conduct financial transactions from anywhere at any time. Many retail banks also have a large network of branches and ATMs, which makes it easy for customers to access their accounts and conduct transactions in person.

Another important feature of retail banking is the variety of financial products and services offered. Retail banks offer a wide range of products and services to meet the diverse needs of their customers, including checking and savings accounts, loans, credit cards, and investment options. These products and services are designed to help customers manage their money, save for the future, and achieve their financial goals.

Another key feature of retail banking is the personalized service that is provided to customers. Retail banks often have dedicated account managers or financial advisors who work with customers to understand their financial needs and goals, and help them choose the products and services that are most appropriate for their situation. This personalized service can be particularly valuable for customers who are new to banking or who are seeking financial advice.

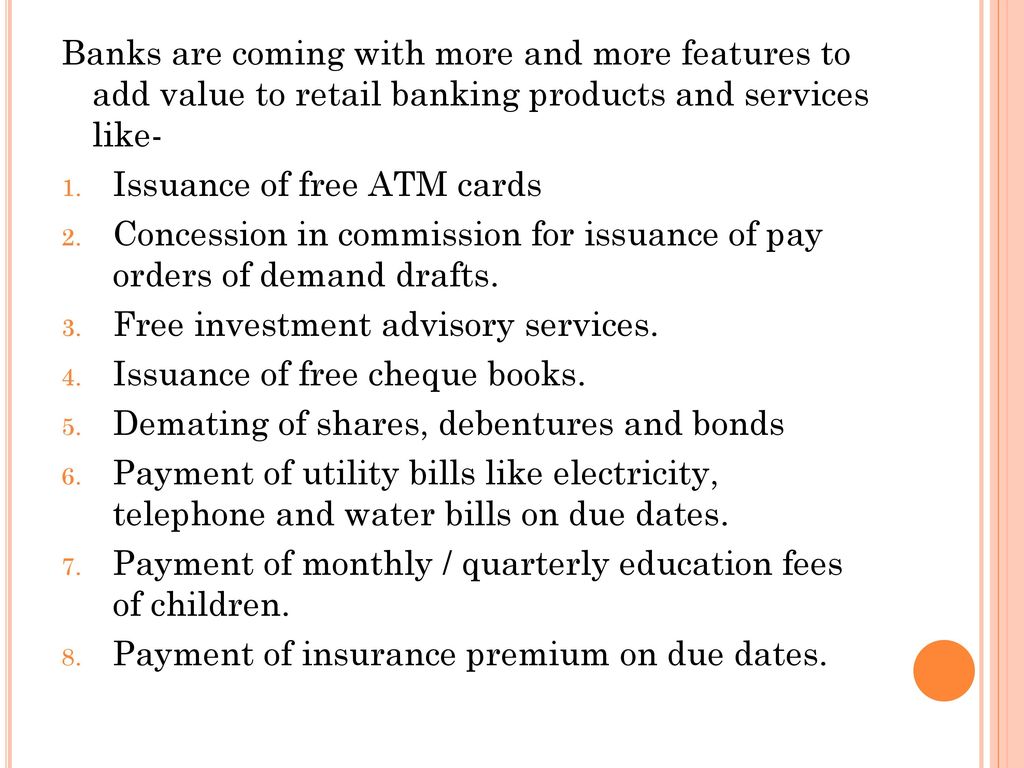

In addition to convenience, variety, and personalized service, retail banks also offer a number of other features and benefits to their customers. For example, many retail banks offer rewards programs for their credit cards and other financial products, which can include cash back, points, or other incentives for using the products. Retail banks may also offer financial education resources, such as online courses or in-person workshops, to help customers better understand financial concepts and make informed financial decisions.

Overall, retail banking offers a wide range of financial products and services that are designed to meet the diverse needs of individual customers. These products and services are offered in a convenient and personalized manner, and are accompanied by a number of additional features and benefits that can help customers achieve their financial goals.