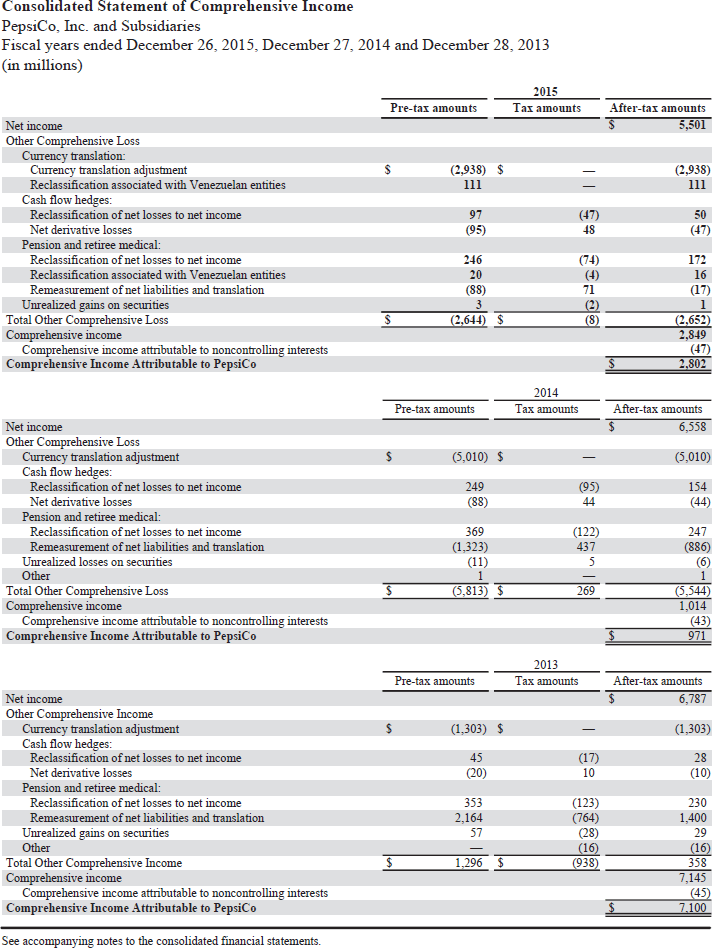

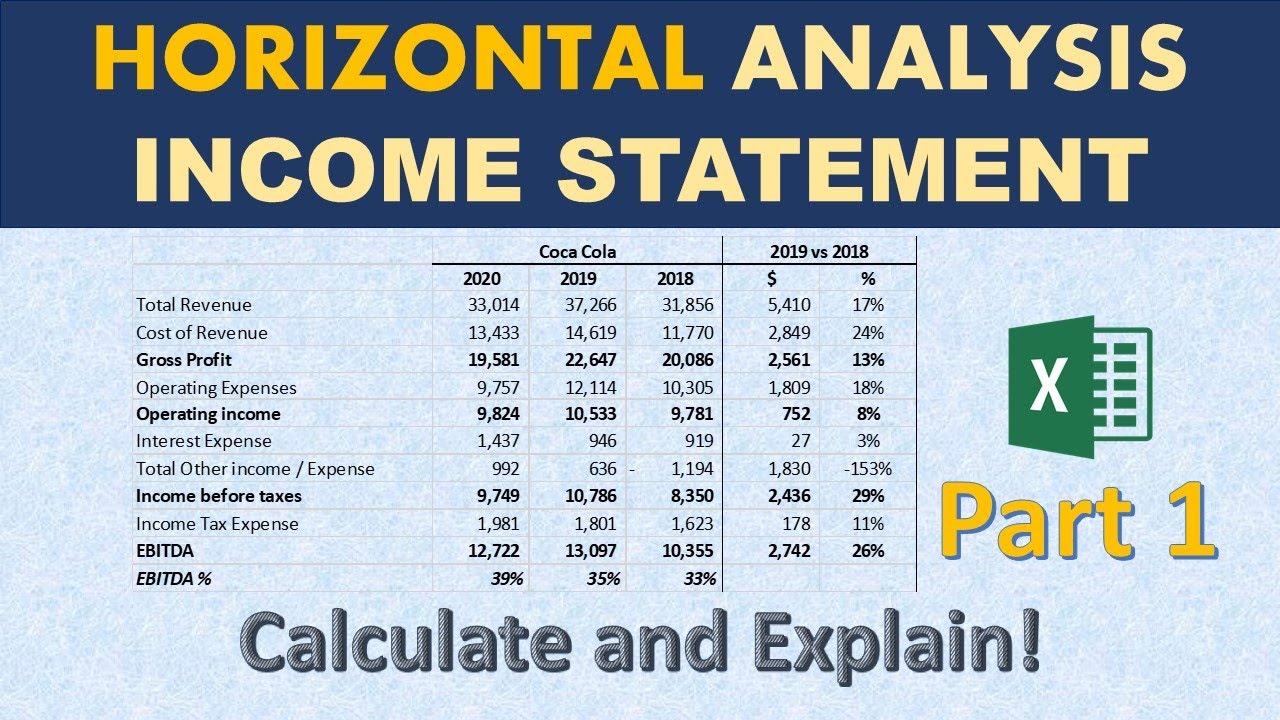

Financial statement analysis is the process of examining a company's financial statements in order to understand its financial performance and position. It involves analyzing the income statement, balance sheet, and cash flow statement in order to understand the company's financial strengths and weaknesses, as well as its potential for future growth. One company that is well-known for its financial stability and performance is the Coca-Cola Company.

The income statement, also known as the profit and loss statement, shows a company's revenues and expenses over a specific period of time, usually a year. The net income, or profit, is the difference between the revenues and expenses. The Coca-Cola Company has consistently reported strong net income, with revenues of over $35 billion in 2020. This is due in part to the company's strong brand recognition and widespread distribution network, which allows it to sell its products in over 200 countries around the world.

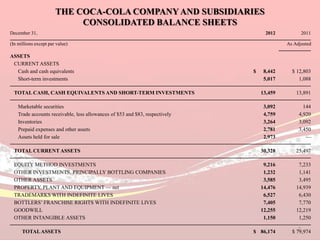

The balance sheet is a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. The Coca-Cola Company has a strong balance sheet, with a relatively low level of debt compared to its assets. This indicates that the company is financially stable and has a strong ability to pay off its debts. The company also has a large amount of cash and cash equivalents, which it can use for investments or to pay off debt.

The cash flow statement shows how a company generates and uses cash over a specific period of time. The Coca-Cola Company has consistently generated positive cash flow, meaning that it has more cash coming in than going out. This is important because it indicates that the company has the financial resources to invest in new projects or pay off debt.

Overall, the financial statements of the Coca-Cola Company indicate that it is a financially stable and successful company. It has strong revenues, a strong balance sheet, and consistently generates positive cash flow. These factors contribute to the company's ability to continue growing and expanding in the future.

In addition to analyzing the financial statements, investors and analysts also use financial ratios to evaluate a company's financial performance and position. Some commonly used financial ratios for the Coca-Cola Company include the price-to-earnings ratio, the debt-to-equity ratio, and the return on equity. All of these ratios are favorable for the Coca-Cola Company, indicating that it is a financially strong and attractive investment.

In conclusion, financial statement analysis is an important tool for understanding a company's financial performance and position. The Coca-Cola Company is a financially stable and successful company, with strong revenues, a strong balance sheet, and positive cash flow. Its favorable financial ratios also make it an attractive investment for investors and analysts.