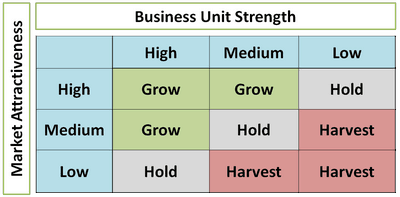

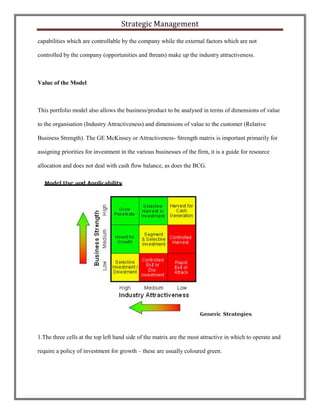

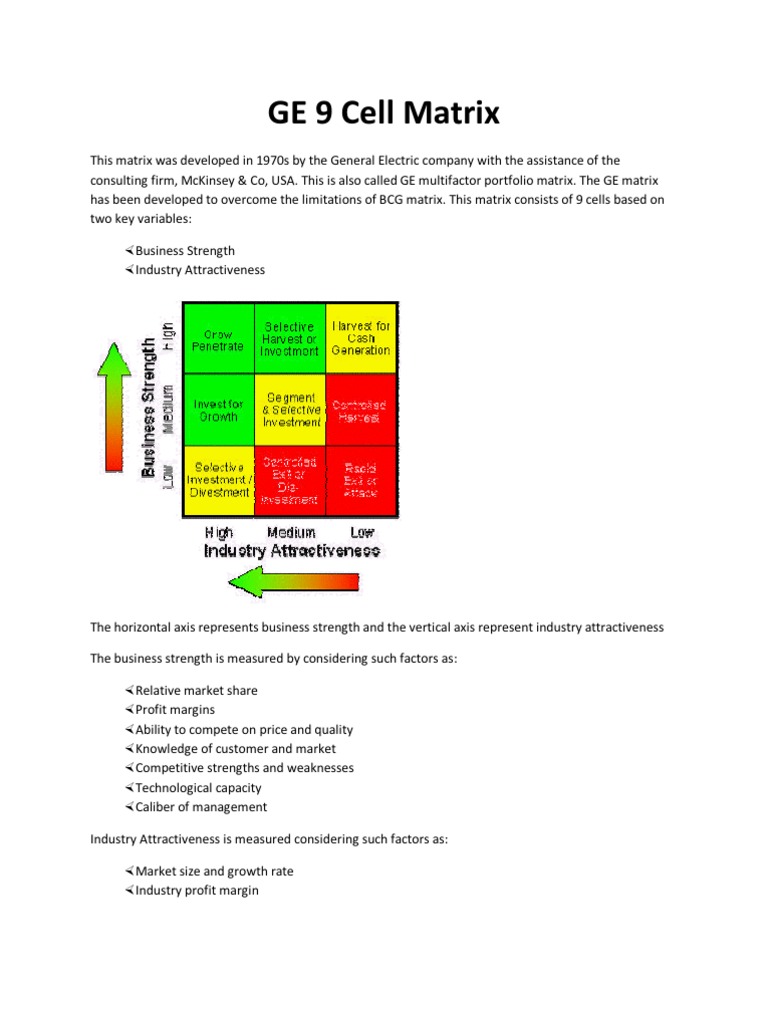

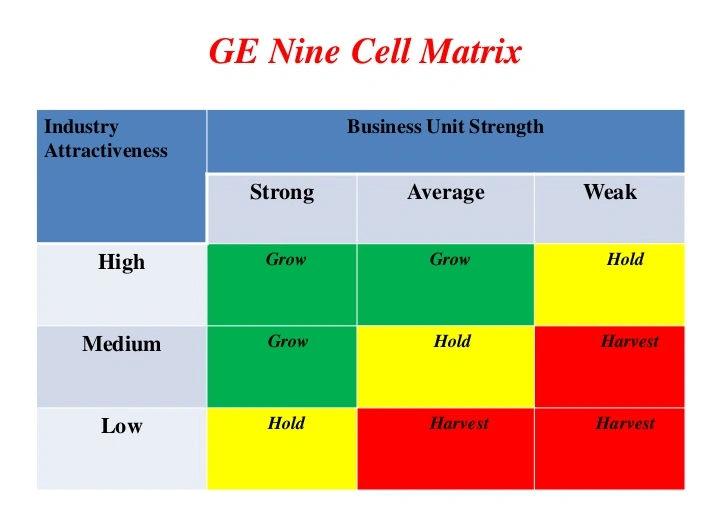

The GE 9 Cell Matrix, also known as the McKinsey Matrix, is a strategic planning tool used to evaluate the performance of business units or products within a company. It is a matrix that plots the business units or products on a grid, with one axis representing the industry attractiveness and the other axis representing the unit's or product's relative market share. The resulting nine cells represent different combinations of market attractiveness and market share, and each cell represents a different strategic direction for the business unit or product.

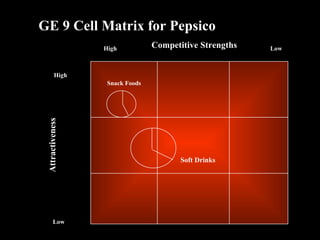

PepsiCo is a multinational food and beverage company with a diverse portfolio of products and business units. The GE 9 Cell Matrix can be used to evaluate the performance and potential of each of PepsiCo's business units or products and to identify areas for improvement or potential growth.

In the GE 9 Cell Matrix, the industry attractiveness is determined by a variety of factors such as the size and growth potential of the market, the level of competition, the level of regulatory barriers, and the availability of resources. The relative market share is determined by comparing the unit's or product's market share to that of its competitors.

For PepsiCo, some of its business units or products may fall into the high industry attractiveness/high relative market share cell, which represents a strong market position. These units or products may be considered cash cows, as they generate a steady stream of revenue and may require minimal investment to maintain their market position.

Other business units or products may fall into the low industry attractiveness/low relative market share cell, which represents a weak market position. These units or products may be considered dogs, as they may struggle to compete in their respective markets and may require significant investment to improve their market position.

PepsiCo may also have business units or products that fall into the high industry attractiveness/low relative market share cell, which represents an opportunity for growth. These units or products may be considered stars, as they have the potential to become cash cows if they can improve their market share. PepsiCo may invest in these units or products to increase their market share and take advantage of the attractive market conditions.

By evaluating its business units or products using the GE 9 Cell Matrix, PepsiCo can identify its strengths and weaknesses, and develop strategies to optimize the performance of each unit or product. This can help PepsiCo to maximize its profits and stay competitive in a dynamic market.