The Harvard Management Company (HMC) is the investment arm of Harvard University, responsible for managing the university's endowment and other financial assets. One strategy that HMC has employed in the past is the use of inflation-protected bonds, also known as inflation-linked bonds or inflation-indexed bonds.

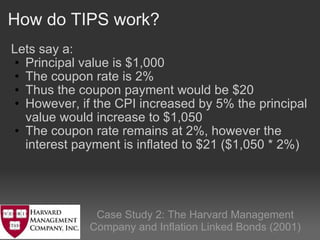

Inflation-protected bonds are a type of fixed-income security that is designed to protect against inflation risk. They are issued by governments and corporations and typically pay a fixed interest rate, but the principal value and interest payments are adjusted for inflation. The adjustment is based on a predetermined index, such as the Consumer Price Index (CPI), and ensures that the purchasing power of the bond's payments remains constant over time.

There are several reasons why HMC and other investors may consider adding inflation-protected bonds to their portfolios. One of the main benefits is that they can provide a stable source of income in an environment of rising prices. When the cost of goods and services increases, the value of traditional fixed-income investments, such as bonds and CDs, can decrease because the purchasing power of their interest and principal payments is eroded by inflation. In contrast, the payments on inflation-protected bonds are adjusted for inflation, ensuring that their value remains constant in real terms.

In addition to providing a stable source of income, inflation-protected bonds can also help to diversify a portfolio. Because their returns are tied to inflation, they tend to have a low or negative correlation with other asset classes, such as stocks and real estate. This means that they can help to reduce the overall risk of a portfolio by providing a source of returns that is uncorrelated with other investments.

However, it is important to note that inflation-protected bonds are not without risk. The main risk is that the issuer may default on its payments, leading to a loss of principal. In addition, the value of the bonds may fluctuate based on changes in interest rates and the level of inflation.

In summary, the Harvard Management Company and other investors may consider adding inflation-protected bonds to their portfolios as a way to protect against inflation risk and diversify their holdings. While these bonds are not without risk, they can provide a stable source of income and help to reduce the overall risk of a portfolio.