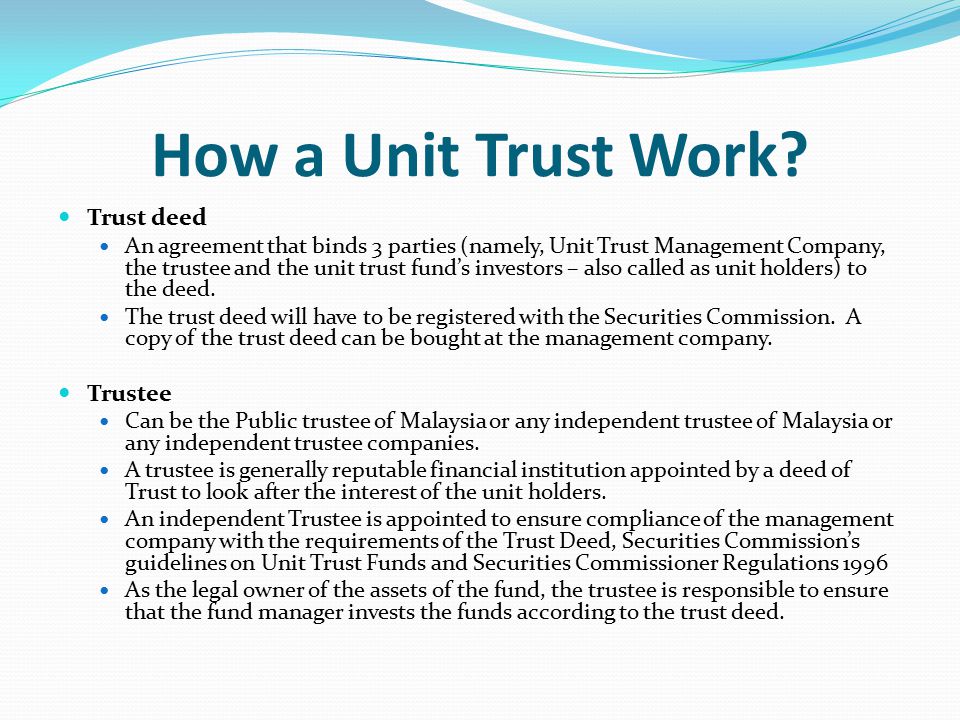

Unit trust is a type of investment vehicle that pools together money from multiple investors and uses that pool of funds to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. In Malaysia, unit trusts are regulated by the Securities Commission, which oversees the operations of unit trust management companies and ensures that they adhere to certain standards and regulations.

The way unit trust works in Malaysia is relatively simple. Investors can choose to invest in a unit trust fund that is managed by a unit trust management company. These companies are responsible for investing the pooled funds in a diversified portfolio of assets, based on the investment objectives and risk profile of the unit trust fund.

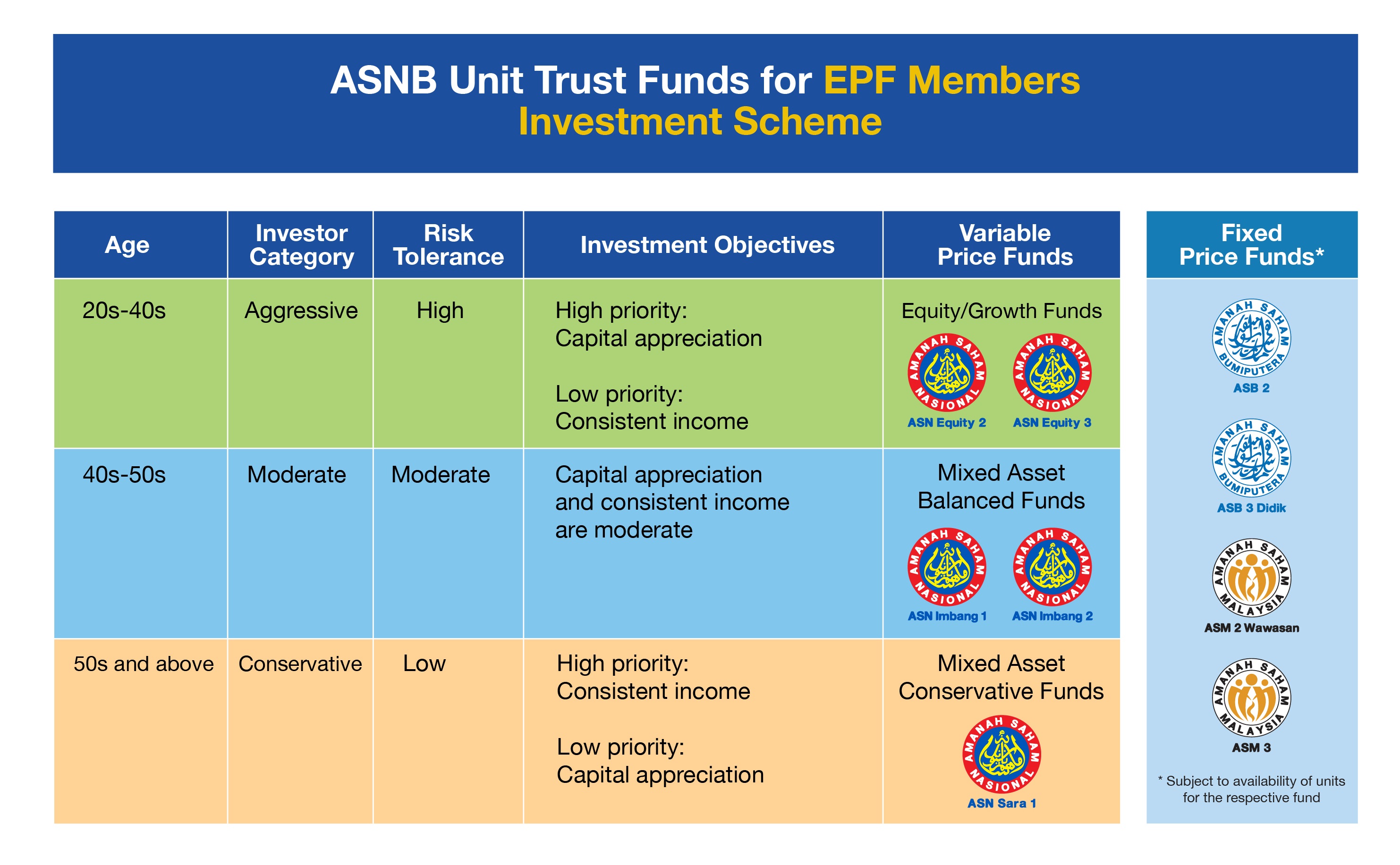

Investors can choose from a variety of unit trust funds that are available in the market, based on their investment goals and risk tolerance. Some unit trust funds may focus on long-term capital appreciation, while others may aim to generate steady income through dividends and interest payments. There are also unit trust funds that are designed to protect against inflation or provide exposure to specific sectors or regions.

When an investor buys units in a unit trust fund, they are essentially buying a share of the underlying assets held by the fund. The value of the units is determined by the value of the assets in the fund, and the units can be bought or sold at any time.

Unit trust funds typically have a fund manager who is responsible for making investment decisions on behalf of the investors. These fund managers use various investment strategies and techniques to try to generate returns for the unit trust fund.

One of the main advantages of investing in unit trust in Malaysia is that it allows investors to diversify their portfolio and spread their risk across a range of different assets. This can help to reduce the overall risk of the portfolio and increase the chances of generating returns.

Unit trust also offers investors the convenience of professional management, as the fund manager takes care of the investment decisions on behalf of the investors. This can be especially useful for investors who do not have the time or expertise to manage their own investments.

Overall, unit trust is a popular investment option in Malaysia that offers investors the opportunity to participate in a diversified portfolio of assets and benefit from professional management. It is important for investors to carefully consider their investment goals and risk tolerance before choosing a unit trust fund, as well as to regularly review their investment to ensure it remains aligned with their objectives.

Unit Trust

The return on investment of unit holders is usually in the form of income distribution and capital appreciation, derived from the pool of assets supporting the unit trust fund. As at 31 December 2008, the unit trust industry saw its NAV dropping to RM134 billion. Malaysia introduced the unit trust concept relatively early compared to its Asian neighbours, when, in 1959, a unit trust was first established by a company called Malayan Unit Trust Ltd. It means for sharing. The fund managers are monitored by a trustee, who helps to ensure that investment decisions are made in your best interests. What assets do they own which bring regular income cash flows to your funds? CIMB assumes no liability for any consequences arising from your reliance on the information presented here. © 2022 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.

A Detailed Guide to Investing in Unit Trusts in Malaysia

So, You want to Buy Units in a Unit Trust Fund … Here are some guidelines: — Find funds that have lower sales charges. In short, the plain and simple cost advise from John Bogle is rarely found into Malaysia investment space. As an investor, this means you need some serious funds to diversify your investments. The chief advantage of this channel is the accessibility that it offers to a wide selection of funds — with varying risk levels, as well as regional and industry exposure — to meet the different risk appetite and preferences of investors. However, you should be doing the opposite, when market is down and everyone is panic, it is the best time to withdraw EPF for equity funds. The fund can invest on your behalf in more than one company, so that all of its investors get to enjoy a portfolio with multiple stocks.

Unit Trust or Mutual Fund investments in Malaysia

However, if you switch the same fund after three months of the purchase date, you will only be changed half the amount in exit fees, i. When new contributions are made, more units are created and when they are sold, then units are subtracted. You are entrusting the job of investing to the fund manager, and it is their full-time job to try and grow your money as best as they can. Balanced fund Balanced funds combine equity and other assets like fixed income securities and cash. DO NOT listen to unprofessionals, gut feeling whispers from your surroundings. For that reason, it is helpful to examine performance over various time periods. In relative terms, the unit trust industry drop is less severe than the fall in share prices in Bursa Malaysia due to the diverse nature of its assets.

Malaysia: Statutory changes for unit trust funds

Many investors who do not know risk analysis would say that the better performing fund would be Fund A with its 15 per cent returns. As time goes by, I read and ask question, knowledge help keep me at ease. How do unit trusts work? Hi Mr Lau, It appears most UT funds touts high Annual Performance percentage in a year, but their actual dividend distribution which is the ROI in a year is a much lower percentage. It has made, on average, 8% a year in returns since its inception in 2013. The legal owner is the trustee, who owns the underlying assets. Hi Andrew, I feel your pain.