Iq and stock market participation. IQ and Stock Market Participation 2022-12-24

Iq and stock market participation

Rating:

7,2/10

1399

reviews

Happiness is a feeling that most people strive for in their lives. It is a sense of contentment and joy that can bring a sense of fulfillment and purpose to one's life. While happiness is a subjective experience and can mean different things to different people, there are certain things that can contribute to a person's overall sense of happiness.

One way to increase happiness is to practice gratitude. Gratitude is the act of being thankful and appreciative for the things we have in our lives. When we focus on the things we are grateful for, we are more likely to experience positive emotions and a greater sense of happiness. We can practice gratitude by keeping a gratitude journal, expressing our thanks to others, or simply taking a moment to reflect on the things we are thankful for.

Another way to increase happiness is to engage in activities that bring us joy and fulfillment. This could be hobbies, sports, volunteering, or anything else that brings us a sense of purpose and meaning. Engaging in activities that we enjoy and that align with our values and interests can help us to feel more fulfilled and satisfied with our lives.

It is also important to cultivate positive relationships with others. Social connections and strong relationships with friends and loved ones can bring us a sense of support, belonging, and happiness. Taking the time to nurture and maintain these relationships can be an important source of joy and happiness in our lives.

In addition to these things, it is also important to take care of ourselves physically and mentally. This includes getting enough sleep, exercising regularly, and eating a healthy diet. Taking care of our physical and mental health can help us to feel more energized, focused, and overall happier.

Finally, it is important to remember that happiness is not a constant state and it is normal to experience ups and downs in life. It is okay to have bad days or to feel down at times, and it is important to allow ourselves to feel and process these emotions. However, by focusing on the things that bring us joy and fulfillment, practicing gratitude, and taking care of ourselves, we can increase our overall sense of happiness and well-being.

(PDF) IQ and Stock Market Participation (2010)

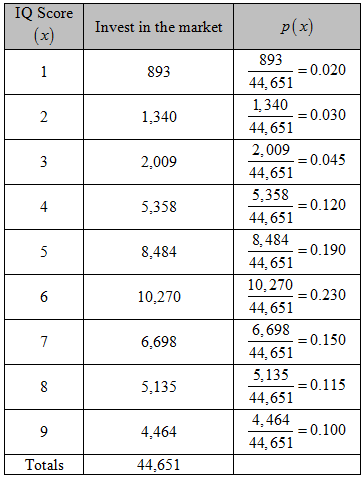

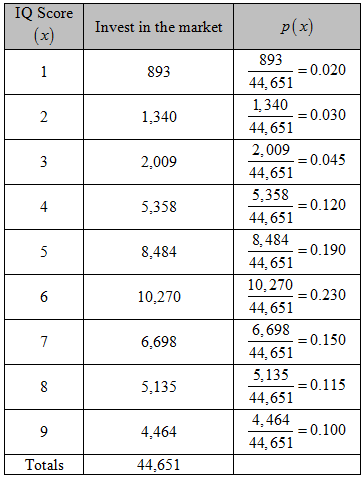

IQs are categorized on the stanine scale of one to nine. Abstract: Stock market participation is monotonically related to IQ, controlling for wealth, income, age, and other demographic and occupational information. I interpret that to mean, you need some intelligence to have the confidence to take some risk, but the smarter you are, the more you realize this game is played best at the standard CAPM level: low fees, high diversification. High-IQ investors are more likely to hold mutual funds and larger numbers of stocks, experience lower risk, and earn higher Sharpe ratios. Note: The table is similar to the one published in the article.

Next

STUDY: High IQ Investors Prefer Mutual Funds and Diversification

By focusing on assumptions that can be given behavioral content, the book maintains an appropriate level of rigor while emphasizing intuitive thinking. LIVING TOGETHER 17 Raising Cognitive Ability 18 The Leveling of American Education 19 Affirmative Action in Higher Education 20 Affirmative Action in the Workplace 21 The Way We Are Headed 22 A Place for Everyone Afterworld APPENDIXES 1 Statistics for People Who Are Sure They Can't Learn Statistics 2 Technical Issues Regarding the National Longitudinal Survey of Youth 3 Technical Issues Regarding the Armed Forces Qualification Test as a Measure of IQ 4 Regression Analyses rom Part II 5 Supplemental Material for Chapter 13 6 Regression Analyses from Chapter 14 7 The Evolution of Affirmative Action in the Workplace Notes Bibliography Index. We start with an overview of theoretical research which casts financial knowledge as a form of investment in human capital. The Finnish Tax Administration provides income, wealth, demographic, and address data from year 2000 tax returns. THE EMERGENCE OF A COGNITIVE ELITE 1 Cognitive Class and Education, 1900-1990 2 Cognitive Partitioning by Occupation 3 The Economic Pressure to Partition 4 Steeper Ladders, Narrower Gates PART II. Just half of U. The authors observe a similar, if less significant, IQ—participation relationship.

Next

IQ and Stock Market Participation

By inference from the HEX data, they find that low-IQ investors earn statistically significantly lower Sharpe ratios, mainly driven by higher diversifiable risk levels. After establishing that IQ level is a strong driver of stock market participation, the authors investigate possible causes. In how many ways can the manager select the three proposals? We acknowledge financial support from the Laurence and Lori Fink Center for Finance and Investments, the Academy of Finland, the Foundation for Economic Education, the Foundation for Share Promotion, and the OP-Pohjola Research Foundation. Based on the results, parts a and b, does it appear that investing in the stock market is dependent on IQ? High-IQ investors are more likely to hold mutual funds and larger numbers of stocks, experience lower risk, and earn higher Sharpe ratios. High-IQ investors are more likely to hold mutual funds and larger numbers of stocks, experience lower risk, and earn higher Sharpe ratios. The Journal of Engineering, Computing and Architecture Vol.

Next

IQ and Stock Market Participation by Mark Grinblatt, Matti Keloharju, Juhani T. Linnainmaa :: SSRN

Participation increases from 10 percent to 47 percent between the lowest and highest IQ extremes. Our appreciation also extends to Antti Lehtinen, who provided superb research assistance, and to ¨ Alan Bester; John Cochrane; John Heaton; Harrison Hong; Emir Kamenica; Samuli Knupfer; George Korniotis; Adair Morse; Toby Moskowitz; Richard Thaler; and Annette Vissing-Jørgensen, who generated many insights that benefited this paper. What is the probability that the cell phone was using color code 5? A vast and rapidly growing literature seeks to explain why those who can afford to save fail to participate. Improvements include a broader class of models for missing data problems; more detailed treatment of cluster problems, an important topic for empirical researchers; expanded discussion of "generalized instrumental variables" GIV estimation; new coverage based on the author's own recent research of inverse probability weighting; a more complete framework for estimating treatment effects with panel data, and a firmly established link between econometric approaches to nonlinear panel data and the "generalized estimating equation" literature popular in statistics and other fields. Suppose you randomly select one point during the combined driving trips. Nearly all households that score high on financial literacy or rely on professionals or private contacts for advice achieve reasonable investment outcomes. Find the probability that a rough diamond is processed in Surat and is a blood diamond.

Next

IQ and Stock Market Participation (Digest Summary)

This method shows that secondary effects account for around 64 percent of the 37 percentage point difference in participation between the highest and lowest IQ stanines, with wealth, education, and income being the main conduits. It is the most widely cited academic journal on finance and one of the most widely cited journals in economics as well. I estimate quantitatively meaningful diversification statistics and investigate their relationship with key variables. Household trade data are obtained from the Helsinki Stock Exchange HEX for 1995 to 2002, with year 2001 returns used to compute portfolio variance. Securities and Exchange Commission, the American Economic Association annual meetings, the 2010 European Winter Finance Summit, and the 2010 Western Finance Association annual meetings for comments on earlier drafts. Two large provinces around Helsinki form the basis of an expansive dataset.

Next

Q69E Stock market participation and I... [FREE SOLUTION]

According to Global Research News March 4, 2014 , one-fourth of all rough diamonds produced in the world are blood diamonds. Additionally, high-IQ investors own more stocks and have more exposure to high book-to-market and small stocks, which are well established as returning higher Sharpe ratios. Save Settings Close Modal Abstract Strong evidence exists that stock market participation is driven by intelligence quotient IQ level more than by any other factor. . Participation increases monotonically with IQ, and they observe a statistically significant difference of 20 percentage points between the extreme stanines. All group differences stem from the top of the loss distribution. It is the purpose of this paper to estimate the average extent of discrimination against female workers in the United States and to provide a quantitative assessment of the sources of male-female wage differentials.

Next

[PDF] IQ and Stock Market Participation

Authorized users may be able to access the full text articles at this site. The Quinella bet at the paramutual game of jai-alai consists of picking the jai-alai players that will place first and second in a game irrespective of order. JSTOR provides a digital archive of the print version of The Journal of Finance. What is the probability that ESPN was selected on Monday, July 11? Assume that the assignment order for the four weekend days was immaterial to the analysis. If the players are of equal ability, what is the probability that you win the bet? To assess secondary effects, such as IQ leading to wealth, income, and so on, the authors use the Blinder, Oaxaca, and Fairlie method. Additionally, income, wealth, and the ratio of those with the highest to those with the lowest educational attainment increase monotonically with IQ. During a sample driving trip that involved crossing from one base station to another, the different color codes accessed by the cell phone were monitored and recorded.

Next

IQ and Stock Market Participation on JSTOR

We discuss implications for policy and finance research. The high correlation between IQ, measured early in adult life, and participation, exists even among the affluent. New attention is given to explaining when particular econometric methods can be applied; the goal is not only to tell readers what does work, but why certain "obvious" procedures do not. As we only want the probability for citizens with IQ scores of 6 and above, we will first add the number of citizens in all 3 columns with an IQ of 6 and above. About the Author s. If you know of missing items citing this one, you can help us creating those links by adding the relevant references in the same way as above, for each refering item. Consider the four networks chosen for the weekends Saturday and Sunday.

Next

IQ and stock market participation — Aalto University's research portal

A final section offers thoughts on what remains to be learned if researchers are to better inform theoretical and empirical models as well as public policy. The result is a chronic earnings gap between male and female full-time, year-round workers. Our appreciation also extends to Antti Lehtinen who provided superb research assistance, and to Alan Bester, John Cochrane, John Heaton, Harrison Hong, Emir Kamenica, Samuli Knüpfer, George Korniotis, Adair Morse, Toby Moskowitz, Richard Thaler, and Annette Vissing-Jørgensen, who generated many insights that benefited this paper. We acknowledge financial support from the Laurence and Lori Fink Center for Finance and Investments, the Academy of Finland, the Foundation for Economic Education, the Foundation for Share Promotion, and the OP-Pohjola Research Foundation. Electronic copy available at: Electronic copy available at: Electronic copy available at: Working Paper No. Each base station has multiple channels called color codes that allow it to communicate with the cell phone.

Next

IQ and Stock Market Participation

We discuss implications for policy and finance research. We discuss implications for policy and finance research. The high correlation between IQ and participation exists even among the affluent. How many ways could the researchers select four networks from the eight for the weekend analysis of commercials? General contact details of provider:. Low-IQ investors earn inferior risk-adjusted returns, which may be a better explanation for their low participation than costs alone.

Next