Managerial accounting is the process of identifying, analyzing, and communicating financial information that is necessary for the management of an organization. It is an essential tool for decision-making and planning, as it provides managers with the data they need to make informed decisions about how to allocate resources and achieve the organization's goals.

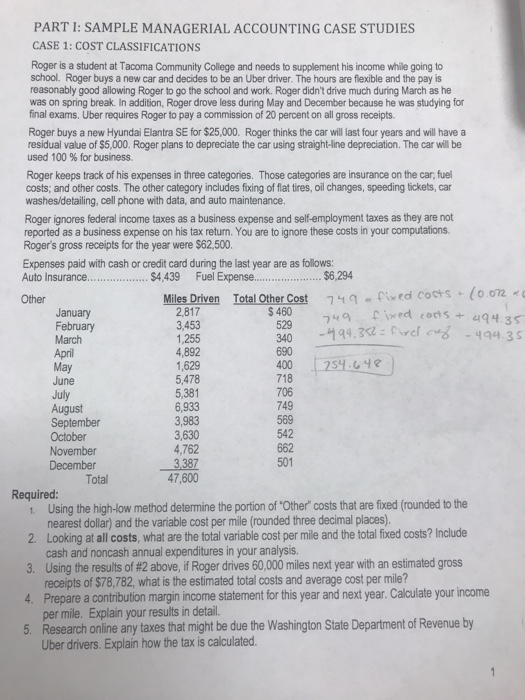

One way that managerial accounting is used in practice is through the use of case studies. A case study is a detailed examination of a specific organization or business situation. It typically involves analyzing financial data and other relevant information in order to understand the challenges and opportunities facing the organization, and to develop recommendations for improvement.

One example of a managerial accounting case study might be an analysis of a company's profitability. In this case, the manager might use a variety of financial tools and techniques, such as cost-volume-profit analysis, to identify areas where the company could improve its efficiency and increase its profits. This might involve identifying areas of waste or inefficiency, or identifying opportunities for growth or expansion.

Another example of a managerial accounting case study might involve analyzing the company's budgeting process. This might involve examining the company's current budgeting practices, and identifying areas where the budget could be more effectively managed. For example, the manager might look at the company's spending patterns and identify areas where costs could be reduced, or where investments could be made to increase the company's revenue.

In addition to these examples, there are many other ways in which managerial accounting can be used in case studies. For example, it might involve analyzing the company's cash flow, or examining the company's use of debt and equity financing. Whatever the focus of the case study, the goal is always to identify opportunities for improvement and to provide recommendations for how the organization can best achieve its goals.

In conclusion, managerial accounting is an essential tool for decision-making and planning in organizations. Through the use of case studies, managers can use financial data and other relevant information to identify opportunities for improvement and to develop recommendations for how to best achieve the organization's goals.