International accounting standards are a set of rules and guidelines that are used to prepare financial statements. These standards are designed to provide a common language for business and to ensure that financial statements are comparable across different countries. The goal of international accounting standards is to increase transparency and consistency in financial reporting, which can help investors and other stakeholders make informed decisions about companies.

One of the main merits of international accounting standards is that they help to create a level playing field for companies. By standardizing financial reporting practices, companies can be compared more easily, which can help investors make more informed decisions about where to invest their money. This can lead to more efficient capital allocation, as investors can better assess the financial health and performance of companies.

Another benefit of international accounting standards is that they can improve the reliability and credibility of financial statements. By following a set of rules and guidelines, companies can reduce the risk of misstating their financial results or engaging in fraudulent activities. This can help to increase investor confidence in the financial markets and foster a sense of trust between companies and their stakeholders.

Despite these benefits, there are also some potential drawbacks to international accounting standards. One of the main concerns is that these standards can be complex and difficult to implement, particularly for smaller companies. This can create a burden for businesses, as they may need to devote additional resources to ensure compliance with the standards.

Another potential issue is that international accounting standards may not be suitable for all countries or industries. Different countries may have different economic and cultural contexts, and what works well in one country may not be appropriate in another. Additionally, some industries may have unique characteristics that are not captured by the standards, which can make it difficult to accurately portray the financial performance of these companies.

Overall, international accounting standards have the potential to bring many benefits to the financial markets, including increased transparency, consistency, and reliability. However, it is important to recognize that these standards may also have some limitations and may not be suitable for all countries and industries.

Advantages and Disadvantages of Accounting Standards

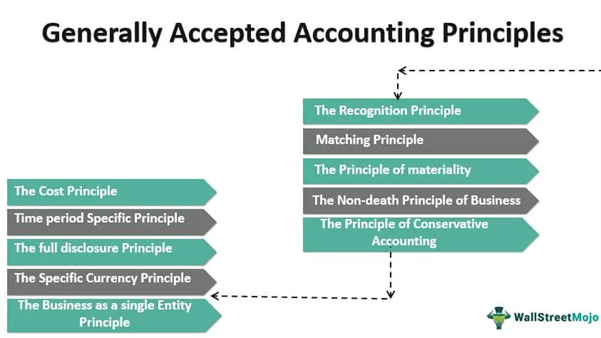

To know the financial position and value of a business, the management prepares financial statements. The Generally Accepted Accounting Principles GAAP that are in use in America have their own particular nuances that are favored by American firms. Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more. However, sometimes, geographical information imposes some restrictions, because different areas have different customers, government policy, and regional cultural differences. Copy to Clipboard Reference Copied to Clipboard.

The Advantages of International Standards on Auditing

The brand builder who attempts to develop a strong brand is like a golfer playing on a course with heavy roughs, deep sand traps, sharp doglegs, and vast water barriers. This information should be presented in a consistent manner to allow reviewers to compare it to industry standards. Detection criterion All financial transactions in connection with services, goods sales, construction contracts and the use of assets of companies by other license fees, interests, etc. Every country has its own standards. But when we face an interpretation conflict, it takes some requirements over the framework. IFRS Accounting Standards bring transparency by enhancing the international comparability and quality of financial information, enabling investors and other market participants to make informed economic decisions.

Advantages and Disadvantages of Accounting Standards (AS)

:max_bytes(150000):strip_icc()/Term-a-accounting-standard_Final-aee795f23ecc42c28c183e9585aafdc1.png)

The disadvantage of regulating accounting information through accounting standards is cost to comply. Over 100 countries so far have either adopted or are in the process of adopting IFRS right now. Under IAS, the company must write down the asset in one fell swoop, which will be a bigger hit to a company's short-term income. As the world developed more there was a need of a system for dealing with international finances therefore in June 1973 International Accounting Standards Board Committee IASC was established as a result of the agreement made between accounting bodies in Australia, Canada, France, Germany, Japan, Mexico, Netherlands, England, Ireland and the United States, and these countries were IASC Board at that time. Companies in a country can mainly depend on bank financing to increase capital. The following are incentives and disincentives for United States to make such accounting change decision.

Advantages and disadvantages of global accounting standards Free Essays

Next, understandability is an advantage of regulating accounting information through accounting standard. The notes to account also describe different contingencies of a firm and the working notes of the headings, making the system more transparent and, therefore, adopting the feature of reliability. The current standards and rules for the different accounting systems in use are currently set by the legislative branches in their respective nations. Although international accounting standards IFRS contain lots of advantages, it exists also disadvantages that can be challenges for businesses. IFRS has been in place since 2006, and it offers an increased comparability across agencies who operate between countries. Codification incorporates all the relevant SEC g. The survey of the patterns of accounting criterions is an of import issue relevant to the good direction of companies in the current environment, and are displayed with the criterions card engineering to the call for answerability and better fiscal coverage, or as a contemplation of society that is altering the outlooks of corporate behavior societal and political monitoring and control of the undertaking.

:max_bytes(150000):strip_icc()/Term-a-accounting-standard_Final-aee795f23ecc42c28c183e9585aafdc1.png)