The Mundell-Fleming model, also known as the IS-LM-BP model, is a macroeconomic model that explains the relationships between interest rates, exchange rates, and national income in an open economy. It was developed in the 1960s by economist Robert Mundell and later expanded upon by economist Marcus Fleming. The model is used to analyze the effects of monetary and fiscal policy on the economy, and it has been widely influential in shaping economic policy in countries around the world.

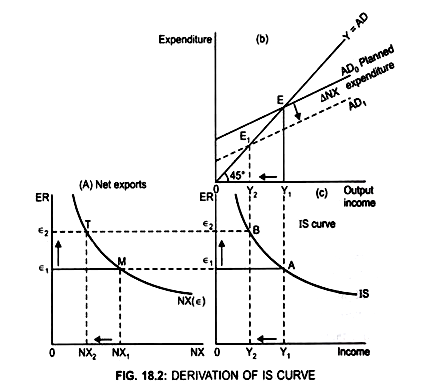

The model is based on two main equations: the IS curve, which represents the relationship between interest rates and national income, and the LM curve, which represents the relationship between money supply and national income. The IS curve is derived from the theory of the marginal efficiency of capital, which states that the rate of return on investment decreases as the level of investment increases. The LM curve, on the other hand, is derived from the theory of liquidity preference, which states that people prefer to hold more money as the interest rate increases.

The Mundell-Fleming model is often used to analyze the effects of changes in monetary and fiscal policy on the economy. For example, if the government wants to stimulate economic growth, it can lower interest rates, which will shift the IS curve to the right, resulting in higher national income. Alternatively, if the government wants to reduce inflation, it can raise interest rates, which will shift the IS curve to the left, resulting in lower national income.

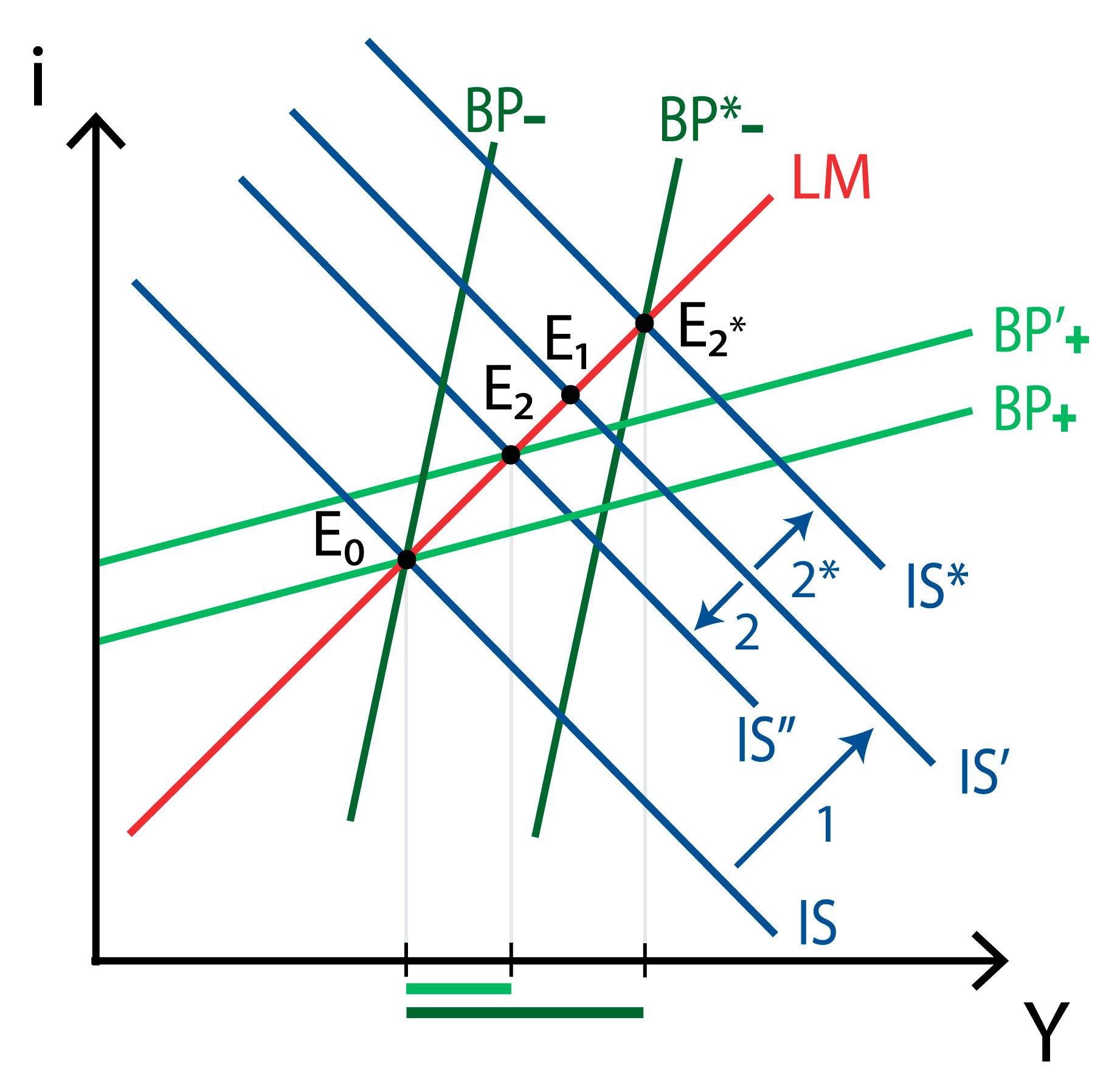

In addition to the IS and LM curves, the Mundell-Fleming model also includes a third curve called the BP curve, which represents the relationship between exchange rates and national income. The BP curve is derived from the theory of purchasing power parity, which states that the exchange rate between two currencies will adjust to reflect the relative purchasing power of the two currencies.

Overall, the Mundell-Fleming model is a powerful tool for analyzing the interactions between monetary and fiscal policy, exchange rates, and national income in an open economy. It has been widely influential in shaping economic policy in countries around the world, and it continues to be an important tool for economists and policy makers today.

The Monetary and Fiscal Policies and Determination of Exchange Rates

Under perfect capital mobility, the BoP curve is always horizontal at the level of the world interest rate. Secondly, the LM curve, which represents the equilibrium in the money market. As with all Keynesian models, we continue to simplify the analysis with the standard assumption that the economy is operating on the horizontal section of the aggregate supply curve, and therefore that prices are unaffected by increases in economic output. The Model with a Floating Exchange Rate Monetary Policy In the Mundell Fleming model with a floating exchange rate, the central bank plays no role in maintaining any particular value for the domestic currency, it simply allows supply and demand to do its thing and settle at the equilibrium rate - the rate at which the BoP is in balance. No doubt any change within the domestic economy may alter the domestic rate of interest, but the rate of interest cannot stay out of line with the world rate of interest for long. These interferences manifest themselves in capital flows and trading. The tendency for the rates of return on capital to become equal in financial markets of different countries as a result of perfect mobility of capital was formalized in a model in the 1960s by Robert Mundell, now a professor at Columbia University and the Late Marcus Fleming, an economist at the IMF.

Mundell

The reverse process applies when government expenditure decreases. Besides, IS curve of the open economy also includes net exports NX as a component of aggregate demand for goods. Under these conditions and with perfect mobility of capital investors or foreign asset holders would try to invest in the asset in any country that yields the highest return. Variables determined by the model After the subsequent equations are substituted into the first three equations above, one has a system of three equations in three unknowns, two of which are GDP and the domestic interest rate. Mundell—Fleming model explained The Mundell—Fleming model, also known as the IS-LM-BoP model or IS-LM-BP model , is an The Mundell—Fleming model portrays the short-run relationship between an economy's nominal exchange rate, interest rate, and output in contrast to the closed-economy IS-LM model, which focuses only on the relationship between the interest rate and output. This means Indian rupee will depreciate. As a quick qualifying point, you should note that at Y2, the domestic economy will maintain a lower exchange rate, and therefore a higher level of exports and fewer imports.

.png/800px-Mundell_Fleming_Model_(fiscal_policy_under_fixed_exchange_rates).png)