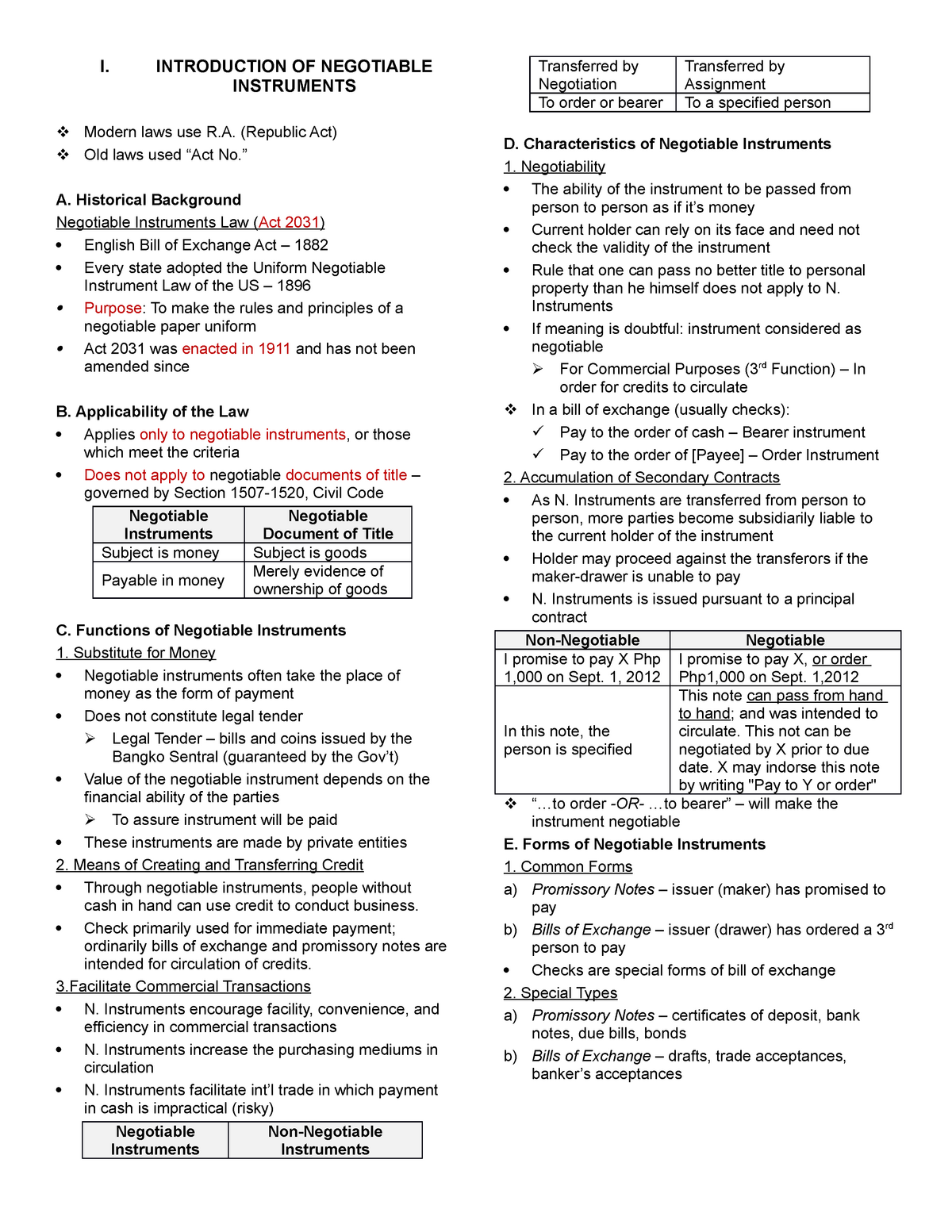

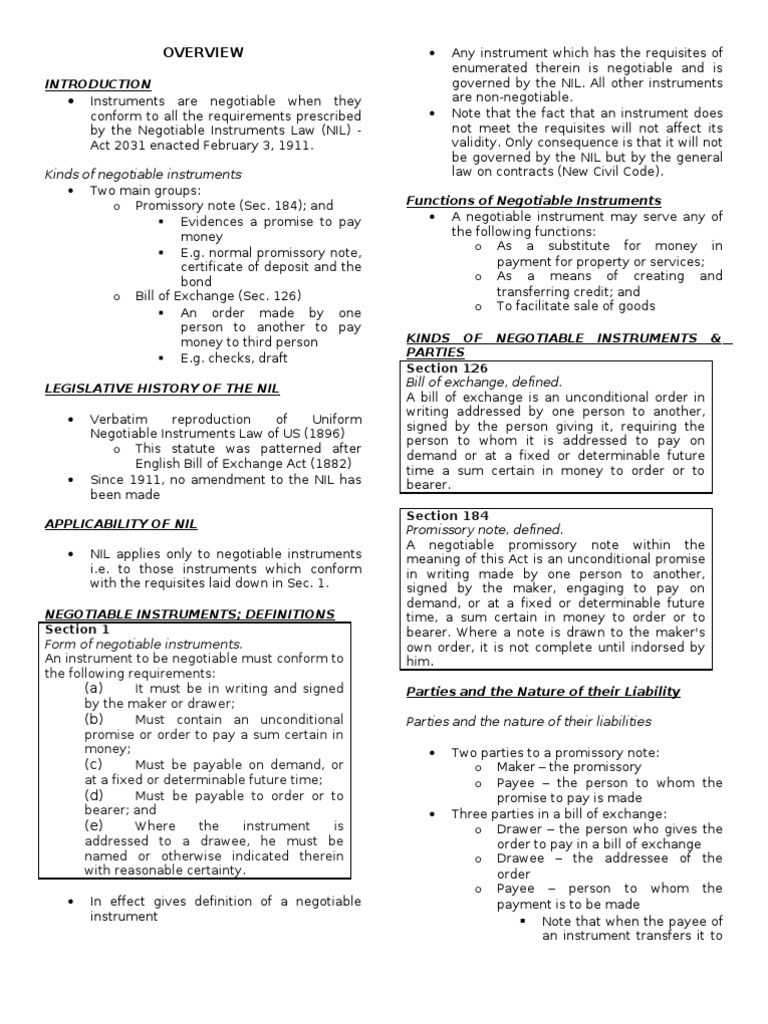

Negotiable instruments law is a branch of commercial law that deals with the creation, transfer, and enforcement of various types of financial instruments that can be traded or exchanged in financial transactions. These instruments, which include checks, drafts, promissory notes, and bills of exchange, are considered negotiable because they can be transferred from one person or entity to another without the need for any additional documentation or endorsement.

One of the key principles of negotiable instruments law is that these instruments are independent of any underlying contract or agreement between the parties involved. This means that the rights and obligations of the parties are determined by the terms of the instrument itself, rather than any other underlying agreements.

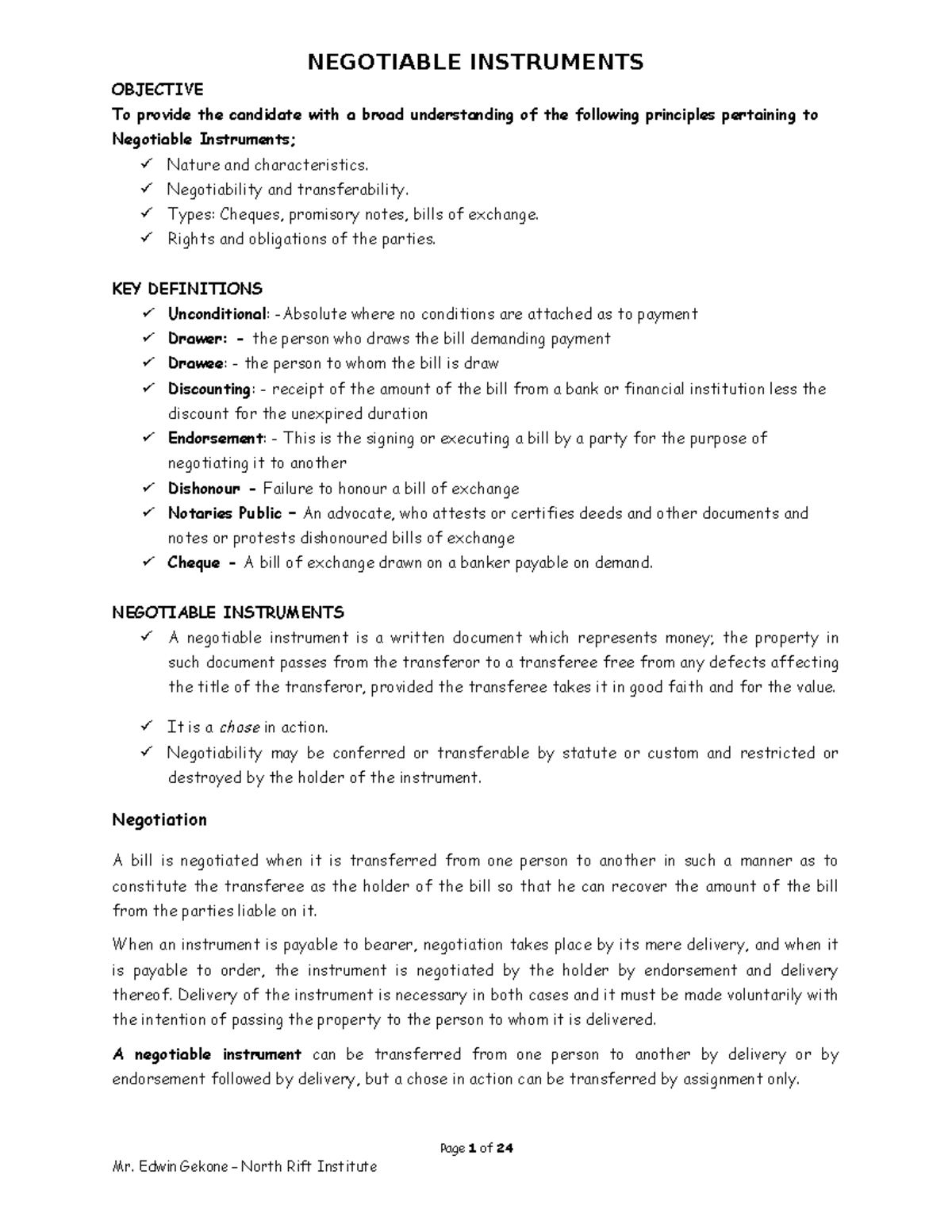

Another important principle of negotiable instruments law is the concept of "holder in due course." This refers to the person or entity that holds the instrument in good faith, without knowledge of any defects or disputes related to it. A holder in due course is entitled to the full value of the instrument and is protected from any claims or defenses that may be asserted by other parties.

Negotiable instruments law also includes provisions for the transfer of these instruments. In order to transfer a negotiable instrument, the holder must either endorse it or deliver it to the intended recipient. An endorsement is a written statement on the instrument itself, indicating that the holder is transferring ownership to another party. A delivery, on the other hand, is the physical transfer of possession of the instrument to another party.

There are also various defenses that can be raised in negotiable instruments law cases. For example, a party may claim that the instrument was not properly negotiated or that it was obtained through fraud or misrepresentation. In such cases, the courts will determine whether the defense is valid and whether the party raising it is entitled to any relief.

Overall, negotiable instruments law plays a vital role in facilitating financial transactions and ensuring that parties are able to rely on the terms of these instruments when conducting business. Its principles and provisions help to protect the interests of all parties involved and provide a framework for resolving disputes that may arise.

:max_bytes(150000):strip_icc()/NegotiableInstrument-a583c112609b4888abefe7b592abbc59.jpg)