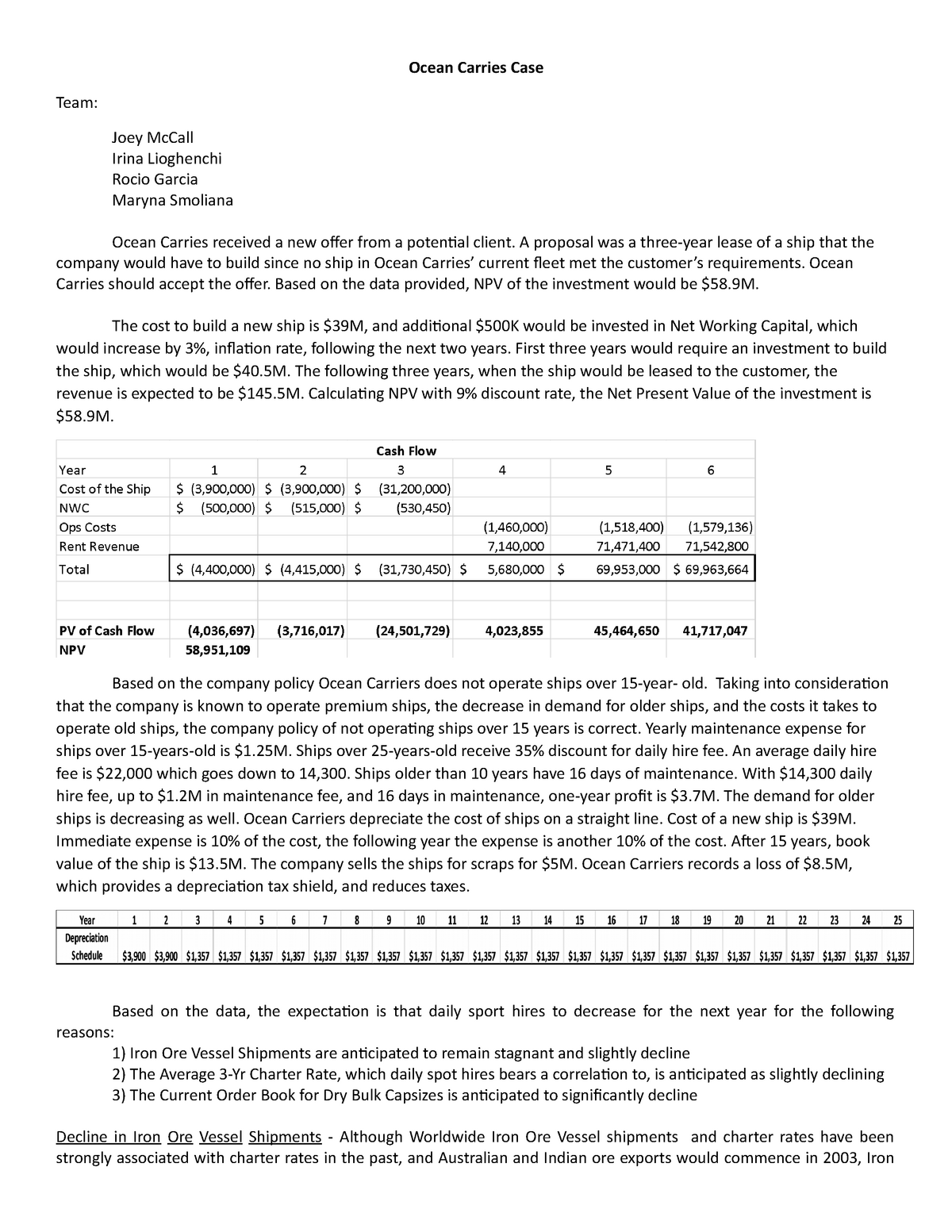

Ocean carriers is a shipping company that operates a fleet of vessels that transport iron ore internationally. The company is considering the purchase of a new vessel that would be used to transport iron ore from Brazil to China. In order to determine whether the purchase of the new vessel would be a good investment, the company has asked its financial analysts to perform a net present value (NPV) analysis.

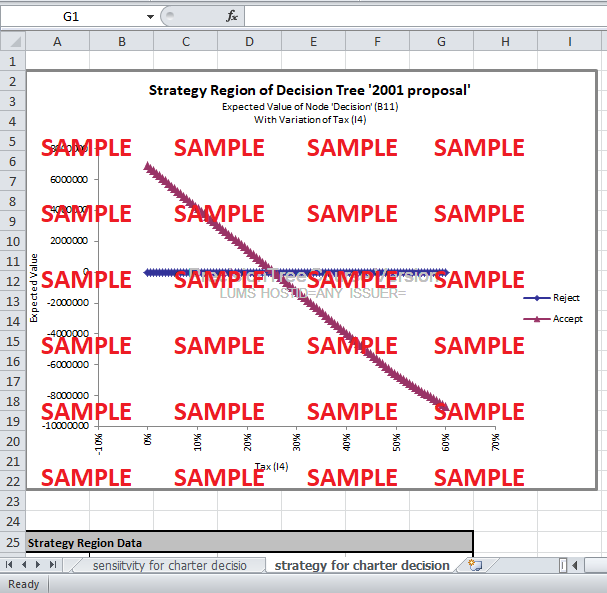

NPV is a financial metric that is used to determine the value of an investment by taking into account the time value of money. It is calculated by discounting the expected cash flows from an investment at a given discount rate and subtracting the initial cost of the investment. If the NPV is positive, the investment is expected to generate more cash than it costs, and is therefore considered to be a good investment.

In order to perform the NPV analysis for the new vessel, the financial analysts at Ocean carriers will need to gather a number of key pieces of information. This includes the expected cash flows from the vessel over its lifetime, the initial cost of the vessel, and the discount rate that will be used to calculate the NPV.

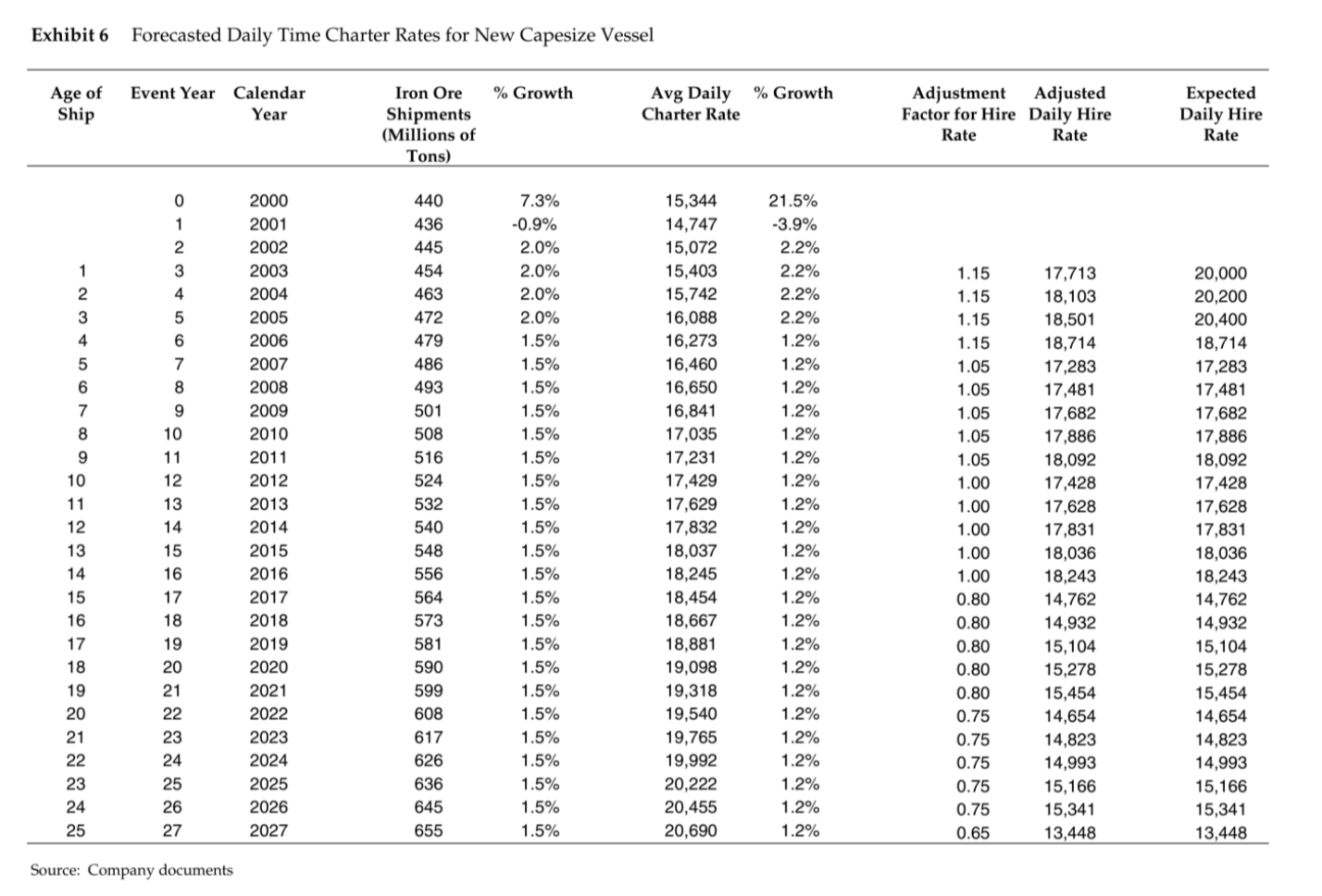

To determine the expected cash flows from the vessel, the analysts will need to consider factors such as the expected demand for iron ore, the expected price of iron ore, and the operating costs of the vessel. They will also need to consider any additional revenue that may be generated from the vessel, such as through chartering the vessel to other companies.

The initial cost of the vessel will include the purchase price, as well as any additional costs such as financing costs and commissioning costs. The discount rate will be determined based on the risk associated with the investment and the cost of capital.

Once all of this information has been gathered, the financial analysts can use it to perform the NPV analysis. If the NPV is positive, it indicates that the investment in the new vessel is expected to generate more cash than it costs, and the company should consider moving forward with the purchase. On the other hand, if the NPV is negative, it indicates that the investment is not expected to generate sufficient cash to justify the initial cost, and the company should consider alternative investments.

Overall, the NPV analysis is a valuable tool that can help Ocean carriers determine whether the purchase of a new vessel is a good investment. By carefully considering the expected cash flows, initial costs, and discount rate, the financial analysts can determine whether the investment is likely to generate a positive return and make an informed decision about whether to move forward with the purchase.