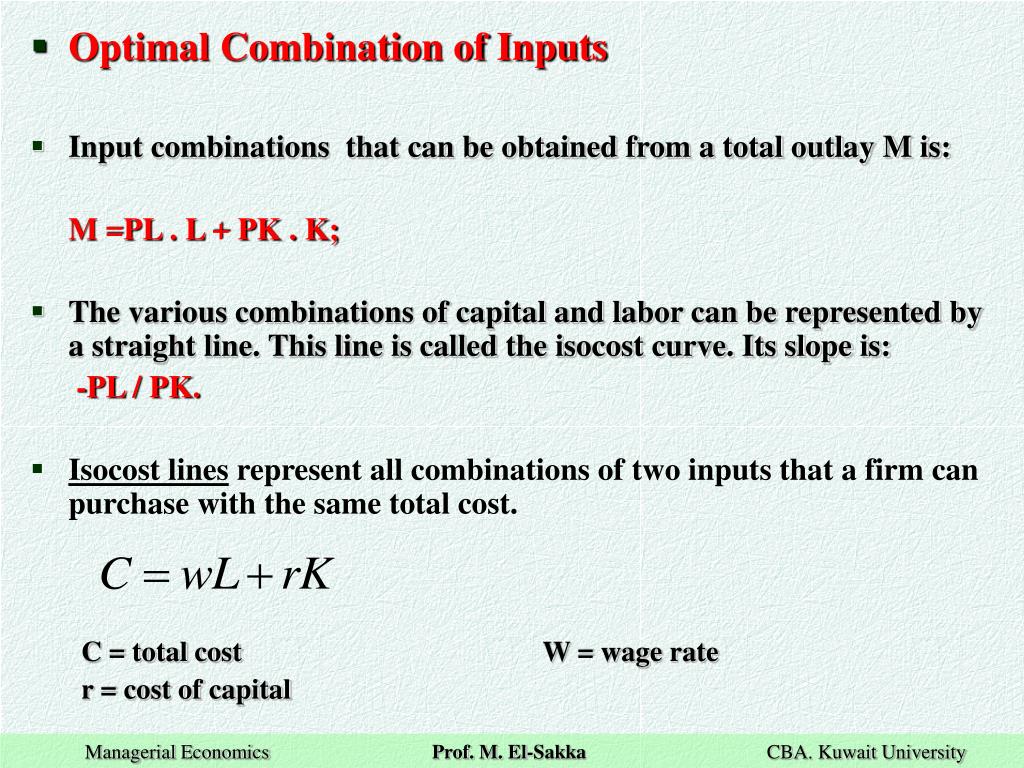

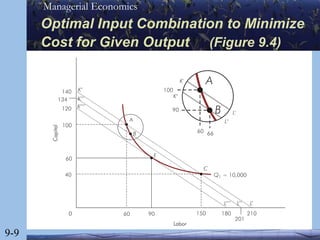

In managerial economics, the concept of optimal input combination refers to the combination of inputs (such as labor, capital, and raw materials) that a company uses to produce a product or service in the most cost-effective and efficient manner. Finding the optimal input combination is an important goal for firms, as it can help them to minimize production costs and maximize profits.

There are several factors that can influence the optimal input combination for a firm. One important factor is the production function, which describes the relationship between inputs and output. For example, a production function might indicate that increasing the amount of labor used will result in a larger increase in output than increasing the amount of capital. In this case, the firm would want to use more labor and less capital in order to achieve the optimal input combination.

Another important factor is the price of the inputs. If the price of one input, such as labor, increases significantly, the firm may need to find ways to substitute other inputs, such as capital, in order to maintain the optimal input combination. This can be done through the use of technology or other process improvements.

In addition to the production function and input prices, firms also need to consider other external factors when determining the optimal input combination. These can include market demand for the product or service, competition from other firms, and regulatory requirements.

One approach to finding the optimal input combination is through the use of linear programming, a mathematical method that involves setting up a model of the production process and optimizing it based on certain constraints and objectives. This can be a complex process, but it can provide valuable insights into the most cost-effective and efficient input combinations.

In conclusion, the optimal input combination is an important concept in managerial economics that refers to the combination of inputs that a firm uses to produce a product or service in the most cost-effective and efficient manner. Finding the optimal input combination requires considering a range of factors, including the production function, input prices, and external factors such as market demand and competition. Linear programming is one approach that can be used to find the optimal input combination, but it can be a complex process.