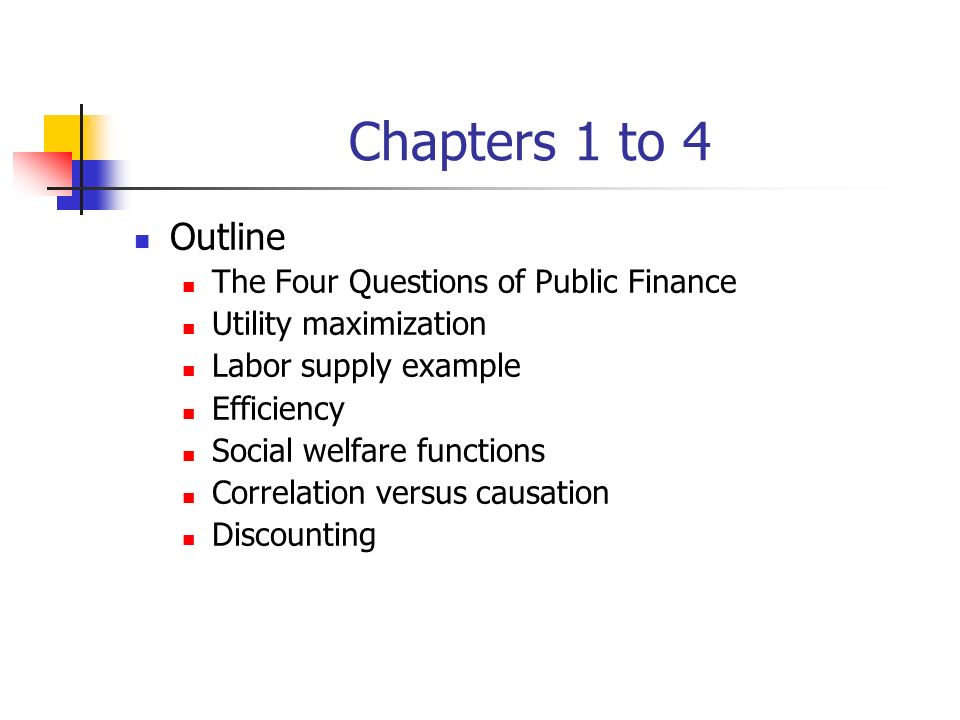

Public finance is the study of how governments raise and allocate public resources. It is a critical field that plays a central role in shaping the economic and social policies of a country. There are many important questions that fall within the realm of public finance, and in this essay, we will explore a few of the most significant ones.

One key question in public finance is how governments should raise the money they need to fund their operations. There are several options available to governments, including taxation, borrowing, and printing money. Each option has its own pros and cons, and the best choice will depend on the specific circumstances of the country in question.

For example, taxation is a common way for governments to raise money. It can be an effective way to fund public goods and services, but it can also be unpopular with citizens if it is perceived as being too high or unfair. Borrowing, on the other hand, allows governments to fund their operations in the short term, but it can create long-term debt if not managed carefully. Printing money, meanwhile, can lead to inflation if done in excess.

Another important question in public finance is how to allocate resources effectively. Governments must decide how to allocate their limited resources in a way that maximizes the public good. This can be challenging because different groups within a society often have competing interests and priorities. Governments must balance the needs of different groups, such as the elderly, children, and the poor, while also taking into account the overall fiscal health of the country.

A third key question in public finance is how to finance large infrastructure projects, such as roads, bridges, and airports. These projects can be expensive and may require long-term financing. Governments have several options for financing these projects, including borrowing, public-private partnerships, and grants. The best option will depend on the specific project and the fiscal situation of the country.

Finally, an important question in public finance is how to address income inequality. Income inequality is a persistent problem in many countries, and it can have negative consequences for social cohesion and economic growth. Governments have several tools at their disposal to address income inequality, including progressive taxation, social welfare programs, and education and job training initiatives.

In conclusion, public finance is a complex and multifaceted field that touches on many important questions. From how to raise the money needed to fund government operations to how to allocate resources effectively and address income inequality, public finance plays a vital role in shaping the economic and social policies of a country.