A short sale hardship letter is a document that explains to a lender the reasons why a borrower is unable to make their mortgage payments and is requesting a short sale of their property. A short sale is a sale of a property for less than the amount owed on the mortgage. It is often used as an alternative to foreclosure, which is when a lender takes possession of a property because the borrower has defaulted on their mortgage.

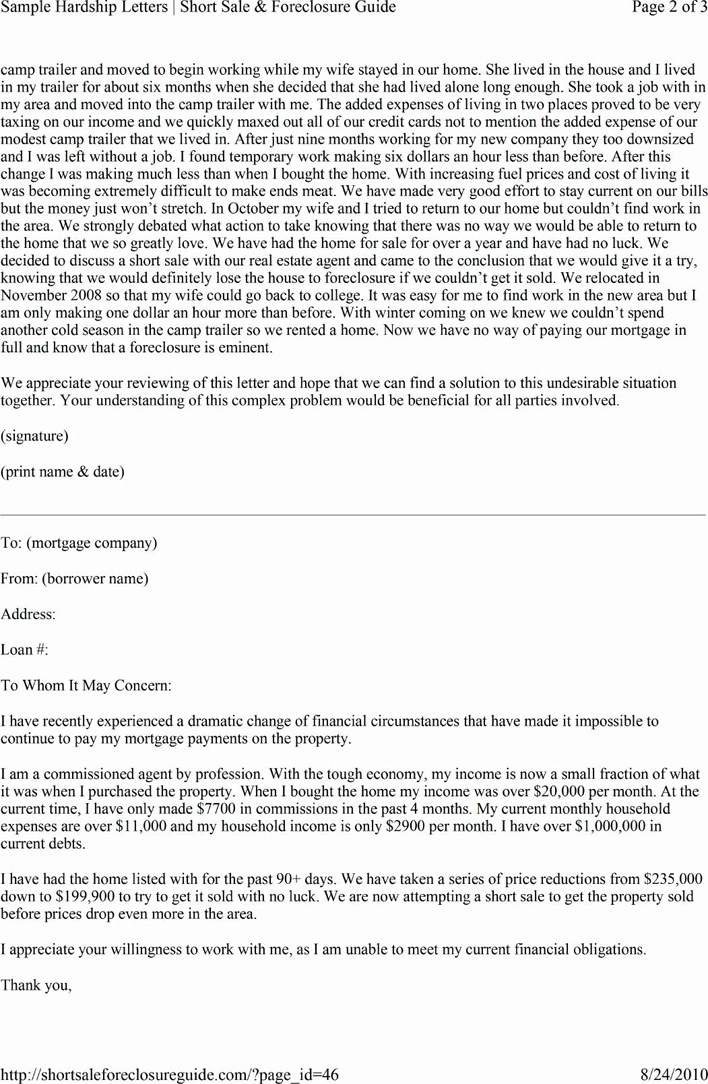

There are several reasons why a borrower may need to request a short sale, such as a loss of income, a divorce, a death in the family, or an unexpected medical expense. Whatever the reason, it is important for the borrower to clearly and concisely explain their situation in the hardship letter.

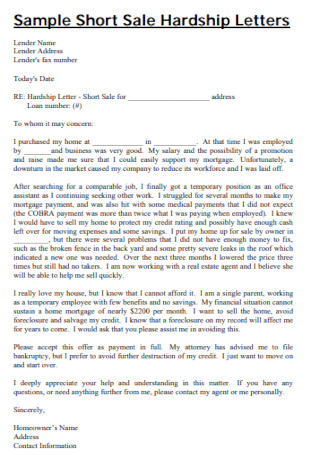

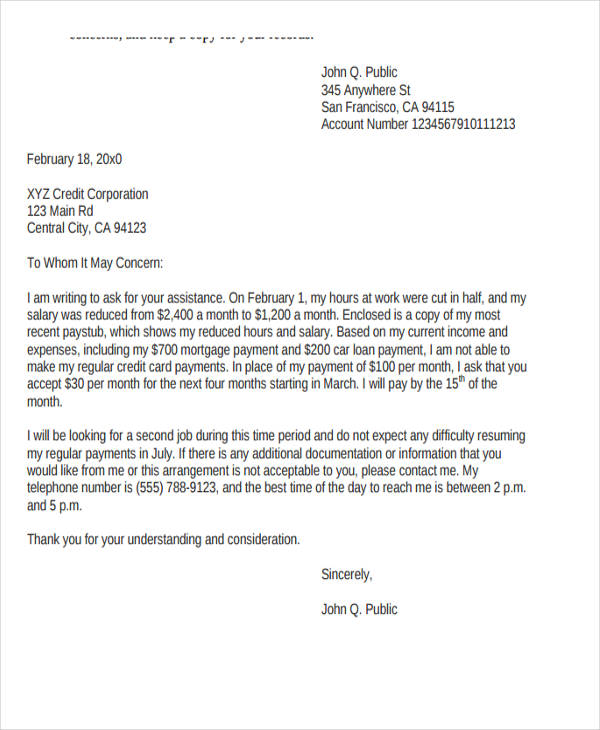

A short sale hardship letter template can be a useful tool for borrowers who are not sure how to structure their letter. It can provide a general outline and some suggested language, but it is important for the borrower to personalize the letter and make it their own.

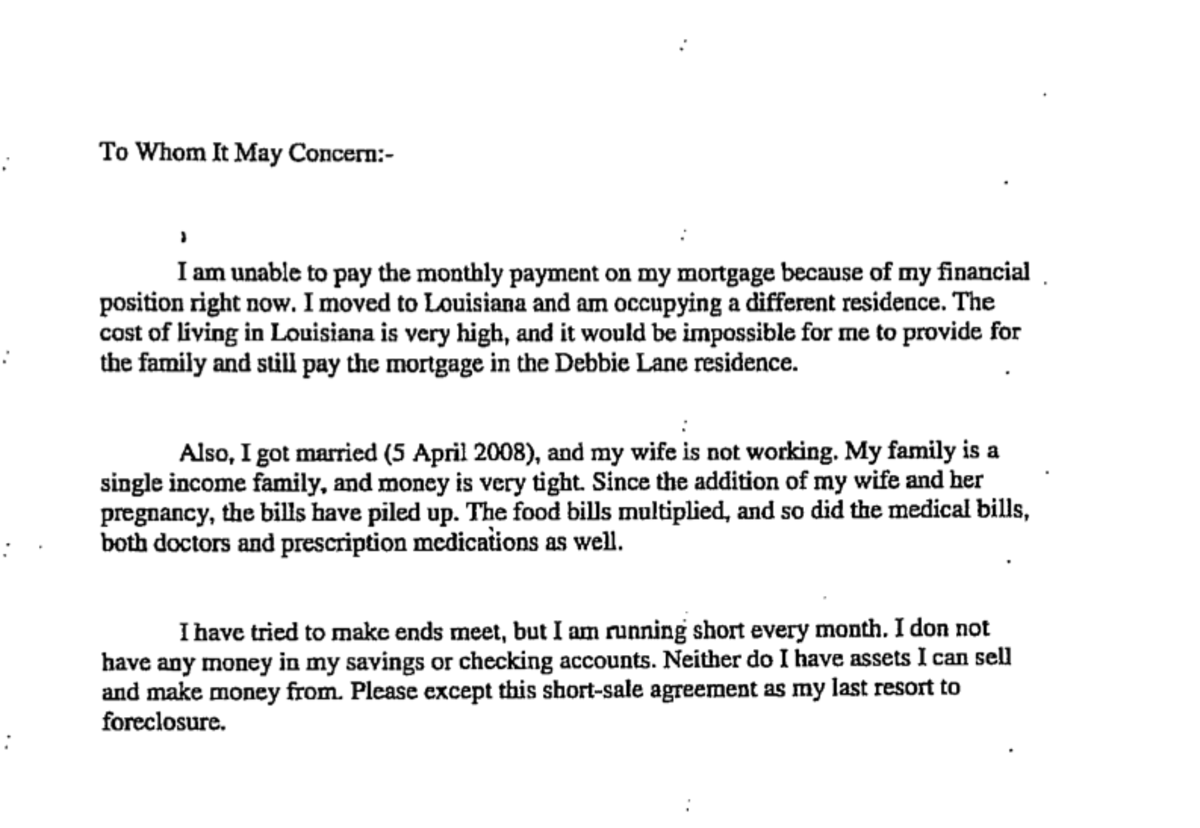

Here is a sample short sale hardship letter template:

Dear [Lender],

I am writing to request a short sale of my property located at [address]. I am unable to continue making my mortgage payments due to [reason for hardship].

I have tried to find a solution to my financial difficulties, but unfortunately, I have been unable to do so. I have explored options such as refinancing, selling the property, and seeking assistance from family and friends, but none of these options have been successful.

I am now facing the difficult decision of either letting the property go into foreclosure or attempting a short sale. I believe that a short sale is the best option for both myself and the lender. It will allow me to avoid the negative consequences of a foreclosure, such as damage to my credit score and legal fees, and it will allow the lender to recoup some of the money owed on the mortgage.

I understand that a short sale will have an impact on my credit score and may affect my ability to obtain future financing. However, I am willing to accept this consequence in order to resolve my current financial difficulties and avoid a more damaging outcome such as a foreclosure.

I have attached supporting documentation, including financial statements and hardship documentation, to this letter. I hope that this information will help you to understand my situation and consider my request for a short sale.

Thank you for your time and consideration. I look forward to working with you to find a solution that is mutually beneficial.

Sincerely, [Your Name]

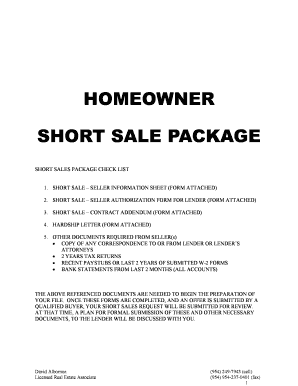

It is important to note that a hardship letter is just one part of the short sale process. Borrowers will also need to provide documentation such as financial statements, proof of hardship, and a list of comparable properties to support their request. Additionally, the lender will need to review and approve the short sale before it can proceed.

In summary, a short sale hardship letter is a crucial part of the short sale process. It allows borrowers to explain their financial difficulties and request a short sale as an alternative to foreclosure. A template can provide a helpful outline, but it is important for borrowers to personalize the letter and provide supporting documentation to increase the chances of a successful short sale.