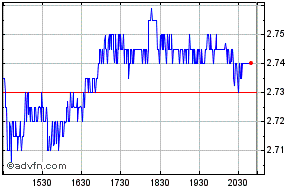

Sirius radio financials. Sirius XM Holdings Inc. (SIRI) 2022-12-26

Sirius radio financials

Rating:

9,3/10

1378

reviews

Sirius XM Radio is a satellite radio company that provides subscription-based audio entertainment and music services to listeners in the United States and Canada. It was formed in 2008 through the merger of Sirius Satellite Radio and XM Satellite Radio, which were two of the first satellite radio services in the world.

In terms of financial performance, Sirius XM has consistently been a strong performer. In 2020, the company reported revenue of $7.4 billion, up from $7.1 billion in 2019. This growth was driven by increases in both subscribers and average revenue per user (ARPU). The company ended 2020 with approximately 34 million subscribers, an increase of approximately 1.4 million from the previous year.

One key factor contributing to Sirius XM's financial success has been its ability to consistently add new subscribers, even as competition from streaming services has increased. The company has achieved this through a combination of strong marketing efforts, partnerships with automakers to offer Sirius XM as a factory-installed feature, and the launch of new services and content offerings.

In addition to its strong revenue growth, Sirius XM has also consistently reported positive net income. In 2020, the company reported net income of $1.3 billion, up from $1.2 billion in 2019. This has been achieved through a combination of strong revenue growth and careful cost management.

Looking ahead, Sirius XM is well positioned for continued financial success. The company has a strong brand and a loyal subscriber base, and it continues to invest in new content and technology to stay ahead of the curve. It has also established partnerships with major automakers and other companies, which should help to drive future growth. Overall, Sirius XM's financials demonstrate the company's ability to adapt to changing market conditions and consistently deliver strong financial results.

Sirius Financials

Please contact us for a free consultation. In addition to its audio entertainment businesses, SiriusXM offers connected vehicle services to automakers. NASDAQ: SIRI is the leading audio entertainment company in North America, and the premier programmer and platform for subscription and digital advertising-supported audio products. Tax collected from customer is tax assessed by governmental authority that is both imposed on and concurrent with specific revenue-producing transaction, including, but not limited to, sales, use, value added and excise. Net income was USD 247 million compared to USD 343 million a year ago. The Beta measures systematic risk based on how returns on SIRIUS XM RADIO correlated with the market. You can analyze the SIRIUS XM RADIO is currently regarded as top stock in price to earnings to growth category among related companies.

Next

SIRIUS XM financials 2023

For the nine months, revenue was USD 6,720 million compared to USD 6,415 million a year ago. SIRIUS Financial Ratios RelationshipsComparative valuation techniques use various fundamental indicators to help in determining SIRIUS XM's current stock value. You can analyze the Sirius XM Holding is currently regarded as top stock in cash per share category among related companies. In addition, it distributes satellite radios through automakers and retailers, as well as its website. The output start index for this execution was twenty-four with a total number of output elements of thirty-seven. It should also be noted that in January 2013, Liberty Media converted the rest of its Series B Preferred Stock into common stock as well, which will further affect earnings per share.

Next

Sirius XM Financial Analysis, Sample of Business plans

This number can be calculated in two ways: by subtracting the total of all operating expenses from net revenue or by adding up changes to cash and other assets or liabilities on this part of the statement. If SIRIUS XM Beta is about zero movement of price series is uncorrelated with the movement of the benchmark. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found in our Annual Report on Form 10-K for the year ended December 31, 2021, and our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, which are filed with the Securities and Exchange Commission the "SEC" and available at the SEC's Internet site Source: SiriusXM Investor contacts: Hooper Stevens 212-901-6718 Natalie Candela 212-901-6672 View original content: SOURCE Sirius XM Holdings Inc. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements. SiriusXM's platforms collectively reach approximately 150 million listeners, the largest digital audio audience across paid and free tiers in North America, and deliver music, sports, talk, news, comedy, entertainment, and podcasts.

Next

SiriusXM to Report Third Quarter 2022 Financial and Operating Results :: Sirius XM Holdings Inc. (SIRI)

The third section is about investing activities, which shows what Sirius XM has done with the money that it received from the sale of assets or what it spent to acquire new ones. Do not rely on someone else's analysis or guesses about the Sirius XM Key Financial RatiosGenerally speaking, Sirius XM's financial ratios allow both analysts and investors to convert raw data from Sirius XM's financial statements into concise, actionable information that can be used to evaluate the performance of Sirius XM over time and compare it to other companies across industries. There are many critical financial ratios that investors are exposed to on a daily basis, but they are usually grouped into few meaningful categories from each financial statement that Sirius XM Holding reports annually and quarterly. Please note, the presentation of Sirius XM's financial position, as portrayed in its financial statements, is often influenced by management's estimates, judgments, and sometimes even manipulations. You can sign up for additional alert options at any time.

Next

SIRI

You have to read the cash flow statement in three sections. Diluted earnings per share from continuing operations was USD 0. Our independence allows us the flexibility to provide a personalised quality service to our all our clients, whilst keeping our fees low, ensuring that you benefit from using our expertise. Basic earnings per share from continuing operations was USD 0. You must click the activation link in order to complete your subscription. NASDAQ: SIRI is the leading audio entertainment company in North America, and the premier programmer and platform for subscription and digital advertising-supported audio products.

Next

Sirius Financials (SIRI)

Another issue that stuck out to me was the high costs that Sirius XM incurred. For more about SiriusXM, please go to: This communication contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. SIRIUS XM RADIO has more than 74 % percent chance of experiencing financial distress in the next two years of operations. Just like the debt to equity ratio, this low current ratio can also mean a higher return on assets for Sirius XM. It complements the equity performance score by supplying investors with insight into company financials without requiring them to know too much about all of the complex accounting and financial indicators surrounding the entity.

Next

Sirius XM Holdings Inc. (SIRI) Company Profile & Facts

Please note, there is a significant difference between SIRIUS XM's value and its price as these two are different measures arrived at by different means. This model doesn't attempt to find an intrinsic value for SIRIUS XM's Stock. SiriusXM, through Sirius XM Canada Holdings, Inc. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties, and contingencies, many of which are difficult to predict and generally beyond our control. This number does not have all of the same line items that are on a cash flow statement, but it leaves out non-cash expenses like depreciation and amortization.

Next

SiriusPoint Ltd.

One glaring issue that I found in the notes to the financial statements of Sirius XM radio is the fact that Liberty Media owns over 50% of Sirius XM radio. Please note, there is a significant difference between Sirius XM's value and its price as these two are different measures arrived at by different means. Investors typically determine SIRIUS XM value by looking at such factors as earnings, sales, fundamental and technical indicators, competition as well as analyst projections. Do not rely on someone else's analysis or guesses about the SIRIUS XM Key Financial RatiosGenerally speaking, SIRIUS XM's financial ratios allow both analysts and investors to convert raw data from SIRIUS XM's financial statements into concise, actionable information that can be used to evaluate the performance of SIRIUS XM over time and compare it to other companies across industries. SiriusXM's subsidiaries Stitcher, Simplecast and AdsWizz make it a leader in podcast hosting, production, distribution, analytics, and monetization. About SiriusXM Sirius XM Holdings Inc.

Next

Income Statement :: Sirius XM Holdings Inc. (SIRI)

One issue with these facts that I quickly noticed upon analyzing the financials of Sirius XM is that Sirius XM relies heavily on subscribers to post its revenue. . Investors typically determine Sirius XM value by looking at such factors as earnings, sales, fundamental and technical indicators, competition as well as analyst projections. The other reason investors look at the income statement is to determine what Sirius XM's earnings per share EPS will be in order to see if they want to buy more shares or not. It is currently regarded as top stock in target price category among related companies fabricating about 673. In the best case, Sirius XM's management is honest, while the outside auditors are strict and uncompromising. As stated in the previous analysis of Sirius XM, it relies heavily on the auto industry for its subscribers, with new cars or leases usually coming with a pre-paid membership to Sirius XM radio.

Next