The Reserve Bank of India (RBI) is the central bank of India and serves as the regulator of the country's monetary policy. It was established in 1935 and is headquartered in Mumbai.

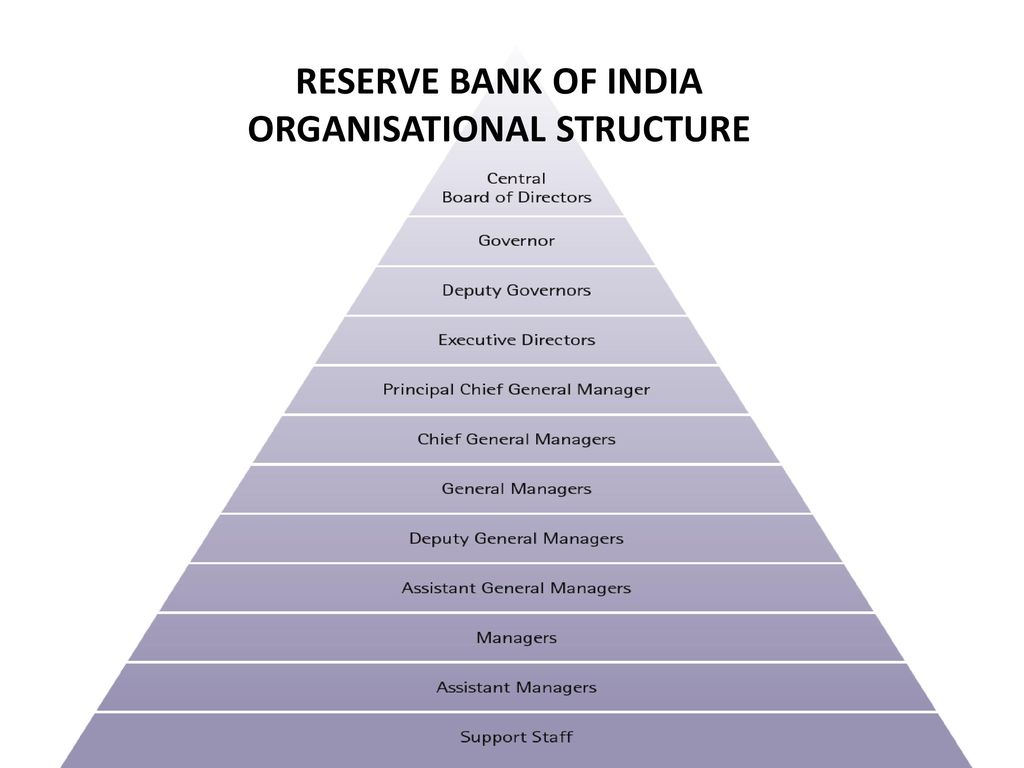

The RBI is structured as a public sector undertaking, which means that it is owned by the Government of India. It is governed by a central board of directors, which is appointed by the Government of India. The board is responsible for the overall direction and control of the RBI's affairs.

The RBI is headed by a governor, who is appointed by the Government of India for a term of three years. The governor is assisted by four deputy governors, who are also appointed by the Government of India. The governor and the deputy governors form the highest decision-making body of the RBI, known as the central board of directors.

The RBI performs a wide range of functions, including issuing and regulating currency, managing the country's foreign exchange reserves, and acting as a lender of last resort to commercial banks. It also plays a key role in maintaining price stability and ensuring the smooth functioning of the financial system.

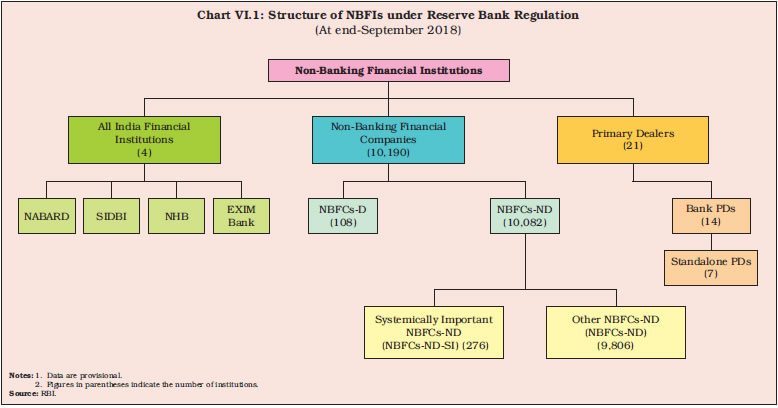

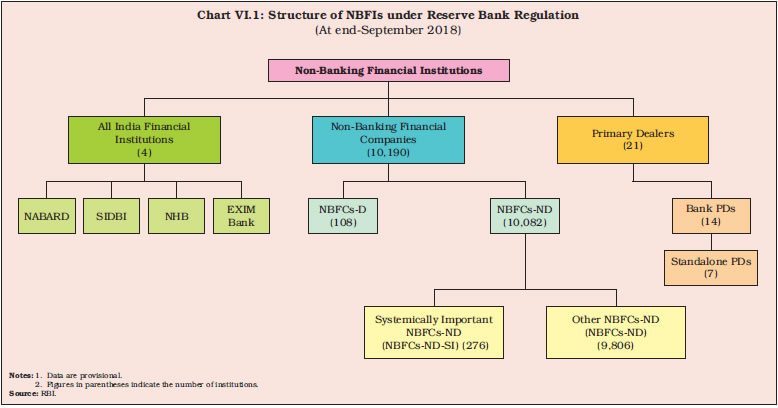

In addition to its monetary policy functions, the RBI also performs regulatory and supervisory functions for the banking sector in India. It sets standards for banks and non-banking financial companies, and it also has the power to inspect and regulate these institutions to ensure compliance with these standards.

Overall, the structure of the Reserve Bank of India is designed to ensure that it can effectively carry out its mandate of maintaining price stability and promoting financial stability in the country. It is an important institution that plays a crucial role in the functioning of the Indian economy.

Reserve Bank of India

However, any such Director shall not be appointed for more than 2 terms, that is, for a maximum period of 8 years either continuously or intermittently. When the exchange rate falls sharply the central banks buy local currency from the exchange markets to increase its demand. To maintain monetary stability in the country. Any person appointed as additional Director in pursuance of this section shall hold office during the pleasure of the Reserve Bank and subject thereto for a period not exceeding 3 years or such further periods not exceeding 3 years at a time as the Reserve Bank may specify and shall not be required to hold qualification-shares in the banking company. Exchange rate stability Central banks also look to keep the currency shocks at bay that may occur due to political or economic reasons. Instead of maintaining thousands of small accounts and incurring huge transaction costs, under wholesale banking, the banks deal with large customers and keep only large accounts. It takes steps to stop the fall in the value of the Indian Rupee.

Objectives and Organizational Structure of Reserve Bank of India

The Central Board of Directors holds minimum 6 meetings every year. In 1st April 1935, Reserve Bank of India was setup. The Central Government may, by notification in the Official Gazette, constitute a Committee to be called the Monetary Policy Committee of the Bank. Economic growth leads to financial prosperity which is achieved by more consumption and increased demand. Like individuals, businesses and banks, Governments too need a banker to carry out their financial transactions in an efficient way, including the raising of resources from the public. In the interest of public and at the request of the Central or State Government, the Central Board may permit the Governor or a Deputy Governor to undertake part-time honorary work, whether related to the purposes of the Act or not. What are the main Functions and Objectives of the Reserve Bank? An increased loan rate is undesirable for the public and it decreases the circulation of money.

History & Structure of Reserve Bank of India

They are as follows: Setting the base rate The setting of base interest rates impacts commercial banks and the general public. With the introduction of the Paper Currency Act, 1861, the British Government of India was conferred the monopoly to issue paper notes in India. In turn, this has arisen the requirement for effective coordination and consultation with other regulators within India and abroad. However, on recommendation of the Central Board, the Central Government may declare any series of bank notes of any denomination as not to be a legal tender. It controls the financial system in the country through various measures.

Reserve Bank of India

The Reserve Bank has four regional representatives, New Delhi in the North, Kolkata in the East, Chennai in the South, and Mumbai in the West. These data inputs are used to analyse specific issues of relevance. In many cases, commercial banks need loans to align their assets and liabilities. It also boosts consumption but does not lead to panic buying. This info also reveals the population and credit needs in each bank.