Lincoln Sports Equipment is a company that specializes in the production and sale of sports equipment. The company's management is considering a proposal to invest in a new machine that would be used to manufacture a new line of products. The machine would cost $500,000 and would have a useful life of 10 years, after which it would be sold for an estimated salvage value of $50,000.

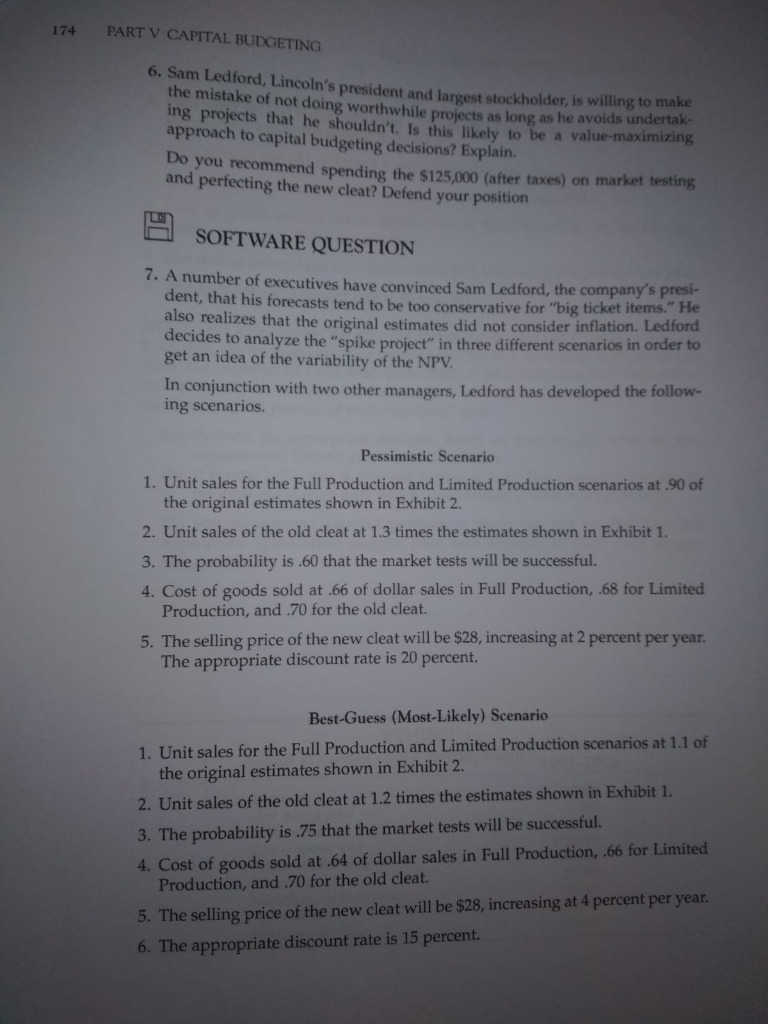

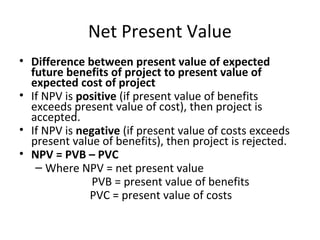

To evaluate the proposal, the management of Lincoln Sports Equipment needs to conduct a capital budgeting analysis. This involves calculating the net present value (NPV) of the investment, which is a measure of the amount by which the investment is expected to increase the company's value. To do this, the management needs to consider the expected cash flows from the investment and the required rate of return, also known as the discount rate.

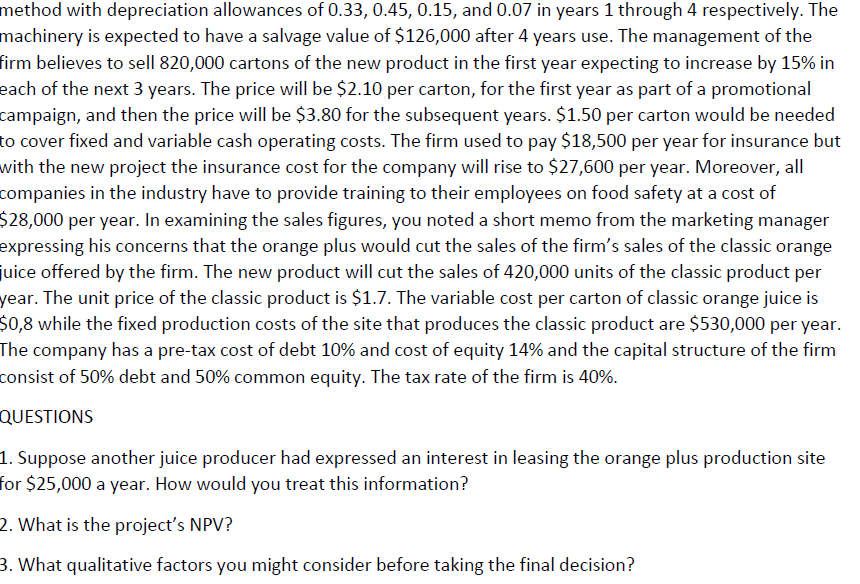

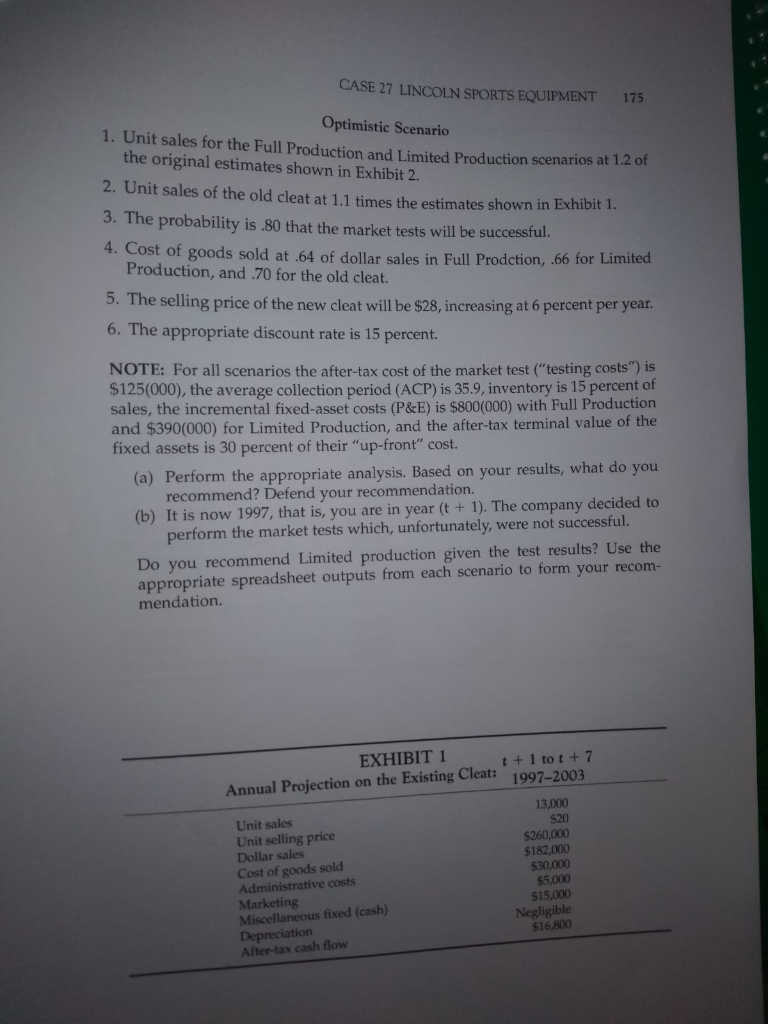

The expected cash flows from the investment can be estimated by forecasting the expected sales and expenses for the new line of products. The management can use the information available to them, such as market research and industry data, to make these projections. The expected cash flows should be discounted to their present value using the required rate of return.

The required rate of return is the minimum rate of return that the management expects to receive on the investment. It takes into account the risk of the investment and the opportunity cost of investing in other opportunities. The higher the risk of the investment, the higher the required rate of return.

Once the NPV of the investment has been calculated, the management can decide whether to accept or reject the proposal. If the NPV is positive, it means that the investment is expected to increase the value of the company by more than the required rate of return. In this case, the management should accept the proposal. If the NPV is negative, it means that the investment is expected to decrease the value of the company, and the management should reject the proposal.

In the case of Lincoln Sports Equipment, the management should carefully consider the expected cash flows and the required rate of return before making a decision on the proposal to invest in the new machine. By conducting a thorough capital budgeting analysis, the management can make an informed decision that is in the best interests of the company and its shareholders.