Tata AIG Life Insurance is a joint venture between the Tata Group, one of India's largest conglomerates, and American International Group (AIG), a global insurance company. Together, they offer a range of life insurance plans designed to meet the diverse needs of Indian consumers.

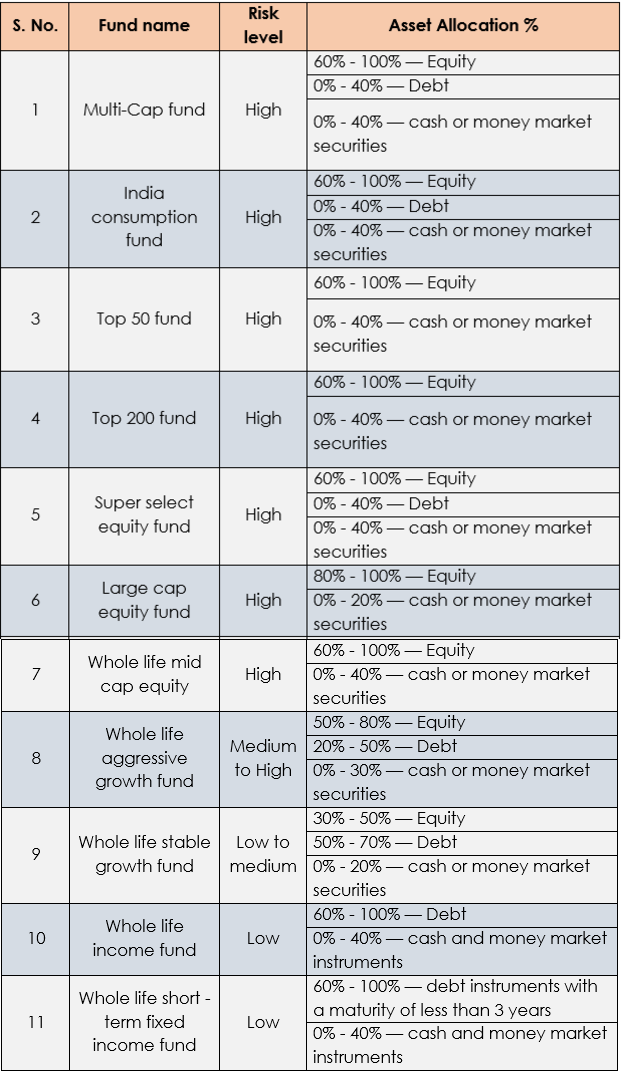

One of the key features of Tata AIG Life Insurance plans is their flexibility. Customers can choose from a variety of policy terms, coverage amounts, and premium payment options to suit their individual needs and budget. Some of the policy options offered by Tata AIG Life Insurance include term insurance, whole life insurance, endowment plans, and retirement plans.

Term insurance is a type of policy that provides coverage for a specific period of time, such as 10, 20, or 30 years. It is often chosen by individuals who are looking for a low-cost way to protect their loved ones in the event of their untimely death. Whole life insurance, on the other hand, provides coverage for the entirety of the policyholder's life, as long as premiums are paid on time. It is typically more expensive than term insurance, but it also offers a cash value component that can be used to fund retirement or other financial goals.

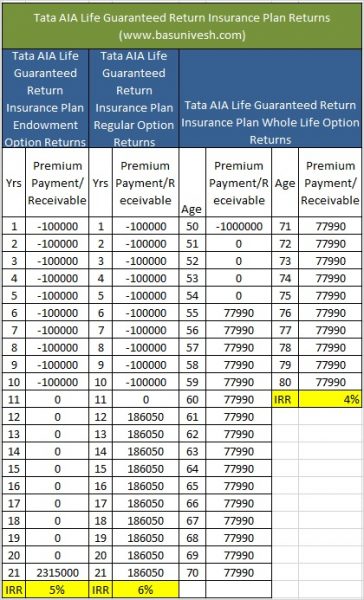

Endowment plans are a type of insurance policy that combines the protection of life insurance with an investment component. They are designed to pay out a lump sum upon the policyholder's death or at a predetermined date in the future, such as upon retirement. These policies are often used to save for specific financial goals, such as paying for a child's education or retirement.

Retirement plans, also known as pension plans, are designed to provide a source of income during retirement. Tata AIG Life Insurance offers a variety of pension plans, including traditional defined benefit plans, defined contribution plans, and annuities. These plans allow customers to save for retirement and ensure a steady stream of income during their golden years.

In addition to the wide range of policy options available, Tata AIG Life Insurance also offers a number of rider options that can be added to their policies to provide additional protection. These riders can cover things like accidental death, critical illness, and long-term care.

Overall, Tata AIG Life Insurance offers a range of life insurance plans that are designed to meet the diverse needs of Indian consumers. From term insurance to retirement plans, they offer a variety of options that can be customized to fit individual circumstances and financial goals.