The relationship between marginal revenue and price is an important concept in economics, as it helps to determine the optimal pricing strategy for a firm. In this essay, we will explore the definition of marginal revenue and price, and how the two are related in a competitive market.

First, let's define marginal revenue and price. Marginal revenue is the increase in total revenue that results from selling one additional unit of a good or service. In other words, it is the change in total revenue that occurs when the quantity of a product sold is increased by one unit. For example, if a firm sells 10 units of a product for $10 each, and then sells an additional unit for $9, the marginal revenue from that 11th unit is $9.

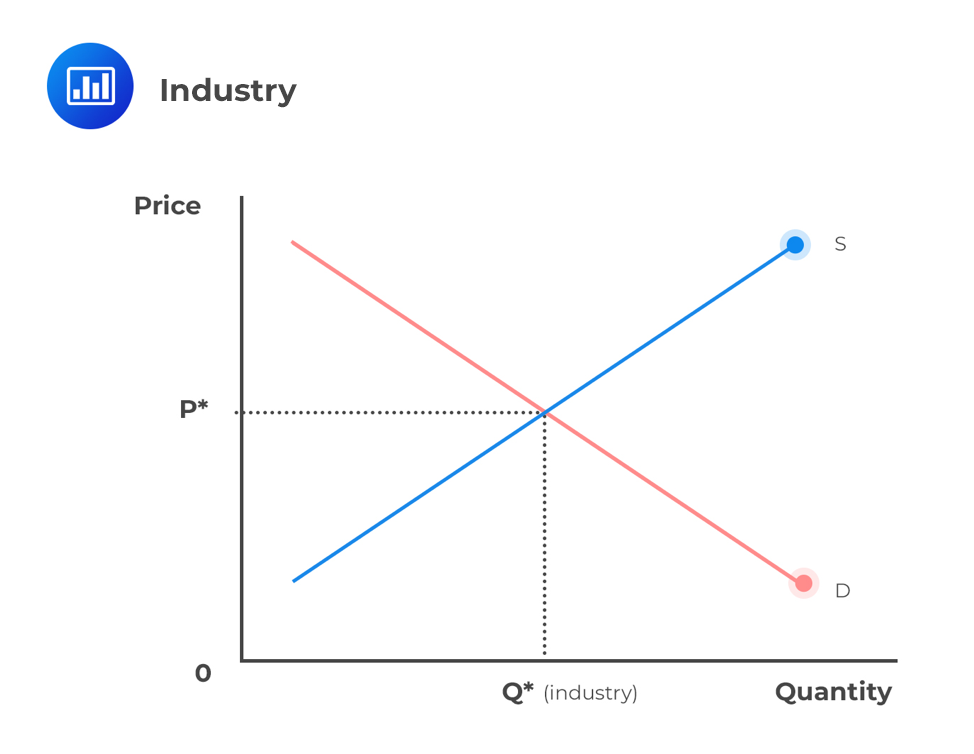

Price, on the other hand, is the amount of money that a buyer must pay to obtain a good or service. In a competitive market, firms typically set their prices based on the marginal cost of production, which is the increase in total cost that results from producing one additional unit of a good or service.

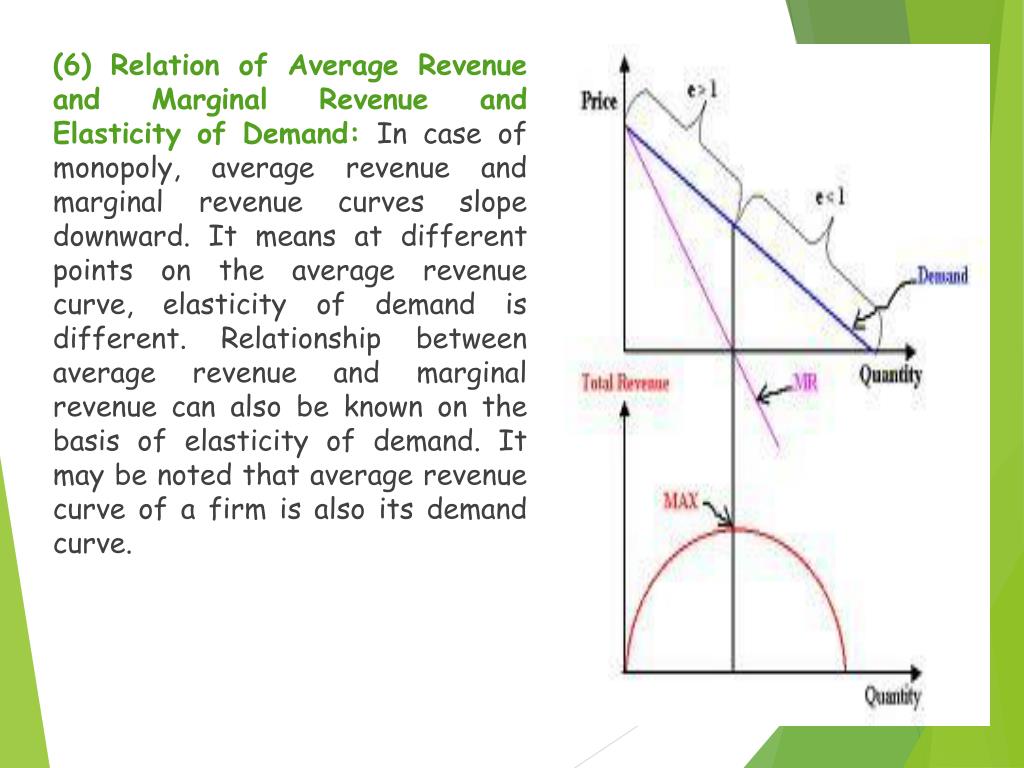

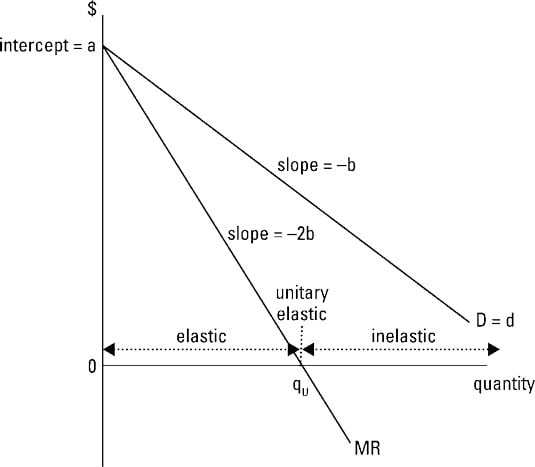

Now, let's examine the relationship between marginal revenue and price. In a competitive market, firms face a downward-sloping demand curve, which means that as the price of a product increases, the quantity of the product demanded decreases. This relationship is known as the law of demand. As a result, when a firm increases the price of its product, it will typically experience a decrease in the quantity demanded, which will lead to a decrease in total revenue.

This decrease in total revenue is reflected in the marginal revenue curve, which is downward-sloping. The marginal revenue curve shows the relationship between the marginal revenue and the quantity of a product sold. As the quantity of a product increases, the marginal revenue from each additional unit decreases, until it reaches zero at the point of maximum total revenue.

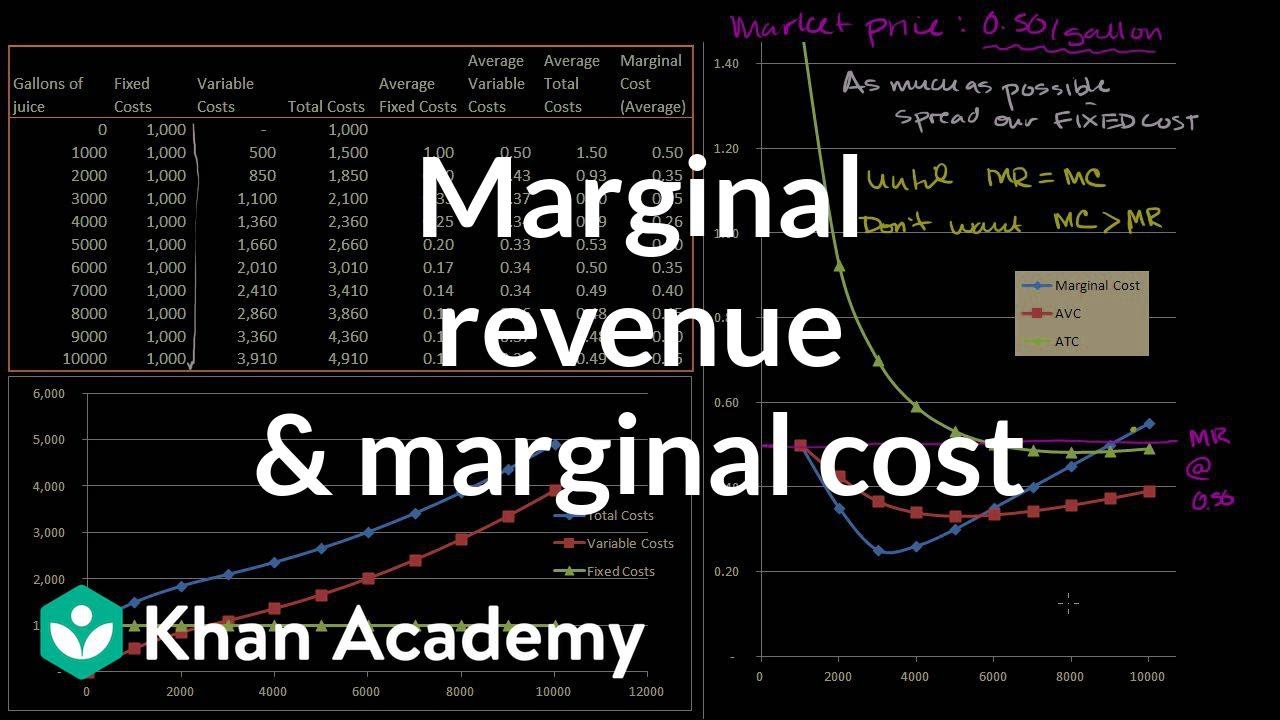

The relationship between marginal revenue and price is an important consideration for firms as they determine their pricing strategies. In order to maximize profits, firms will set their prices such that the marginal revenue from each additional unit sold is equal to the marginal cost of production. This is known as the profit-maximizing price.

In summary, the relationship between marginal revenue and price is an important concept in economics, as it helps firms to determine the optimal pricing strategy for their products. The marginal revenue curve is downward-sloping, which means that as the price of a product increases, the quantity demanded decreases and the marginal revenue from each additional unit sold decreases. Firms will set their prices such that the marginal revenue from each additional unit sold is equal to the marginal cost of production in order to maximize profits.