Transaction exposure is a type of foreign exchange risk that arises when a company engages in international trade or financial transactions that involve foreign currencies. This risk arises because the value of the foreign currency can fluctuate over time, which can impact the value of the transaction. For example, if a company exports goods to a foreign country and receives payment in a foreign currency, the value of that payment could change between the time the goods are shipped and the time the payment is received, due to changes in exchange rates. This could result in the company either receiving more or less value than it expected from the transaction.

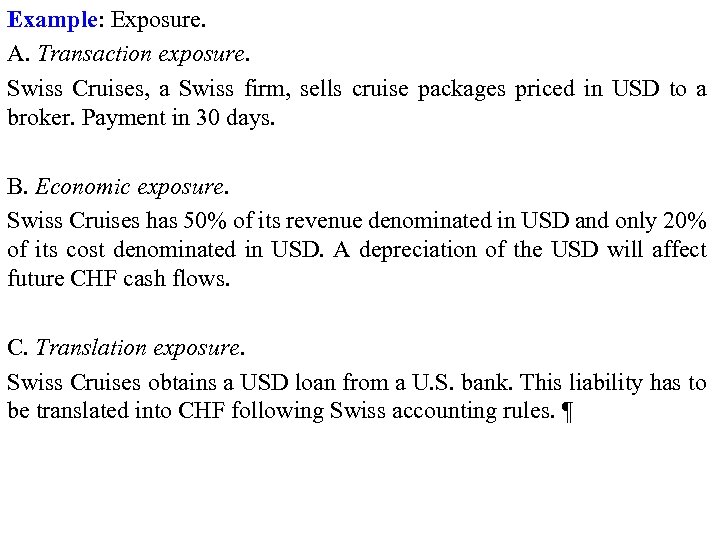

One example of transaction exposure can be seen in the case of a U.S. company that exports goods to a customer in Japan. Let's say the U.S. company quotes a price of $100 for the goods, and the customer agrees to pay in Japanese yen. At the time of the quote, the exchange rate is 1 USD to 100 JPY, which means the customer will pay 10,000 JPY for the goods. However, by the time the goods are shipped and the payment is received, the exchange rate has changed to 1 USD to 80 JPY. In this case, the U.S. company would receive only 8,000 JPY for the goods, even though the quote was for 10,000 JPY. This would result in a transaction loss for the U.S. company, as it would receive less value than it expected from the transaction.

To mitigate the risk of transaction exposure, companies can use various strategies, such as entering into forward contracts or currency swaps to fix the exchange rate at the time of the transaction. Companies can also use hedging instruments, such as options and futures, to protect against the risk of fluctuating exchange rates.

In conclusion, transaction exposure is a type of foreign exchange risk that arises when a company engages in international trade or financial transactions that involve foreign currencies. It can be caused by fluctuating exchange rates, which can impact the value of the transaction. Companies can use various strategies, such as forward contracts, currency swaps, and hedging instruments, to mitigate this risk.

Transaction exposure definition — AccountingTools

The longer a deal takes to finalize, the longer the transaction is exposed to the other risks. Since an exchange rate can vary dramatically in a short period of time, this unknown, or risk, creates translation exposure. Commodity Risk Similar to foreign exchange, 3. It supplies clothes worth £40,000 to a Mall located in the UK on 1 December 2018 under one-month credit terms. This relates to the risk attached to specific contracts in which the company has already entered that result in foreign exchange exposures.

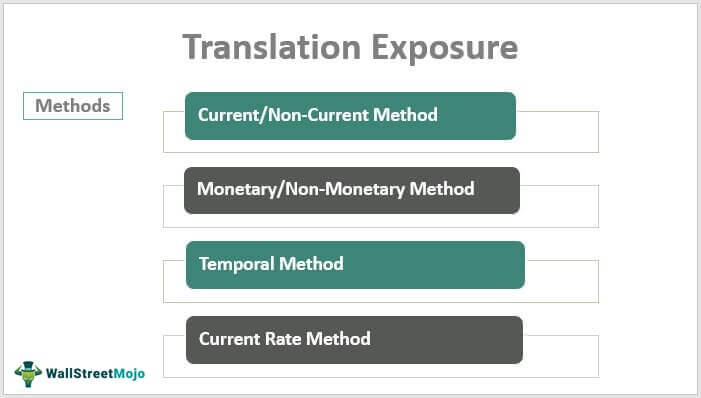

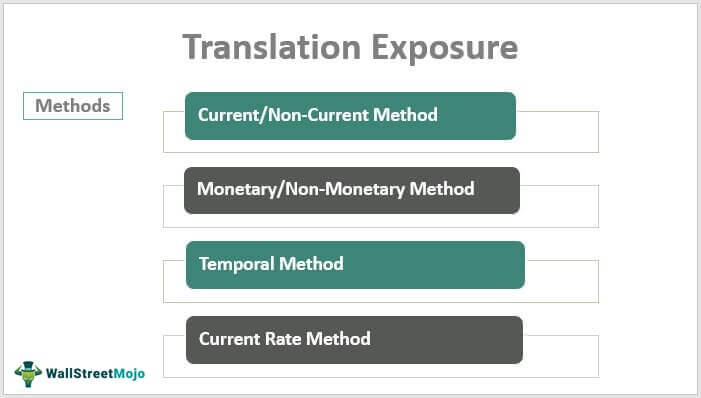

Translation Exposure

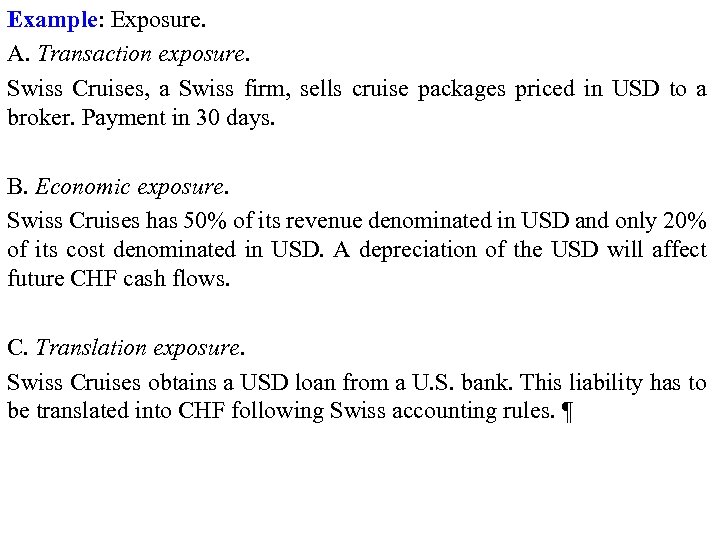

Translation risk can lead to what appears to be a financial gain or loss that is not a result of a change in assets, but in the current value of the assets based on exchange rate fluctuations. Ultimately, the net gain recognized in the financial statements is equal to the actual realized gain on the foreign currency transaction over the two months. The company operating in its own currency does not face risk from Transaction exposure should not be confused with translation exposure. They can choose to convert at the current exchange rate or at a historical rate prevalent at the time of occurrence of an account. Hedging Companies will engage in Within the context of transactions, companies will often complete hedging arrangements to reduce the effects of Foreign Exchange and Commodity Risk associated with the deal. Suppose that Tata Motors sells products worth 50,000 USD to AIMCO on 1 March 2015; the credit period is 2 months. Monetary accounts are those items that represent a fixed amount of money, either to be received or paid, such as cash, debtors, creditors, and loans.

transaction_exposure_blog.sigma-systems.com

The fundamental principle is that all transactions are recorded at the spot rate on the date of the transaction. Machinery, buildings, and capital are examples of non-monetary items because their market values can be different from the values mentioned on the balance sheet. The company decides to convert all of its foreign holdings into dollars, to present a consolidated balance sheet on March 31, 2020. Définir: Transaction Exposure signifie Exposition de la transaction. This is not an offer to buy or sell any security or interest. The German company is not affected if it costs the U. In conclusion, from the transaction date to the settlement date, the Indian Rupee has increased in value by INR 1, which has generated a realized foreign currency transaction gain of INR 50,000.

What is Transaction Exposure? Definition, Meaning, Example

How to Manage Transaction Risk To mitigate the effects of transaction risk, some precautions each party of the deal can take include the following mitigation techniques. If a company imports or sells goods and products overseas, then the profit it makes on the transaction partly depends on the exchange rate. Regardless of the change in the value of the dollar relative to the euro, the German company experiences no transaction exposure because the deal took place in its local currency. Conversely, if the British pound weakens, the foreign currency receivable lose value in terms of the Euro, leading to a loss. Tata Motors will recognize a foreign currency transaction gain on 1 May 2015 of INR 20,000.

Transaction Exposure: International Investing

This creates transaction exposure for Export Inc. This type of exposure affects the value of the company. Solution On 1 March 2015, Tata Motors will have account receivables of INR 3,000,000 USD 50,000 × INR 60. Translation exposure can arise only when a parent company is consolidating the financials of a foreign affiliate or subsidiary. However, neither standard requires disclosure of the line item in which these gains and losses are located.

Transaction Exposure: Definition, Example, Hedging Strategies

Suppose Tiger Ltd, a company based in Mexico, exports goods to a distributor in India to be settled in Indian Rupees having a value of MXN 100,000. Definición: Transaction Exposure significa Transaktionsexposition. The exchange rate has changed. On the other hand, non-current assets and liabilities are converted at a historical rate. Accountants can choose among several options while converting the values of foreign holdings into domestic currency. Exchange rates usually change between quarterly financial statements, causing significant variances between the reported figures.