Tyco International was a diversified multinational corporation that provided products and services in various industries, including healthcare, electronics, and security. However, in 2002, the company made headlines for all the wrong reasons when it was discovered that top executives had been engaging in fraudulent activities that had resulted in the misappropriation of millions of dollars. The Tyco fraud case serves as a cautionary tale of the dangers of corporate greed and the importance of strong corporate governance.

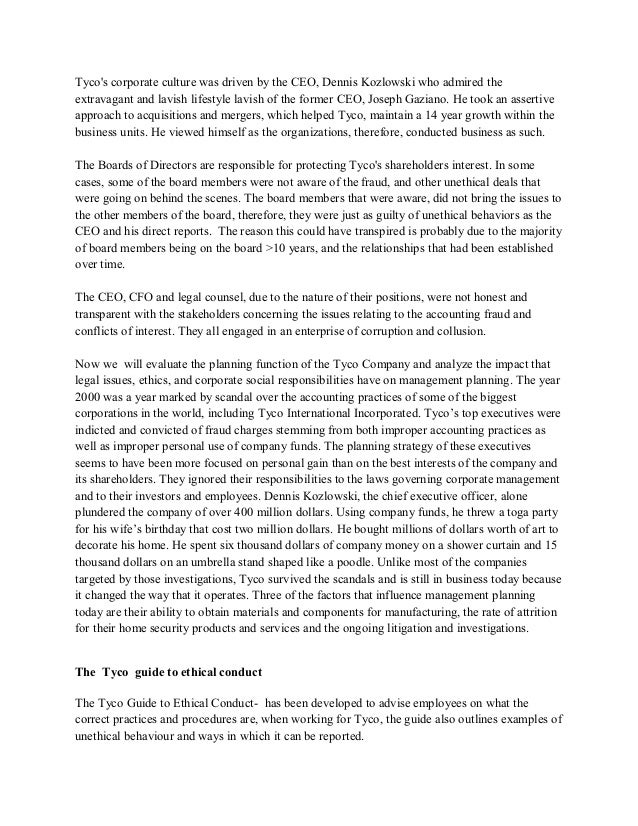

In the early 2000s, Tyco was led by CEO Dennis Kozlowski and CFO Mark Swartz. These executives had been with the company for several years and were considered to be key players in its success. However, it was later revealed that they had been using their positions of power and influence to enrich themselves at the expense of the company and its shareholders.

One of the most significant examples of fraud that was uncovered at Tyco involved the misappropriation of company funds for personal use. Kozlowski and Swartz were found to have used company money to pay for lavish personal expenses, including expensive artwork, jewelry, and vacations. They also used company funds to pay for their own salaries and bonuses, which were significantly higher than what was justified by their performance.

In addition to misusing company funds, Kozlowski and Swartz also engaged in insider trading, buying and selling shares of Tyco stock based on information that was not available to the general public. This allowed them to make significant profits at the expense of ordinary shareholders.

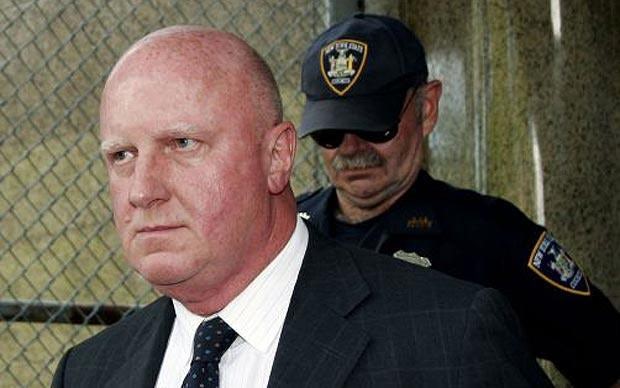

The Tyco fraud case ultimately led to the downfall of Kozlowski and Swartz, who were both convicted of grand larceny and securities fraud in 2005. Kozlowski was sentenced to 8-25 years in prison, while Swartz was sentenced to 8-30 years. Both executives were also ordered to pay millions of dollars in restitution to Tyco.

The Tyco fraud case serves as a reminder of the importance of strong corporate governance and the need for effective oversight of corporate executives. It also highlights the dangers of corporate greed, as Kozlowski and Swartz were motivated by their own personal financial gain rather than the interests of the company and its shareholders.

Overall, the Tyco fraud case serves as a cautionary tale for companies and investors alike, reminding them of the importance of maintaining ethical standards and the need for strong corporate governance practices. It is a reminder that even seemingly successful and reputable companies can be vulnerable to fraud and that it is essential to remain vigilant and ensure that appropriate measures are in place to prevent and detect such activities.