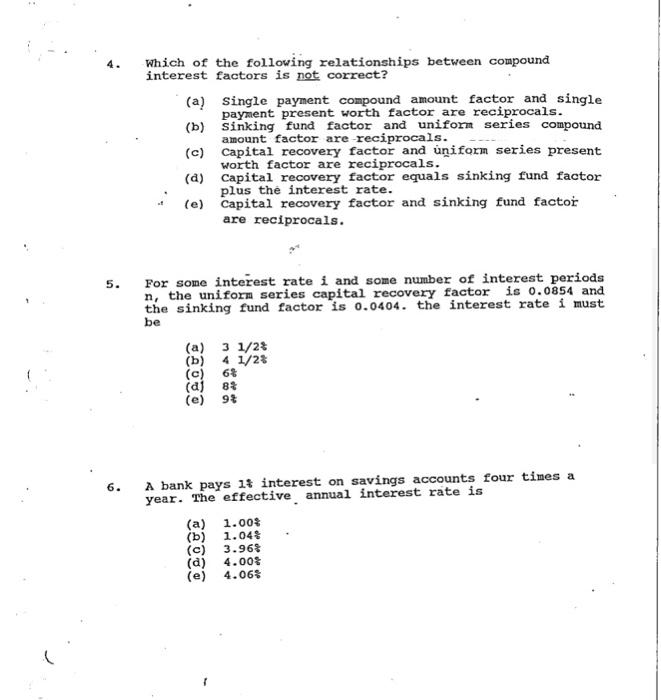

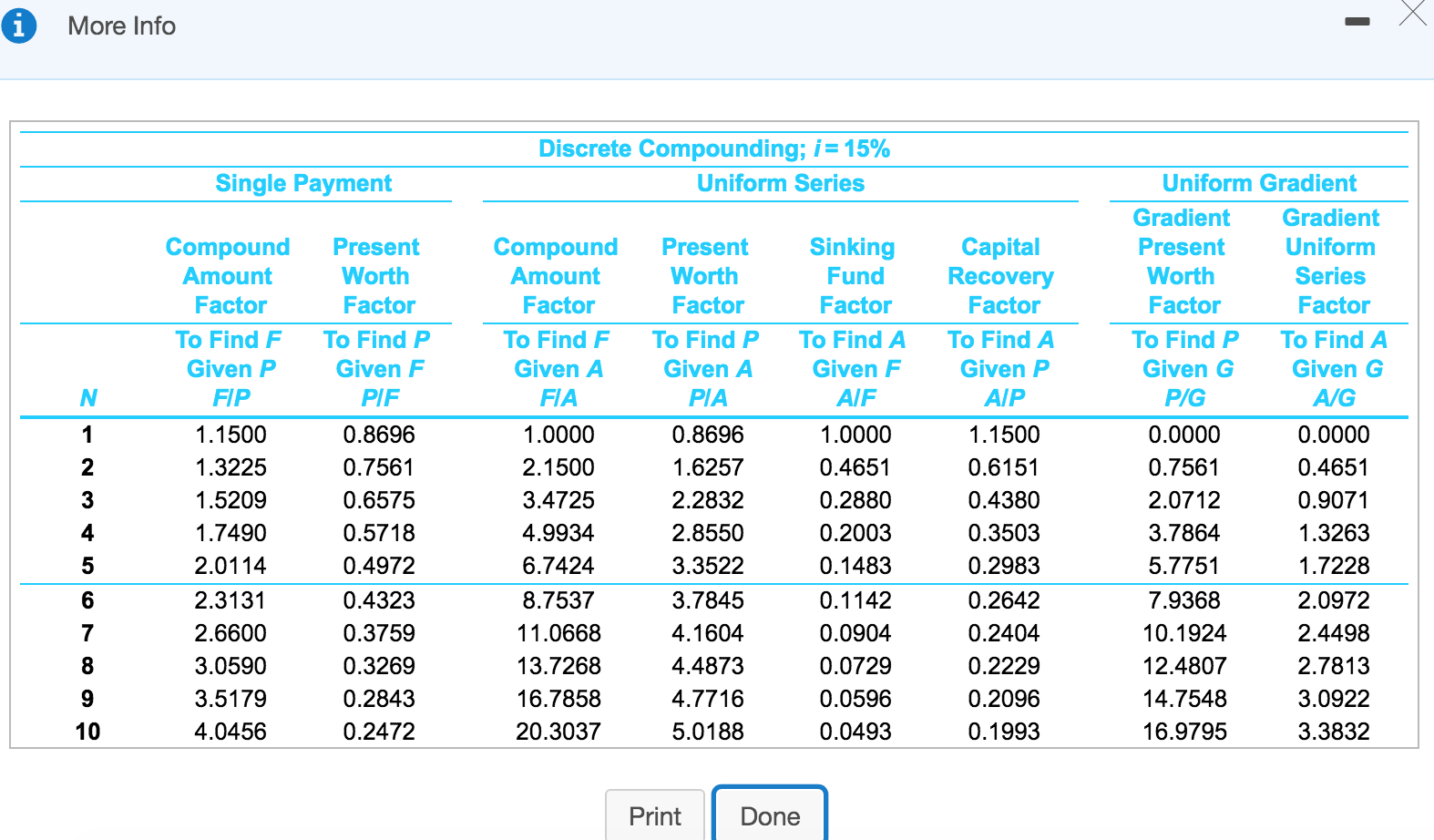

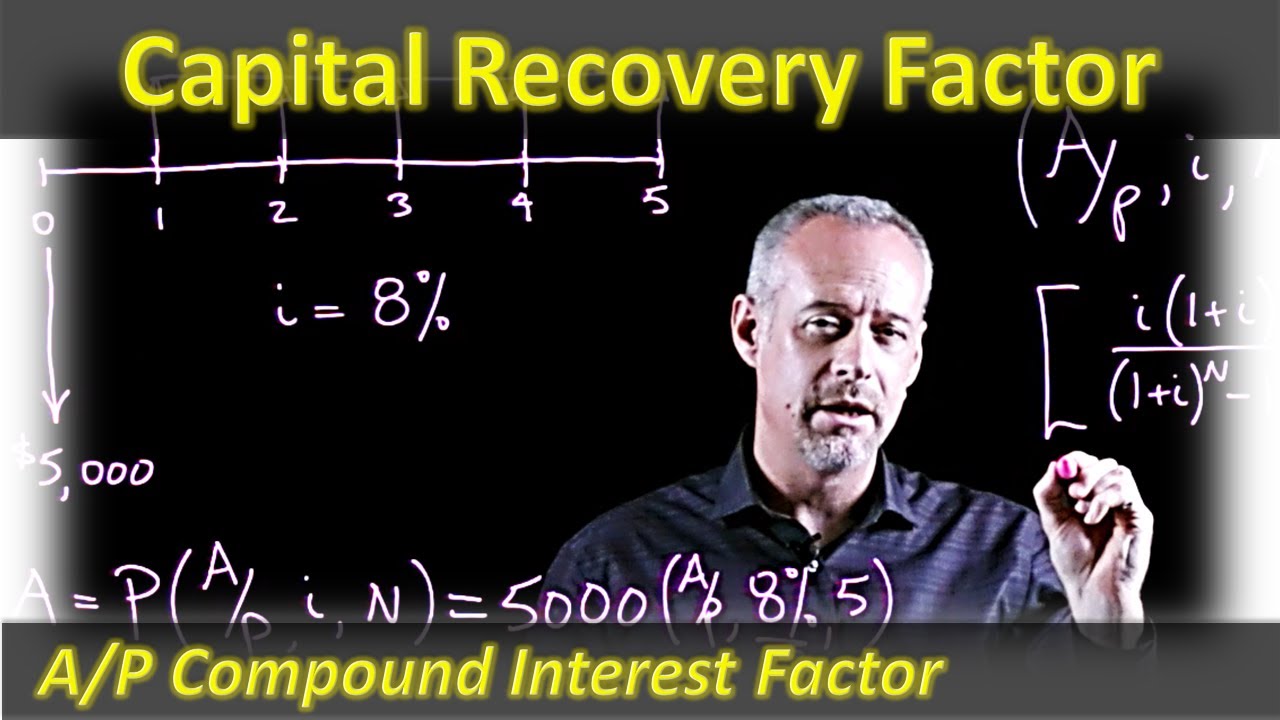

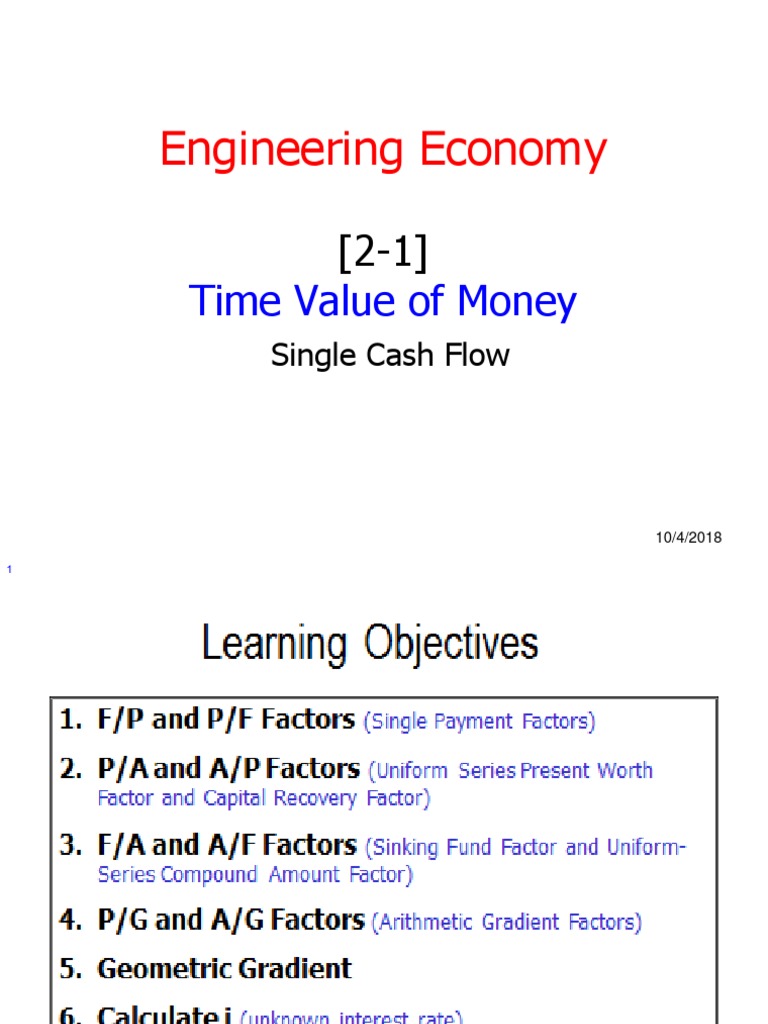

A uniform series capital recovery factor is a financial tool that is used to calculate the present value of a series of equal periodic payments. It is often used in real estate, construction, and other industries where a series of payments are made over time, such as when financing a project or paying off a loan.

To calculate the present value of a series of equal periodic payments using a uniform series capital recovery factor, you need to know the following information:

- The total number of payments in the series

- The amount of each payment

- The interest rate or discount rate

The uniform series capital recovery factor is then calculated using the following formula:

Uniform series capital recovery factor = 1 / (1 + i)^n

Where "i" is the interest rate or discount rate and "n" is the total number of payments in the series.

For example, let's say you have a loan with a 10-year term and a 6% annual interest rate. The loan requires you to make equal monthly payments of $500. Using the formula above, we can calculate the uniform series capital recovery factor as follows:

Uniform series capital recovery factor = 1 / (1 + 0.06)^120

This gives us a uniform series capital recovery factor of 0.67.

To calculate the present value of the series of payments, we simply multiply the uniform series capital recovery factor by the amount of each payment. In this case, the present value of the series of payments would be $335 ($500 x 0.67).

The uniform series capital recovery factor is a useful tool for determining the present value of a series of equal periodic payments, and it is often used in financial analysis and decision-making. It is important to note, however, that the accuracy of the calculation depends on the accuracy of the inputs, particularly the interest rate or discount rate.